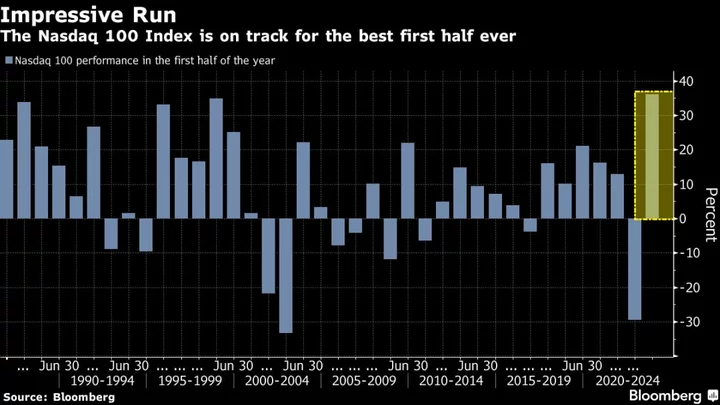

As a dizzying first half for US stocks draws to a close, the Nasdaq 100 Index is poised for its best opening six months to a year ever, and Wall Street is growing concerned that the Federal Reserve will derail the rally.

Optimism that the US central bank is approaching the end of its tightening campaign helped transform the technology-heavy gauge from 2022’s market underachiever to 2023’s early champion, with a surge of 36% erasing last year’s 33% slump.

The resurgence has defied skeptics, coming in the face of bank failures, recession fears and the highest borrowing costs since 2007. But investors stuck with stocks amid signs that the US economy remains resilient and the earnings outlook appears to be improving.

Historically, a robust first-half in the stock market is a good omen for the rest of the year. But Wall Street strategists are leery, warning that the rally in tech stocks looks overblown, with rich valuations and just a handful of high-flyers like Apple Inc., Microsoft Corp. and Nvidia Corp. providing the strength. Stocks are coming off the boil a bit, with the S&P 500 Index just posting its worst week since March.

Nonetheless, global money managers are hoping 2023 will end on a high note after a tumultuous 2022 sent the Nasdaq 100 and S&P 500 to their biggest annual losses since 2008.

The S&P 500 has gained 13% this year, helping it recoup all of its plunge since the Fed kicked off its cycle of rate hikes in March 2022. The gauge is also up 22% from its Oct. 12 closing trough, leaving it above the threshold of what’s considered a bull market. That advance goes to show that while October can evoke fear on Wall Street because of past market crashes, the month is actually living up to its reputation as a “bear-market killer.”

Of course, stocks have far surpassed Wall Street’s expectations for 2023. At the start of the year, strategists forecast that the S&P 500 would be flat this year, and they enter the second half anticipating that it will finish the year about 6% below its Friday close.

Skeptics such as Morgan Stanley’s Mike Wilson and JPMorgan Chase & Co.’s Marko Kolanovic predict the latest leg up in stocks will be short-lived, in part because the Fed is signaling further tightening. But other strategists are starting to break from the pack, like Bank of America Corp.’s Savita Subramanian, who says worries over Big Tech driving the rally are overblown.

One source of reassurance for the optimists is the broadening of market leadership beyond tech. Last year’s big S&P 500 losers, from tech to consumer discretionary stocks, have had double-digit leaps. While there’s concern that the advance has been too narrow, other groups tied to the health of the economy, including the industrial and materials sectors, joined the rally in June. That’s helped bolster confidence, since cyclical groups tend to outperform in the early stages of bull markets.

Clearly, investors have a lot to digest as they ponder what lies ahead. They do, however, have some encouraging history to fall back on: A strong first half for the S&P 500 has typically led to another solid run in the remaining six months, according to data compiled by Bloomberg.

Since the early 1950s, when the index has climbed more than 10% through June, it rises by a median of 10% in the second half, per Ryan Detrick, chief market strategist at Carson Group.

--With assistance from Matt Turner, Lu Wang and Alexandra Semenova.