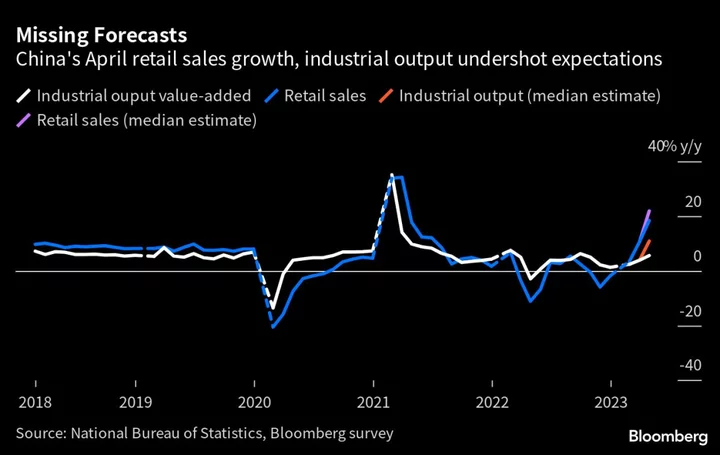

Investment banks are split over whether weaker-than-expected Chinese economic data for April redefine the growth outlook for the entire year.

China’s poor economic performance last year makes for a low base of comparison, suggesting it’s easier for gross domestic product to register solid growth for 2023.

That’s behind the thinking of Standard Chartered Plc economists led by Wei Li, who retained their projection for GDP to rise 5.8% this year — even after official data Tuesday showed China’s industrial output, retail sales and fixed investment grew at a much slower pace than expected last month.

Read More: China’s Waning Economic Recovery Spurs Calls for Policy Action

But JPMorgan Chase & Co. and Barclays Plc disagreed, reducing their forecasts.

“April data points at a big loss in recovery momentum,” JPMorgan economists led by Haibin Zhu wrote in a note to clients. The bank lowered its full-year GDP growth estimate to 5.9% from a previous 6.4%, which had been among the highest of economists’ forecasts.

Barclays economists led by Jian Chang went further, with “5.6% growth for this year now out of reach,” setting a new target for this year of 5.3%. For the current quarter, the bank slashed its calculation to just a 1% gain from the previous three months, at an annualized rate.

Nomura Holdings Inc. also downgraded their forecast for growth this year to 5.5% from 5.9%, Weak confidence among consumers and business investors has contributed to the economy’s losing steam, the economists led by Lu Ting said.

Some of those maintaining their 2023 forecasts cited the likelihood of Beijing expanding its stimulus measures to support the economy.

“If growth disappoints in the coming months, China may boost infrastructure investment and roll out some targeted consumption support” in the second half of the year, wrote Wang Tao, chief China economist at UBS Group AG. The bank left its projection at 5.7%.

Morgan Stanley’s team, including Robin Xing, similarly retained its 5.7% call, saying that estimate “remains on track with additional policy easing and broadening consumption gains” in the second half.

But Barclays and JPMorgan aren’t counting on that outcome.

“The probability seems low, in our view” of consumption stimulus, JPMorgan’s team wrote. The economists also said it’s important to monitor “whether the government can adjust industrial policy to restore confidence among private entrepreneurs, to build up a better business environment.”

Keeping in mind that Beijing has targeted growth this year only at around 5%, “we don’t expect aggressive easing” to be enacted, the Barclays economists wrote. Meantime, “big downside surprises in industrial production, retail sales, real estate investment, and youth employment confirm weakening demand amid deepening property woes,” they wrote.

Neither of the two more pessimistic banks sees much by way of monetary-policy measures.

JPMorgan said the People’s Bank of China signaled no change in policy rates in its quarterly monetary policy report this week. To Barclays, while interest-rate cuts can’t be ruled out, “room for such an action is limited this year.”

The Nomura economists projected 10-basis point cuts to the PBOC’s one-year policy rate as well as the nation’s de facto benchmark lending rate in June.

“We see a rising risk of slower activity growth, rising unemployment, persistent disinflation, falling market interest rates, and a weaker currency,” Nomura economists wrote in a note Wednesday.

Chinese assets came under pressure after Tuesday’s releases, with the offshore yuan falling to its lowest level this year against the dollar.

--With assistance from George Lei and Yujing Liu.

(Updates with Nomura’s downgrade.)