Britain’s property market has shattered another record with rental costs growing at the fastest pace in at least a decade, while home sellers pushed up asking prices for the first time in four months, two separate reports showed.

The figures underscored inflationary pressures in the UK economy that are alarming the Bank of England and adding to pressure for another hike in interest rates later this week. They’re also an indication of turmoil in the property market that’s having a heavy impact on consumers.

Tenants paid 12% more than a year ago for new rental agreements in August, the largest rise since property broker Hamptons began publishing its letting index. The average rent in Britain is now £1,300 ($1,617) a month, £140 up from a year ago and the highest on record, the broker said.

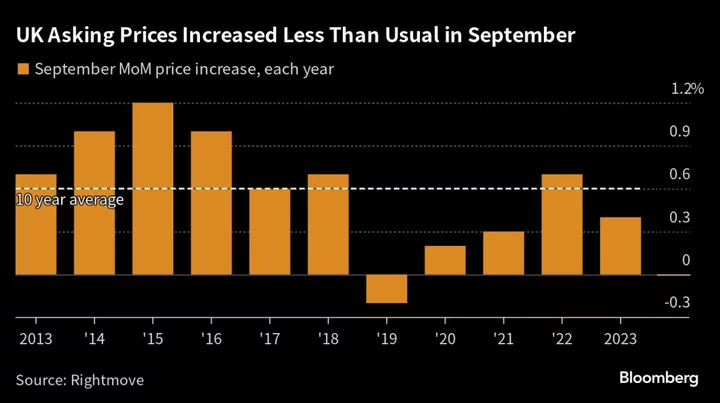

In the sales market, property portal Rightmove said sellers bumped up the prices they’re asking for by 0.4% in September, the first time asking prices have risen since May.

But this was well below the increase usually seen at this time of year — over the last decade, prices have risen by an average of 0.6% in September.

The central bank is hoping that its longest string of rate hikes in three decades reins in inflation. But those measures have raised the cost of buying a home, leaving more people stuck in the rental market. It’s also cut into the value of renting out property, prompting landlords to sell up and exacerbate a shortage that’s driven up rents.

The convulsions in the property market — including the abrupt halt of more than a decade of rising house prices — is a risk for Prime Minister Rishi Sunak’s government. Shortages in the rental market are hampering people’s ability to move, a friction that undermines the ability of the economy to grow. Meanwhile, a weakening housing market will make property owners feel less wealthy in the lead-up to the next general election, which is expected next year.

Rightmove’s figures are the first major piece of data about the housing market this month. The mortgage lenders Nationwide and Halifax reported that prices are falling at their sharpest pace since 2009, and the Royal Institution of Chartered Surveyors said estate agents remain gloomy about the outlook for the property market.

Economists expect a 10% plunge in prices during this slump, and mortgage lender data suggests the UK is about half-way thorough that downturn. While rate rises make borrowing more expensive, many homeowners have yet to feel the pain as they are on fixed-term deals which have not yet expired.

“In almost 20 years of selling homes, I feel that this summer and last summer have been the most subdued,” said Andy McHugo, director at McHugo Homes in Birmingham.

He attributed this to both prospective buyers and sellers catching up on holidays lost during the pandemic, and the “current economic backdrop.”

Forces slowing the property purchase market are leaking into rentals and helping fan inflation-busting increases in the cost of lettings. A shortage in new instructions to rent property is compounded by anemic construction levels, with the rate of new home building plunging as developers pull back on new projects.

“Each passing month has ushered in a new rental market record,” Hamptons head of research Aneisha Beveridge said. “Rents have risen more in the last 12 months than they did between 2015 and 2019.”

Rents are rising fastest in London as they catch up from a slump during the coronavirus pandemic. Residents in the outer regions of the capital now face a 30% higher bill than in January 2020, before the first lockdowns encouraged some residents to escape the city.

September Market

September is an important month for property sellers, with buyers returning from holiday and making decisions about moving. Since the start of the month, Rightmove found an “encouraging” up-tick in inquiries from homeowners looking to enter the market.

On an annual basis, however, asking prices were still falling. They slid 0.4% in September, the biggest drop since March 2019. Price reductions hit a level not seen since January 2011 — 36.3% of properties for sale had been knocked down in price, with the average reduction equating to £22,700 or 6.2%.

“More people who have been thinking about what they need from a home and where they want to be living next year and beyond are taking action and coming to market,” said Rightmove’s director of property science Tim Bannister. “We still anticipate an autumn bounce.”

The number of sales agreed across the whole of August was down 18% on the same month pre-pandemic, in 2019. First-time buyers were the best-performing sector, with sales down by a more limited 13%.

While rising borrowing costs have been deterring buyers across the board, Rightmove said there were “small steps” being made towards improved affordability conditions, with the average five-year fixed mortgage now at 5.67% down from a peak of 6.11% in July.

--With assistance from Eamon Akil Farhat.