UK inflation tumbled to the lowest level in two years, firming up bets that the Bank of England will be able to cut rates as early as the middle of next year.

Consumer prices rose 4.6% from a year earlier in October, down sharply from 6.7% in September and the slowest pace since 2021 as energy prices fell, the Office for National Statistics said Wednesday. The figures allowed Prime Minister Rishi Sunak to declare victory in his goal of cutting inflation in half in this year, one of five priorities he hoped would improve his party’s poll number ahead of a looming general election.

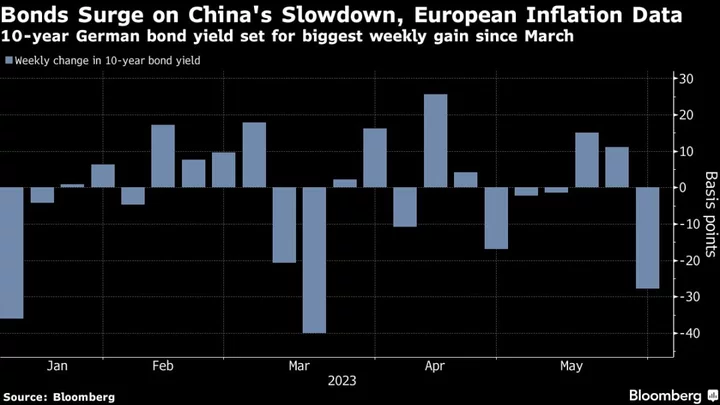

The drop was even sharper than the 4.7% reading economists had anticipated. Traders added to wagers that the BOE was done raising interest rates, part of a wave of repricing that began after softer-than-expected US price data Tuesday spurred a rally in global fixed-income markets.

Britain’s reading was the latest sign that soaring prices that pushed central banks around the world into rapid interest-rate increases were easing. With economies weakening and wars in Gaza and Ukraine unsettling the outlook, investors are betting on a sharp reversal in rates next year, even though policymakers insist borrowing costs will have to remain high to fight underlying price pressures.

Traders maintained wagers that the BOE was done raising interest rates, following a wave of repricing that began after softer-than-expected US price data Tuesday spurred a rally in global fixed-income markets.

Traders are betting on a first full quarter-point rate decrease by June. Earlier this week, that expectation focused around August. Bonds eked out gains and the pound slipped, trading 0.3% weaker at $1.2462 as of 9:48 a.m. in London.

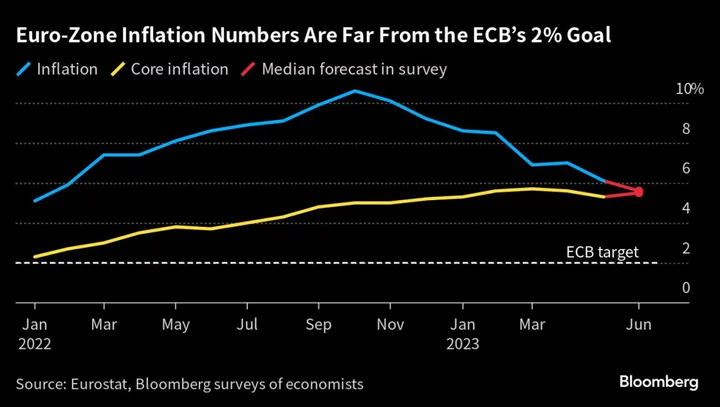

BOE Governor Andrew Bailey has attempted to hold the line against market expectations, arguing after the bank decided to hold rates at a 15-year high on Nov. 2 that it was too early to discuss cuts. Chief BOE Economist Huw Pill said Tuesday that pay and inflation in the services sector were still “stubbornly high,” warning that price pressures could persist.

Inflation remains more than double the BOE’s 2% target and policymakers have warned that the “last mile” would be ‘the hardest. The central bank and outside economists forecast don’t forecast a return to the target level until 2025.

“Today’s data are unlikely to shift the dial for the Bank of England, with interest rates expected to remain at their current level until the second half of next year,” said Yael Selfin, chief economist at KPMG UK. “While the drop in inflation will be welcomed by households, it is not in itself a signal of sustained inflationary easing but rather reflects the lagged impact of the fall in wholesale gas prices feeding through to energy bills.”

The fight against inflation also has big political ramifications for Sunak, even though he had little power to control prices other than to resist calls for income tax cuts and pay increases for public-sector workers. Sunak set a relatively modest goal of cutting inflation in half from its peak of more than 10%, but even that seemed in doubt only a few months ago.

“While it is welcome news that prices are no longer rising as quickly, we know many people are continuing to struggle,” Sunak said in a statement. Chancellor of the Exchequer Jeremy Hunt said on Sky News said, “there is lots more work to do,” a signal he will resist calls to reduce taxes in his autumn economic statement next week.

What Bloomberg Economics Says ...

“Progress is slow and suggests the remaining distance to the 2% target will be a grind – we think it will take at least another year. As a result, interest rate cuts look unlikely until the second half of 2024.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the REACT.

This month’s reading marked the biggest drop since 1992, when inflation plunged from 7.1% to 4.7% as a boost to prices a year earlier fell out of the annual comparison. The surge in prices stemmed from then-Chancellor Norman Lamont’s 1991 budget, which included an increase in VAT and numerous duties.

In the UK, both core and services inflation — which are being closely watched by the BOE for signs of underlying inflation — came in weaker than economists had expected. Core inflation, which strips out volatile energy and food prices, slowed to 5.7% from 6.1%. There was no increase in consumer prices between September and October.

“Food prices were little changed on the month, after rising this time last year, while hotel prices fell, both helping to push inflation to its lowest rate for two years” ONS Chief Economist Grant Fitzner said. “The cost of goods leaving factories rose on the month. However, the annual growth was slightly negative, led by petroleum and basic metal products.”

The cost of electricity, natural gas and other domestic fuels fell 7% in October compared with a 24.7% surge a year earlier. The annual rate of inflation for housing and household services, which includes energy bills, was the lowest since 1950, the ONS said.

Food price inflation slowed to 10.1% from 12.3%, with prices gaining just 0.1% on the month. Auto fuel prices rose 1.8% on the month, providing upward pressure on the inflation rate.

Pipeline price pressures continued to ease. Producer input costs slipped 2.6% from a year earlier, and output prices – the cost of goods leaving factory gates – fell 0.6%, which matched the largest drop in three years.

--With assistance from Eamon Akil Farhat, Mark Evans, Joel Rinneby and Kitty Donaldson.

(Updates with market reaction from fourth paragraph.)

Author: Tom Rees, Philip Aldrick and James Hirai