Soon-to-mature Treasury bills rallied as trading resumed after the Memorial Day holiday, following a tentative deal over the debt ceiling which eased concerns of a US default.

The so-called ask yields on securities due June 6, the day after the US may run out of cash, were indicated 13 basis points lower at around 5.16% in Asia on Tuesday, according to data compiled by Bloomberg. Equivalent yields on debt due June 15 were indicated down 27 basis points. The bills traditionally trade in light volumes in the Asia session.

President Joe Biden and House Speaker Kevin McCarthy expressed confidence Monday that a deal to suspend the debt ceiling while capping discretionary spending will pass Congress in coming days. And approval gained early support from prominent members of each party’s moderate and pragmatist wings.

Yields on some bills topped 7% last week as investors steered clear of at-risk securities after Treasury Secretary Janet Yellen warned the government would exhaust its borrowing capacity by June 5.

“Voting on the US debt ceiling is expected to begin from Wednesday and there appears to be sufficient support to clear passage,” said Tapas Strickland, head of market economics at National Australia Bank Ltd. “Focus now shifts to the liquidity implications of rebuilding the Treasury General Account via a deluge of bill issuance.”

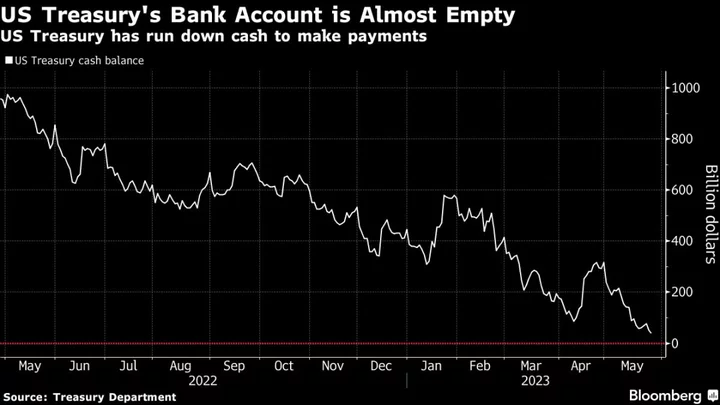

Analysts expect Treasury will soon replenish its cash balance and may sell more than $1 trillion of bills through the end of the third quarter, according to some estimates. The US cash stockpile currently sits around $39 billion, a six-year low.

That could limit declines in shorter-dated yields as investors attempt to gauge what comes next.

Read: A $1 Trillion T-Bill Deluge Is Painful Risk of a Debt-Limit Deal

Elsewhere, longer-dated Treasury yields also fell. The benchmark 10-year yield dropped four basis points to 3.76%, while its 30-year equivalent fell five basis points to 3.91%.

Aside from the passage of the debt deal, bond traders are also mulling expectations for Federal Reserve interest-rate policy in June and July, with about one more hike priced in. Friday’s US jobs report will be closely watched to see if the labor market continues to show signs of cooling down.

This week also brings a month-end rebalancing of the US Treasury bond index to incorporate large quarterly new issues of 10- and 30-year debt, which may drive demand for those sectors of the market.