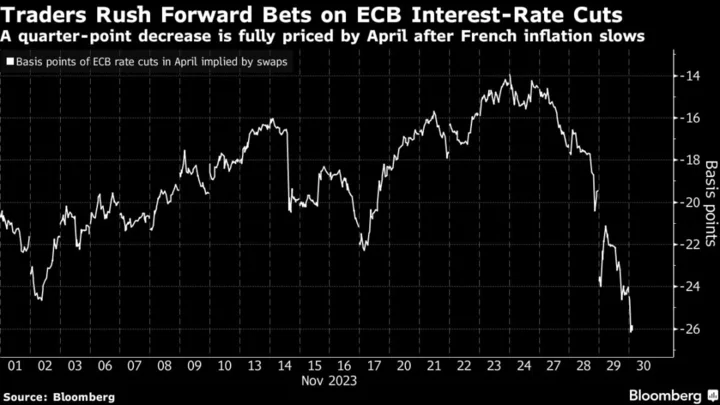

Traders are betting on an ever-earlier start to European Central Bank interest-rate cuts next year after surprisingly low inflation readings in the region’s main economies.

A quarter point decrease to the ECB’s deposit rate is now fully priced by April and markets see a 45% chance of a cut in March, according to swaps tied to the central bank’s meeting dates. Just over a month ago, the market expected the first rate cut in June.

The latest leg of the repricing Thursday comes after data showed inflation in France eased more than expected by all economist in a Bloomberg survey. It also follows reports showing Spanish and German consumer-price growth slowed more than anticipated.

Conviction that central banks will unwind their restrictive policy stance sooner than was previously expected comes even as policymakers warn that borrowing costs will remain elevated for an extended period. The euro-area inflation reading is due later on Thursday and economists expect it to drop to 2.7%, according to a Bloomberg survey, well below a peak of more than 10% last year.

“We think it is only a matter of time until the ECB formally acknowledges that it has overtightened policy,” said Simon Harvey, head of FX analysis at Monex Europe Ltd. He adds this will weigh on the euro, which may fall back below $1.09.

European bonds gained after the data, extending a strong monthly rally that saw the yield on 10-year German notes fall 40 basis points, the most since July 2022. The euro fell to the day’s low at $1.0941, lagging gains in most of its Group-of-10 peers.

The ECB’s string of aggressive rate increases is expected to continue to take a toll on economic growth. Meanwhile, the effect of surging energy prices that followed Russia’s invasion of Ukraine has also dissipated, bringing consumer price growth back toward the ECB’s 2% target.

Markets currently imply 113 basis points of rate cuts from the ECB by the end of 2024, compared to 82 basis points at the end of last week. For the Federal Reserve, expectations are for 121 basis points of easing, up from 84 basis points on Friday.

Fed Governor Christopher Waller helped bolster rate-cut bets earlier this week, saying the current level of policy looks well positioned to slow the economy and bring down inflation. Some investors, including billionaire Bill Ackman, say the easing will start even earlier than traders anticipate.

Yet other officials are pushing against that narrative, saying the battle to tame inflation is far from over. Core inflation — which strips out volatile items including food and fuel — is only expected to slow to 3.9% in the euro area, according to a Bloomberg survey.

“We find the market pricing on inflation returning to 2% from summer next year like a Goldilocks scenario, and see risks skewed to the upside,” said Piet Christiansen, chief strategist at Danske Bank.

This hasn’t stopped bonds from rallying, with a Bloomberg gauge of global sovereign and corporate debt headed for the biggest monthly gain since 2008, when the Fed cut rates to the zero bound and pledged to boost lending to the financial sector following the collapse of Lehman Brothers Holdings Inc.

--With assistance from James Hirai and Alice Gledhill.

(Updates with context, comments and prices throughout.)