China’s top housing official urged financial regulators and lenders to strengthen efforts to revive the country’s ailing property sector.

In a recent meeting with property developers and builders, Minister of Housing and Urban-Rural Development Ni Hong called for homebuyers who had paid off previous mortgages to be considered as first-time purchasers, the official Xinhua news agency reported Thursday. Up to now, many buyers in big cities who have a mortgage history but don’t currently own a property are subject to higher down-payment rules.

The call is the latest in a series of efforts by authorities to stabilize the nation’s property market, a key component of the world’s second-largest economy. China’s real estate crisis is stifling its recovery, fueling expectations for the government to take more steps to revive demand.

A Bloomberg Intelligence gauge of property company shares rose 1.8% on Friday afternoon. Country Garden Holdings Co. was up 5%.

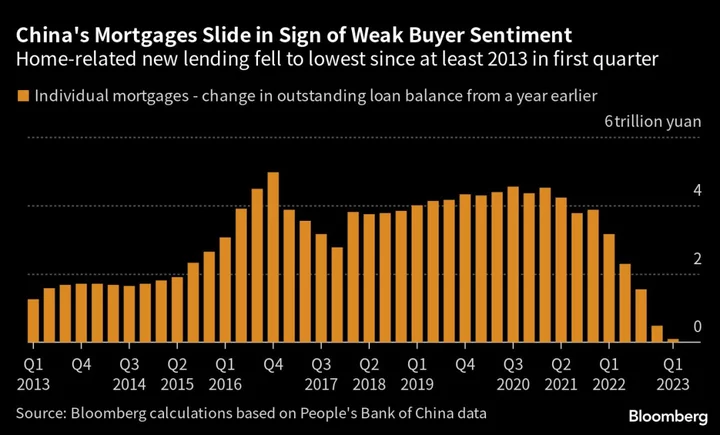

Home sales resumed declines in June following a brief rebound earlier this year, adding to pressure on debt-laden developers and reducing demand for resources such as iron ore.

The housing minister also called for measures such as relaxing down-payment rules and reducing mortgage rates for first-home purchasers, according to Xinhua. Currently, buyers of a second home are subject to more restrictive borrowing limits.

The ball is now in the court of the banking sector. Earlier this month, financial regulators already stepped up pressure on banks to ease terms for property companies by encouraging negotiations to extend outstanding loans. The People’s Bank of China and National Financial Regulatory Administration said in a joint statement July 10 that the aim was to ensure the delivery of homes under construction.

Bloomberg News reported last week that Chinese authorities were considering easing homebuying restrictions in the nation’s biggest cities — potentially removing a hurdle that has curbed demand in Beijing and Shanghai for years.

China has since 2016 sought to suppress real estate demand in the largest cities by treating buyers with previous mortgages as second-time purchasers, substantially raising down-payment thresholds and increasing borrowing costs. While some local governments have scrapped the rules, homebuyers in more than 10 big cities still face such restrictions, according to agency China Index Holdings Ltd.

Ni’s meeting with developers came after China’s top leaders signaled they would ease property policies. An official readout of a meeting of the Communist Party’s Politburo, a top decision-making body, omitted President Xi Jinping’s long-used slogan “housing is for living, not for speculation” — underscoring a deeper shift toward supporting the property market.

The government “strongly” supports home purchases to meet essential dwelling demand and needs for better housing, Ni told the executives from eight state-owned and private-sector construction firms. He also called for tax and fee relief for housing upgrades and replacement.

Top leaders at the Politburo meeting acknowledged that demand and supply in the housing market had seen “fundamental changes,” while economists have tipped real estate as the sector in greatest need of aid. Recent data suggest the property market — which along with related industries accounts for about 20% of the economy — is in decline again after a short-lived rebound.

Stabilizing the two pillars of the construction industry specifically and the real estate sector more broadly plays an important role in promoting economic recovery, Ni stressed to the companies.

“The government seems to be preparing for further policy relaxation,” said Liu Yuan, vice president for property research at Centaline Group. “But we have yet to see any effective measure in place, and that’s why market sentiment is still depressed.”

While China has reduced benchmark rates and pushed average mortgage rates to a record low, most Chinese households haven’t seen the benefit, as banks won’t reprice existing loans until the beginning of next year.

The policy push, however, is likely to weigh on earnings at banks already struggling with shrinking margins and tepid loan demand.

Some Wall Street analysts are also wary of growing risks associated with the debt-laden local government financing vehicles, with Goldman Sachs Group Inc. analysts saying the lenders’ exposure to LGFVs could weaken capital positions and lead to lower dividend payouts.

--With assistance from Fran Wang, Jing Zhao, Lin Cheng, Evelyn Yu, Zheng Li, Lisa Du and Emma Dong.

(Updates with context on mortgage restrictions in large cities in the second and ninth paragraphs; adds shares in the fourth)