Thyssenkrupp AG wrote down the value of its steel business by a further €1.8 billion ($1.96 billion), the latest sign of German industry suffering due to high energy costs and a worsening economic outlook.

That pushed the conglomerate to a €1.98 billion net loss for its financial year ended Sept. 30, even as free cash flow before mergers and acquisitions turned positive to €363 million compared with the prior year. Thyssenkrupp said it expects earnings to improve to a figure in the high-three-digit million euro range as performance improvement plans yield results.

“We are continuing to work consistently on improving the performance of all our businesses,” Chief Financial Officer Klaus Keysberg said in a statement Wednesday. “This will create the conditions for achieving our medium-term goals, even in a challenging environment.”

The shares rose slightly in early trading in Frankfurt, gaining 0.8% with the stock up 19% this year.

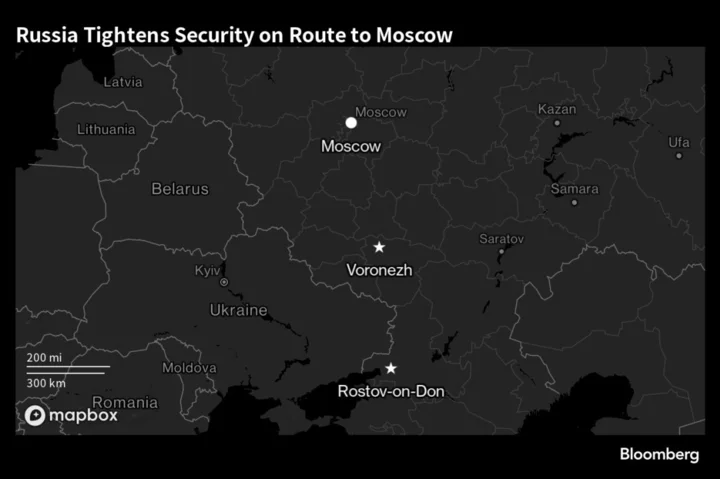

Thyssenkrupp’s steel unit has repeatedly failed to break even due to high investment requirements and low steel prices, weighing on the company’s overall earnings. High energy prices stemming from Russia’s invasion of Ukraine and rising interest rates have also increased costs for the division, which was the subject of a €350 million writedown earlier this year before Wednesday’s additional €1.8 billion.

The company has for years looked to spin off or sell its steel business, and is in talks to sell half of the unit to Czech billionaire Daniel Kretinsky.

Once synonymous with German industrial prowess, Thyssenkrupp is undergoing a restructuring after several challenging years. Miguel Ángel López Borrego took over as chief executive officer in June after his predecessor, Martina Merz, left amid criticism of slow progress in her effort to transform the company.

Thyssenkrupp reaffirmed mid-term targets, saying it would continue to strive to achieve an adjusted EBIT margin of 4% to 6% at group level, a significantly positive value for free cash flow before M&A and reliable dividend payments. The company proposed a dividend payment of 0.15 cents per share, the same as in the previous year.

(Updates with share price in fourth paragraph)