No valuation case seems compelling enough to keep global investors from giving up on Chinese assets.

The evidence is everywhere. The MSCI China Index is in a bear market and trading at just 9.4 times earnings. That’s about a 40% discount to the MSCI’s world gauge. The yuan has plummeted to levels last seen in November and credit risk is spreading across to local government issuers. Don’t be fooled by Friday’s stock rebound. It was underpinned by low volume.

Hedge funds — the fast money who were first in and first out of Chinese stocks — have unwound more than half of the positions added in the November to January period, according to strategists at Goldman Sachs Group Inc.

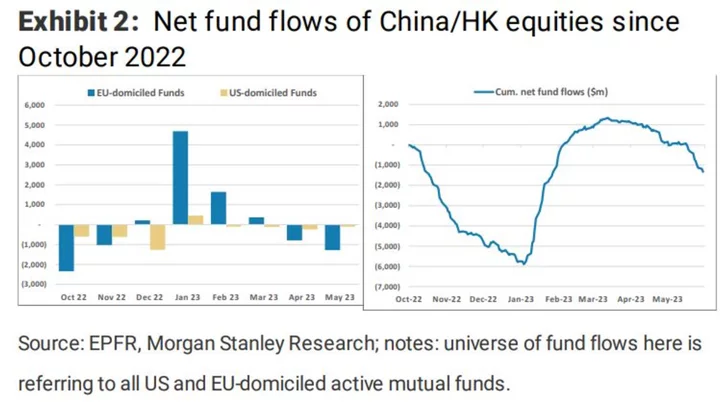

Sentiment is so bearish now that even European-based money managers, the biggest buyers of Chinese shares in the first quarter, have turned underweight on the market after driving much of the $1.6 billion of outflows in May, according to Morgan Stanley’s quantitative research team.

US institutional investors, who never really chased the reopening trade, have continued to unload Chinese stocks. They now hold just $714 billion, down from a peak of $1.1 trillion in 2020, according to Goldman.

The outflows show the difficulty in attracting the stickier longer-term allocators that President Xi Jinping’s government wants in China’s financial markets. Some of Asia’s other major markets — like India, South Korea and Japan — are emerging as more attractive alternatives for global investors, as my colleague Ishika Mookerjee wrote here.

VIDEO

Here’s my roundup of the week’s key developments for China markets:

Bear market

Chinese stocks are officially in a bear market after a prolonged decline of more than 20%. Worse-than-expected economic data, a mixed earnings season, high unemployment and tensions with the US have all made investors more pessimistic about the country’s markets.

- Everywhere You Look in China Are Signs of More Market Misery

Big-name visitors

Two business titans visited the mainland for the first time since before the pandemic: Jamie Dimon of JPMorgan Chase & Co. and Elon Musk of Tesla Inc. Dimon said his bank is committed to doing business in China and will remain there in both good and bad times. Musk met with government officials in Beijing and stressed the importance of maintaining ties.

- Dimon Says JPMorgan Will Be in China for Good and Bad Times

- Musk’s Jet Departs Shanghai After Whirlwind China Visit

Beijing’s rebuff

Beijing declined Washington’s request for their two defense chiefs to meet. One issue is China’s top general has been under US sanctions since 2018. President Joe Biden will have to decide whether to keep those sanctions and sacrifice talks, or lift them and risk appearing soft on China heading into election season.

- China Spurns US Defense Chiefs Talks Showing Limits to Ties

Uncertain recovery

China’s manufacturing surveys provided contradictory signals of factory activity in May, suggesting the outlook for the economy remains uncertain — and complicating a policy response from Beijing. The government is considering giving tax breaks to some high-end producers to encourage more innovation. Home sales growth slowed last month, showing the property sector remains a drag.

- China’s Mixed Factory Surveys Show Recovery Still Uncertain

- China’s Home Sales by Top Developers Slow as Rebound Falters

- China Considers Tax Breaks for Manufacturers as Economy Cools

Debt risks

The creditworthiness of China’s local government financing vehicles, or LGFVs, was the most frequently cited top risk in a Bloomberg survey of 53 economists, money managers and strategists. S&P Global Ratings put the total debt of LGFVs at more than 46 trillion yuan ($6.5 trillion), with about 4.3 trillion yuan maturing onshore this year.

- Investors Zero In on China Local Debt Blowup as Top Risk in Asia

... and three things to watch for next week

- Trade and inflation reports for May. Factory deflation is forecast to deepen, while exports are expected to fall year-on-year.

- Earnings are due from travel agency Trip.com Group Ltd. and electric-vehicle maker Nio Inc.

- This chart shows there’s been little upside to owning shares listed in China or Hong Kong since markets bottomed at the end of October. In dollar terms, global investors would have made exactly the same returns buying global stocks with exposure to China’s economy as they would have tracking the MSCI China Index.

For a deeper dive into where China stands now — and where it’s going next — sign up to the Next China newsletter.