A few years ago, top investment bankers at Goldman Sachs Group Inc. wouldn’t even bother picking up phone calls from recruiters at smaller rivals. This year, managers at Jefferies Financial Group Inc., Evercore Inc. and PJT Partners Inc. say they’ve been inundated with CVs from the likes of Goldman, Barclays Plc and Credit Suisse.

Never in their careers have they seen so much interest from senior Goldman staffers, the bankers said, asking not to be identified discussing competitors. Those smaller firms are talking to dozens of partners and managing directors across the industry at any given time and selecting the best from that crop, they said.

Welcome to the new normal in the world of investment banking. A slump in mergers and acquisitions and the collapse of Credit Suisse have sparked an epic turnover of senior managers across the industry spanning trading and advisory services. It goes all the way to the top: of last year’s eight top merger advisory firms, seven have changed their investment bank chiefs or shuffled their M&A leadership in 2023.

Having expanded aggressively during the boom years, Goldman, Morgan Stanley and Citigroup Inc. are among those cutting jobs in some of the biggest downsizing rounds the industry has seen in the past decade. At the same time, lower-ranked rivals such as Deutsche Bank AG and Banco Santander SA are on a hiring spree, while boutiques are poaching top talent they’ve eyed for years, betting the next M&A boom cycle is just around the corner.

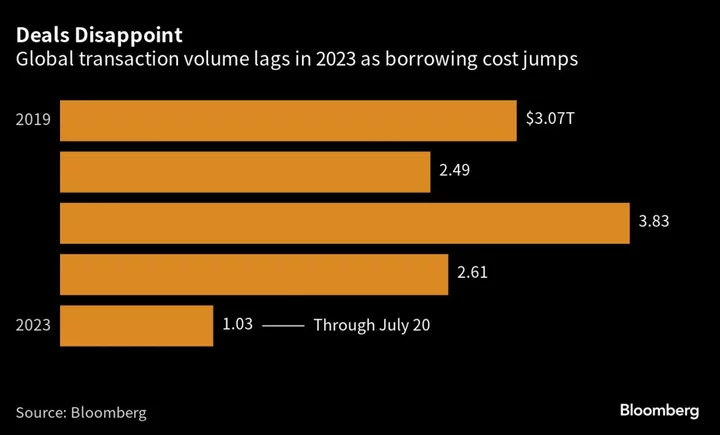

But the current downturn remains the elephant in the room and prospects for a revival still seem hazy. Higher finance costs, volatility spurred by geopolitical tensions and threats of a global recession have sent deal volumes down about 40% to roughly $1 trillion this year through July 20 from the same period in 2022. The record $3.83 trillion reached in 2021 is all but a distant memory now. In London, bankers’ pay fell at every level of seniority last year. The highest tier of vice presidents, for instance, made 13% less, according to a Dartmouth Partners survey.

Many transactions are stuck because of wrangling over valuations or regulatory hurdles. Private equity, a key fee generator for Wall Street, has also gone into a retreat mode. Though some such as Moelis & Co. are predicting a recovery, they aren’t sure when. Morgan Stanley Chief Executive Officer James Gorman has said deals will pick up but likely not until next year.

The churn across the industry this time has gone beyond what you’d normally see after a dismal bonus season or the occasional annual pruning exercise undertaken by banks to trim costs. Wall Street’s biggest banks shrank their ranks by about 21,000 people in the first half of this year, Bloomberg News reported this month. Goldman posted a 58% drop in second-quarter earnings as merger fees slid and revenue from investment banking missed estimates.

Some at Goldman — which has ranked as the top merger adviser for each of the last six years — have been surprised to see several colleagues leave for Evercore in just the last few months. Neil Wolitzer, a partner in real estate investment banking, is the latest of at least half a dozen senior bankers to leave Goldman and land at the firm run by John Weinberg this year, according to people familiar with the matter.

Evercore isn't actively looking to poach Goldman bankers but instead has seen more rainmakers become open to a move, according to an executive at the boutique advisory firm. Weinberg himself was a senior Goldman leader, responsible for running the banking franchise alongside now Goldman CEO David Solomon for the better part of a decade before he joined Evercore in 2016.

Representatives for Goldman, Jefferies, PJT and Evercore declined to comment.

Sensing Opportunity

With the big industry shakeup flooding the market with talent, many investment banks that have lagged far behind their Wall Street peers in M&A rankings are sensing an opportunity to either rebuild their teams or simply fill the gaps in their coverage for a shot at the league tables. Even boutique firms that depend on M&A fees are ramping up recruitment. Their strategy could either prove prescient or end up as a costly error in hindsight if the M&A market fails to bounce back.

“We’re seeing big team lifts because of the current difficulties at various places,” said Genevieve Fraser, a partner at global executive headhunting firm Maven Search in New York. Also, “institutionally, some banks are expecting a boom to follow this depression. When that comes, they want to be well-positioned to capitalize on it,” she said.

The turbulence is seen across the board: UBS Group AG, which acquired Credit Suisse in a government-brokered rescue deal in March, is planning to slash its smaller rival’s 45,000-strong workforce, Bloomberg News has reported; Morgan Stanley eliminated about 3,500 jobs this year following an earlier round in December; Goldman is letting go of 125 managing directors, including many in investment banking; and, Citigroup has been eliminating hundreds of positions, with its investment banking division among those affected.

Cost savings during the downturn seems to be the overarching reason behind the job reductions at the Wall Street firms. But lenders such as Barclays have had their own internal shakeups.

The UK lender, one of Europe’s last remaining global investment banks, has seen a series of departures, especially in the US, since naming Cathal Deasy and Taylor Wright as co-heads of investment banking earlier this year. A few months into the job, former Credit Suisse veteran Deasy has seen Barclays bankers leave for UBS — now the owner of his former employer.

Act of Revolt

Some of the exits were an act of revolt against the management reshuffle that saw a relatively new European manager brought in above the old guard comprising a tight-knit group of ex-Lehman bankers, including John Miller and Marco Valla — two key dealmakers at Barclays investment bank, according to people familiar with the matter.

The worst compensation cycle since at least 2008 was another reason, the people said. Some were approaching the end of their careers and decided to leave so they could pick up guaranteed pay packages before retirement, one person said. The people asked not to be identified discussing sensitive matters.

The reshuffle was intended to introduce fresh ideas and boost Barclays’ European investment banking franchise, some of the people said. And the lender has hired a slew of senior bankers to replace exiting staffers.

In a June interview with Bloomberg Television, Chief Executive Officer C.S. Venkatakrishnan said the turnover was only slightly higher than usual and called it “a little bit of musical chairs” and a “time-honored tradition” that follows the bonus season.

A representative for Barclays declined to comment.

Earmarking Resources

The exit of bankers at places like Credit Suisse and Barclays and cuts at Goldman and Morgan Stanley mean hiring opportunities for others.

Santander, the Spanish bank which has never been near the league tables, has earmarked resources for a hiring spree, which it is betting may pay off if deal volumes recover, according to a person with knowledge of the plans. The expansion mainly focuses on the US and the UK, the person said.

The bank has already brought aboard some top bankers jumping ship at Credit Suisse and is planning to recruit dozens more, people familiar with the matter have said. A spokesperson for Santander declined to comment.

Deutsche Bank, Germany’s largest lender, has hired more than 50 coverage dealmakers this year on top of a surprise acquisition of UK corporate broker Numis Corp. The purchase is expected to give the bank instant access to a long list of corporate clients that need advice on everything from debt to equity issuance, M&A and hostile takeovers.

“It hasn’t been a good year for investment banking,” said Matthias Schulthess, a managing partner at search firm Schulthess Zimmermann & Jauch. “But there’s also a lot of hiring, which is telling us that it’s a good time to fill the leadership or succession gaps in your global coverage for those who are catching up.”

Read More: Deutsche Bank on M&A Hiring Spree in Push to Win Market Share

Credit Suisse Woes

Plenty of those hires have come from Credit Suisse, which is now part of UBS. Many dealmakers have already left and some of those still around are upset with the integration process, according to people familiar with the matter. Only a handful of Credit Suisse staffers have been picked for leadership roles, while others are concerned they’ll be passed over for jobs despite possessing what they view as better credentials than their UBS peers, they said. UBS is also hiring from Barclays at the same time, adding to concerns that may alienate more Credit Suisse employees, they said.

A UBS spokesperson declined to comment.

Rivals have benefited from Credit Suisse’s troubles even before its ultimate collapse in March. The exodus of employees started in 2021 when the firm was grappling with losses stemming from the debacles of Bill Hwang’s Archegos Capital Management and supply-chain finance firm Greensill Capital.

Jefferies in 2021, for instance, scooped up a big team of Credit Suisse financial-services dealmakers. Other banks adopted that playbook.

Most of the hires at the moment are “idiosyncratic decisions” by individual banks showing interest to buy the “talent dip” as compensation packages shrink, said Ronan O’Kelly, who heads the corporate and institutional banking group for Europe at management consultancy Oliver Wyman.

Read more: London Bank Bonuses Plunged Across Board in 2022 M&A Drought

‘Employer’s Market’

For some firms, the job situation has now flipped to an “employer’s market” from what used to be a “candidate’s market” during the boom years, said Miguel Hernandez, who heads investment banking at Alantra, a Spanish boutique that’s hired 20 senior bankers in IB this year. Bonuses are often tied to the firm’s stock price. With shares down, it’s cheaper to hire.

Junior bankers who are still building out their client list may have to take downgrades in brand and compensation to find a new role, and it’s especially challenging if their focus is more into M&A than coverage, Maven Search’s Fraser said.

Still, top US talent remains “incredibly expensive,” she said, adding that the most sought-after bankers in the market are those who have 10 to 15 years of managing director-level experience with the ability to bring their clients and relationships to the new firm.

“Most firms do not want a project in the current market, they want someone who can bring a book of business,” she said. In many cases, they get a guaranteed bonus for two years in compensation for what they may have lost at their previous employers.

Despite the upheaval in the industry, Christoph Zeiss, a partner at Europe-based executive search firm Heads! International, also sees reason for optimism.

There’s been intense hiring happening especially in sectors such as telecommunications, technology, media and pharmaceuticals, Zeiss said. Companies looking to recruit the top of the top know such candidates expect high salaries, and are prepared to meet their demands as they position themselves for the next growth cycle, he said.

“There’s no crisis in investment banking,” Zeiss said.

--With assistance from Sridhar Natarajan, Liana Baker, Matthew Monks, Katherine Doherty, Fion Li and Fareed Sahloul.

Author: Jan-Henrik Foerster, Crystal Tse and Aaron Kirchfeld