Wall Street is eager to see the Federal Reserve wind down its aggressive rate-hiking cycle that's battered markets and tested investor morale. Although a pause in interest rate hikes appears likely, cuts may be farther off than some believe.

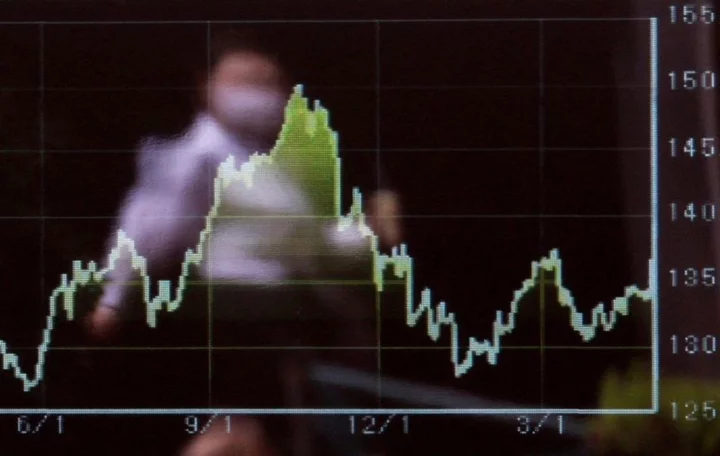

The stock market has stayed resilient this year after a brutal 2022 that was roiled by persistent inflation, the Federal Reserve's interest rate hikes, Covid shutdowns and geopolitical tensions.

Still, investors have remained hyper-alert for signs that the central bank could let up its brisk clip of interest rate increases. The Fed issued its tenth consecutive rate hike this May, raising rates by a quarter point. The central bank also opened the door to a pause, accelerating bets that the Fed will hold rates steady at its next meeting in June and cut rates as soon as July.

But experts say that the Fed probably won't slash rates so soon, at least if the economy stays hot (all bets are off if the US defaults on its debt). A rate-hike pause could actually be better for stocks than a cut, they say.

The Fed is unlikely to cut rates in July

Experts say that the Fed won't cut rates anytime soon for two key reasons: Inflation remains sticky, and the economy has stayed strong.

Although prices are stabilizing, inflation remains well above the Fed's 2% target. The Personal Consumption Expenditures price index, the Fed's preferred inflation gauge, rose 4.2% for the 12 months ended in March.

Meanwhile, American unemployment is at a record low. The US housing market is cooling, but low inventory and persistent demand is pushing home prices higher in some parts of the country.

In other words, there's nothing — at least, not yet — to convince the Fed it should pivot to lowering rates.

"The Fed rarely cuts rates without some sort of crisis in between," said Kara Murphy, chief investment officer at Kestra Investment Management.

The Fed last slashed rates after an emergency meeting in March 2020, when the onset of the Covid-19 pandemic sent US markets tumbling into the first bear market in 11 years and incited panic that the global economy could tip into a deep recession.

The collapses of Silicon Valley Bank, Signature Bank and First Republic Bank this year spurred fears that the banking sector could face more turmoil and credit standards will tighten. But the turmoil has largely been contained to regional banks, and both financial and economic leaders have maintained that the banking sector remains stable.

A serious turn for the worse in the banking sector, an implosion in the labor market or a similar nosedive for the economy would have to occur for the central bank to lower rates in July, says Liz Ann Sonders, chief investment strategist at Charles Schwab.

"The Fed would lose what credibility they have left if for no reason, they went from hiking to cutting," Sonders added.

Would a July cut benefit stocks?

Even if the Fed were to bring rates down soon, an immediate bull run isn't guaranteed.

History shows that stocks tend to perform tepidly following a pivot to rate cuts compared to a pause: The S&P 500 has historically climbed 16.9% on average in the 12 months following the last hike of a Fed rate cycle and fallen 1% in the 12 months after the central bank first cut rates, Credit Suisse said in a May 9 note.

"Assuming that the May 3 rate increase was the last of this cycle, stocks should perform quite well through the remainder of the year. However, if the Fed were to ease in July — as the futures imply — the upside would be far more limited," the analysts said.

Cutting rates prematurely could hold grave consequences for the economy.

Between 1972 and 1974, then-Fed Chair Arthur Burns hiked interest rates dramatically. Then, he cut them back down as the economy contracted.

When inflation later ripped higher, the Paul Volcker-led Fed took drastic action to push interest rates up to tame it. The effective Fed funds rates topped 22% by its peak in July 1981, and the central bank's aggressive tightening helped trigger back-to-back recessions that drove the unemployment rate as high as 10%.

Powell acknowledged the missteps in a speech last August at Jackson Hole. The Fed has since signaled that it likely won't lower rates this year and reaffirmed its commitment to tamping down inflation.

"I don't think that the Fed is going to be in any hurry to cut rates this time," said Marco Pirondini, US head of equities at Amundi.

that's not to say that a Fed rate cut this year is completely out of the cards, says Nicole Webb, senior vice president at Wealth Enhancement Group. The Fed eventually will want to lower rates back down, but it likely won't want to do it at the historical pace it's raised them over the past year, she says.

"They can slowly pace us down to 2.5% without the inflation monster rearing its ugly head again," Webb said. "And I do actually believe it's possible."