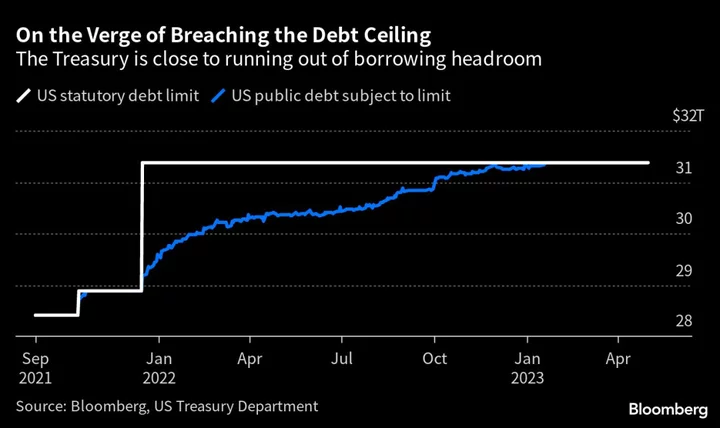

The fear premium baked into Treasury bills once seen as most at risk of a US default due to the debt-ceiling crisis has ebbed now that the Senate has passed legislation to suspend the borrowing limit.

Yields on Treasury bills maturing in early June — when Treasury Secretary Janet Yellen had said her department was at risk of running out of cash in the absence of a debt-cap deal — tumbled further Friday, with rates on some issues dropping below 5%. That’s well below levels of 7% or more that some had reached at the height of the crisis last month. Meanwhile, the cost of insuring US sovereign debt against default via derivatives has also eased back.

The debt-cap measure now goes to President Joe Biden, who forged the deal with House Speaker Kevin McCarthy and is set to sign it into law with just days to spare before a potentially catastrophic US default.

From Washington to Wall Street, here’s what to watch to gauge how sentiment is shifting.

The Bills Curve

Investors have historically demanded higher yields on securities that are due to be repaid shortly after the US is seen as running out of borrowing capacity. That puts a lot of focus on the yield curve for bills — the shortest-dated Treasuries. Noticeable upward distortions in particular parts of the curve tend to suggest increased concern among investors that that’s the time the US might be at risk of default. That had been most prominent around early June, but yields on those maturities have eased since the Biden-McCarthy deal was announced, suggesting investors are less concerned about the threat of missed payments.

The Cash Balance

The amount that sits in the US government’s checking account fluctuates daily depending on spending, tax receipts, debt repayments and the proceeds of new borrowing. If it gets too close to zero for the Treasury’s comfort it could still be a problem until the legislation is passed. As of Tuesday there was just $37.4 billion left, although it has rebounded since then. Focus has also been on the so-called extraordinary measures that the Treasury’s been using to stretch out its borrowing capacity.

Insuring Against Default

Beyond T-bills, another key area to watch for insight on debt-ceiling risks is what happens in credit-default swaps for the US government. Those instruments act as insurance for investors in cases of non-payment. The cost to insure US debt has retreated significantly and is now getting closer to non-crisis levels.

Rating Companies

Hovering over the whole debt-ceiling mess, meanwhile, is the risk that the major global credit assessors might choose to change their views on the US sovereign rating. Fitch Ratings recently issued a warning that it could opt to cut the country’s top credit score, a market-roiling step that Standard & Poor’s took during the 2011 debt-limit fight. This time around both S&P and Moody’s Investors Service have refrained from shifting their outlooks, although that is potentially a risk and investors will be clued in to anything the major rating companies might say about the situation even as the implementation of the agreed deal edges toward completion.