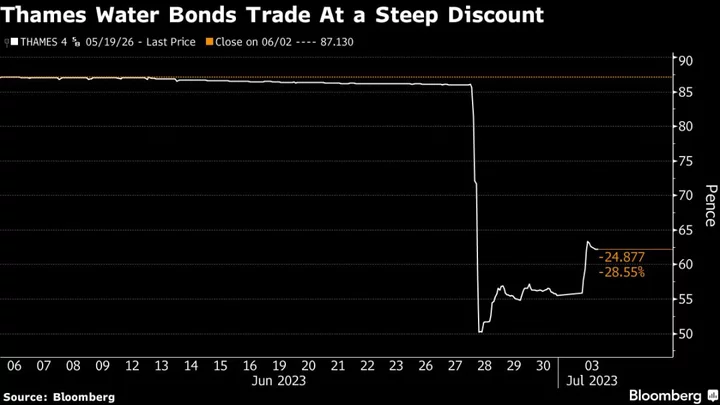

The bonds of the UK’s biggest water provider climbed on Monday as investors bet a selloff driven by fears the utility would be nationalized had gone too far.

Notes issued by Thames Water’s holding company unit that are due to mature in three years gained about 7 pence on the pound to 62, according to CBBT data compiled by Bloomberg. Meanwhile, debt due in 2027 that was sold by the operating company rose 0.6 pence to around 91 per pound.

The rebound comes as traders try to gauge the potential losses involved in holding the riskiest portions of the company’s debt. The bonds tumbled last week as concern mounted over the company’s heavy debt pile after it was revealed that Thames Water is in talks with government officials over contingency plans, including a temporary nationalization.

The company owes more than £14 billion ($18 billion) at the operating company level — its so-called ring-fenced borrowings, which are considered to be its safest liabilities. On top of that, however, the group has debt issued at the holding company level — including notes issued by Kemble Finance Plc which jumped on Monday — that rely on cash from the operating companies.

London Water Crisis Exposes ‘Broken Britain’ Risk for Sunak

Kemble bonds were quoted around 86 pence at the start of last week and closed on Friday below 56 pence. That steep discount is luring buyers, and trades are going through in the low 60s, according to people with knowledge of the matter who asked not to be identified because they’re not authorized to speak publicly.

The concerns around Thames Water have upended the perception of utilities as a dull-but-safe-investment, due to their key role in the country’s infrastructure. The firm’s executives face a parliamentary grilling later this month.

Citigroup analysts Jenny Ping and Rory Graham-Watson warned in a note on Monday that the debt at the holding company level could be at risk of default if the liabilities aren’t borne by consumers or taxpayers.

“Our understanding is that if a water company requires government help financially, it would be the operating company ring fenced assets and debt issued at these level that government takes over/support,” the said.

Author: Giulia Morpurgo, Tasos Vossos and Priscila Azevedo Rocha