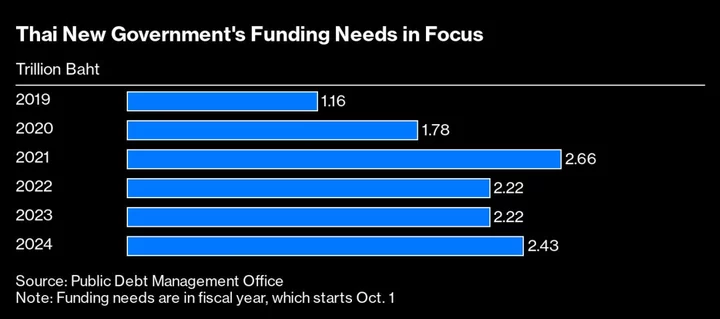

Thailand will reduce sales of long-tenor debt in favor of shorter notes to soothe investors worried about its plan to lift sovereign borrowing to a three-year high, according to the nation’s debt office.

The government plans to raise 2.43 trillion baht ($66 billion) in debt in the fiscal year starting Oct. 1, the most since 2020-21 when it funded Covid stimulus. The near 8% hike in borrowing is to finance a raft of measures announced by the government to lower the cost of living.

“We think the market can absorb the planned supply as we talk to market participants all the time,” Patricia Mongkhonvanit, director general of the Public Debt Management Office, said in an interview on Thursday. “We need to strike a balance between our funding needs and what the investors want.”

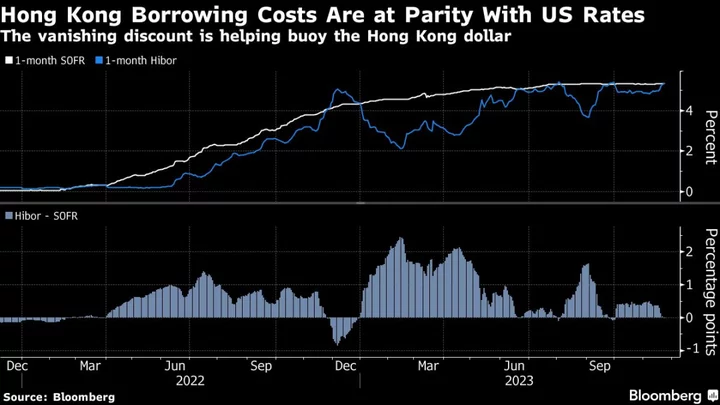

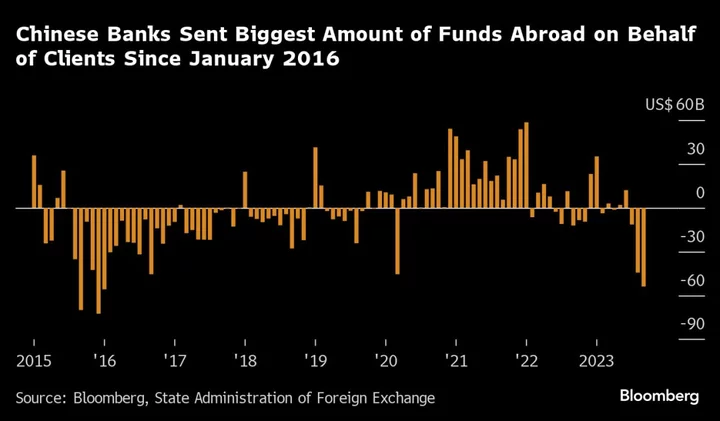

The debt office will need to contend with a fading appetite for Thai notes among foreign portfolio investors, who are net sellers of more than $2 billion of Thai bonds after a general election in May triggered a months-long political impasse. The yield on benchmark 10-year bonds have soared about 55 basis points to near an 11-month high since Srettha Thavisin was elected as the prime minister of a coalition government last month.

Srettha’s populist government has unveiled measures to spur economic growth that requires higher state spending, prompting the cabinet to clear a bigger budget deficit next year. The Bank of Thailand has raised its key rate to a decade-high 2.5%, and most economists now expect it to be on an extended pause.

The debt office plans to address any investor concerns by lowering the ratio of long-tenor bonds of 10 year and more to 48% of total issuance from 54% planned earlier. Thailand is also more reliant on local insurance, pension and mutual funds as foreign investors own only about 5% of government’s outstanding bonds, Patricia said.

Standard Chartered Bank Plc expects foreign investors to continue to shun Thai bonds given the additional supplies, preference for higher-yielding emerging market notes and the baht weakness. The BOT pause is likely to sustain rates curve steepening pressure, and the wide rate differentials with the US will likely continue to fuel portfolio outflows from Thailand, Stanchart analysts led by Tim Leelahaphan said in a report.

Breakup of Debt Plan:

While 1.7 trillion baht will be used for debt restructuring and refinancing, 730.8 billion baht will be new borrowing mainly to finance the budget deficit, Patricia said. The debt office plans to auction as much as 286 billion baht of bonds in the three months through December, including 107 billion baht of securities in October, it said on its website Friday.

The cabinet approval for public debt has penciled in only 194.4 billion baht as new borrowing for 2024 fiscal year, a fraction of the 1.13 trillion baht this year as it takes into account only the ongoing investment projects. The plan will be revised to include budget deficit and new projects, Patricia said.

Other key points from the interview:

- The debt office plans to borrow 19.7 billion baht in loans from Asia Infrastructure Investment Bank and Asian Development Bank for infrastructure projects.

- A plan to issue dollar bonds is still “on the table,” but the timing is not right as it’s still “too expensive and market is too volatile.”

- Plans to limit issuance of savings bonds to 100 billion baht this year not to crowd out corporate borrowers.

- Patricia not much worried about the nation’s sovereign credit ratings as the metrics which were outstanding are now more in line with other peer-rated countries

(Updates with bond auction schedule in eighth paragraph.)