Thailand unveiled a $14 billion cash handout to jumpstart its economy, trimming the size of the planned stimulus only slightly despite warnings from some economists and former central bankers that the outlay may stoke inflation and widen fiscal deficit.

The so-called digital wallet program will cover 50 million people with each receiving 10,000 baht ($280) that may be ready for disbursal by May, according to Prime Minister Srettha Thavisin. That’s down from an original proposal to extend the handout to 56 million people who are 16 years or older.

To be eligible for the cash handout, one should be earning less than 70,000 baht a month and hold less than 500,000 baht in savings accounts.

The cash dole will cost the government 500 billion baht and will be funded through a one-time borrowing, Srettha said. The government plans to move a special bill before the parliament by early next year to facilitate the borrowing, he said, adding the administration will also inject 100 billion baht into a capacity-building fund to promote automation and industrial innovation.

Read More: Thailand’s ‘Salesman’ PM Travels the World to Woo Investment

Shares of Thailand’s retailers and home-furnishing companies rallied on the wallet announcement while bonds and currencies fell on concerns of fresh borrowing widening the fiscal deficit. Central Retail Corp Pcl jumped as much as 6%, Berli Jucker Pcl surged 5.6%, Home Product Center Pcl rose 3.4% and Index Livingmall Pcl advanced 3%.

The baht extended losses to 0.8%, set for its first weekly loss in three, while the yield on 10-year sovereign bonds rose 3 basis points to 3.066%.

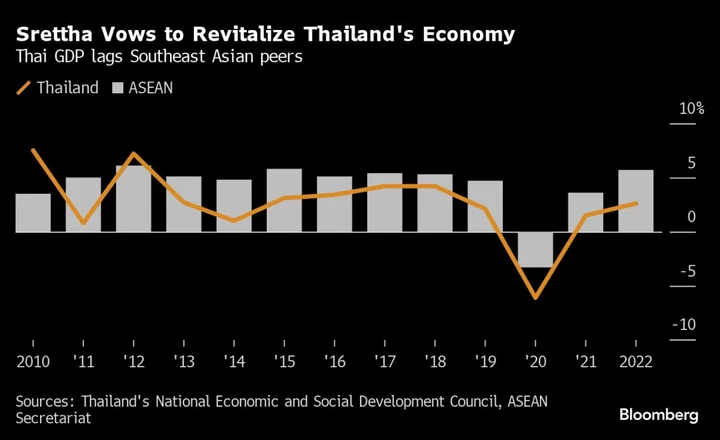

The one-time digital wallet payment is the flagship pre-election promise of Pheu Thai Party that leads the current coalition government. Srettha, a former property tycoon-turned-premier, has said the cash handout “will act as a trigger to revitalize the economy,” that has expanded at less than 2% average in the past decade, well below its Southeast Asian neighbors such as Indonesia and Vietnam.

“This marks the beginning of Thailand’s economic shift,” Srettha said. “This digital wallet scheme is only an initial economic stimulus policy. And let me reiterate that this is not a populist policy that will damage the economy and wellbeing of the people.”

Srettha’s proposals are part of a plan to stimulate economic growth to about 5% annually over the next four years. A petition signed by dozens of Thai economists and analysts, including former central bankers, last month said the program will do more harm than good. It’s also at odds with Bank of Thailand Governor Sethaput Suthiwartnarueput’s stance calling for prioritizing investment over stimulating consumption.

Read More: Thai Premier’s Rift With Central Bank Is Spooking Markets

On Friday, Srettha defended the stimulus measures saying they were meant to boost the economy in the short term and will not be inflationary. The funding of the digital wallet scheme will adhere to fiscal discipline and help reduce the ratio of public debt to gross domestic product, he said. The plan needs the approval of the cabinet and parliament, the premier said.

The main opposition Move Forward Party slammed the the plan to borrow money to finance the digital wallet, saying it will violate several existing laws and imperil the nation’s fiscal discipline and saddle it with interest and debt burden for years to come.

“Interest burden on the budget will exceed 10% in fiscal year 2025, which is something that credit rating agencies are definitely keeping an eye on to cut ratings,” party’s deputy leader Sirikanya Tansakun said.

While the cash handout is seen stimulating purchasing power at grassroots level of the economy in the short term, more measures may be needed to sustain the momentum, said Amonthep Chawla, head of research at CIMB Thai Bank.

The use of blockchain technology will help prevent the fund’s misuse and lay the foundation for a digital economy that can tackle structural problems, Srettha said.

Those not eligible for the cash handout can claim a personal income tax rebate on spending of as much as 50,000 baht in 2024, Srettha said. The government plans to pay back the money borrowed to finance the digital wallet within four years, he said.

(Updates with comments from opposition party in 11th paragraph.)