It’s the kind of acrimonious breakup that's hardly unusual. He says she took money out of a joint bank account and pilfered household items including a Nespresso machine. She says he's retaliating after the relationship went sour, and that $1 million of her money is locked out of her reach.

What sets it apart is the characters involved: Terry Smith, a UK money manager beloved by retail investors and his former partner Teresa de Freitas, who invested in his funds when the two were still a couple.

Their dispute blurs the lines between the personal and the professional, with her investment in Smith's offshore fund in Mauritius held up by criminal allegations made against her, according to an affidavit from a director at the fund. Those allegations, levelled by Smith, have since been dropped by the police.

At the heart of the argument are withdrawals by de Freitas from a bank account she shared with Smith when they lived together in Mauritius. In August 2020, shortly after the couple split up, she took 10 million Mauritian rupees ($250,000 at the time) and put most of it into one of his funds — after telling him her plans, she says. Months later, in the spring of 2021, he took legal action, saying she’d misappropriated the money and fraudulently invested it. The Supreme Court of Mauritius agreed to his request to have her assets frozen.

For de Freitas, the experience has been a lesson in the costs of going up against a powerful figure who holds a lot of sway on the small Indian Ocean island. Her inability to access her investment in Smith’s Mauritius-registered fund is linked to the suits he brought. It’s also a warning about the potential risks of using offshore locations, where investor protections may not be as stringent or as rigidly applied as in bigger financial centers, according to lawyers and tax experts.

Mauritius police said there are no investigations ongoing and that the funds can't have been misappropriated from what was a joint account. But more than two years on, the money is still stuck.

This story is based on interviews with de Freitas, correspondence with Smith’s lawyers, emails and court documents. Smith didn’t respond to requests for an interview.

Due Diligence

De Freitas applied to withdraw her money from the Mauritius fund in April 2021, but has faced additional checks by Apex Fund Services, the fund administrator. The affidavit from the Fundsmith director in 2021 said that the “enhanced due diligence” was necessary due to “criminal allegations pending against her.”

Those allegations were made by Smith, who also accused de Freitas of stealing items from their onetime home, including a coffee machine, a toolbox and a dressing table. Police investigated de Freitas, who was briefly arrested. The criminal case has since been dropped, the Mauritius police said in an emailed response to questions from Bloomberg.

Smith and de Freitas are still fighting through the courts over the misappropriation of funds.

In response to questions, Smith’s lawyers said he “has had to take the necessary legal action in Mauritius to secure the funds.” They said that any suggestion that he “improperly induced Fundsmith to disadvantage an investor for his own personal benefit is incorrect.”

Fund Success

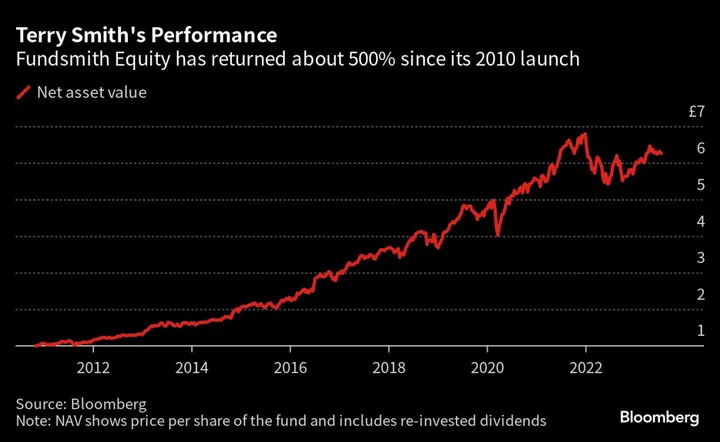

De Freitas and Smith first met in the UK in 2005 through work. A relationship developed and they were together when Smith — already a well-known figure in the City of London — launched his Fundsmith Equity fund in 2011. De Freitas invested £100,000 the following year.

The fund, which has grown to almost £24 billion, is the UK’s biggest for retail investors. It’s up more than 500% since inception, turning Smith into a sensation with a devoted following. The Bloomberg Billionaires Index calculates that Smith has built a personal fortune of over $1 billion, much of which is now in the control of a Seychelles-based foundation.

The couple later moved to Mauritius, where Smith continued to manage his popular UK fund. He also set up a new private vehicle to replicate his UK success.

Unlike the UK-registered fund, available to anyone via a website for a minimum £100 a month, the second falls under the jurisdiction of Mauritius, has an entry minimum of $100,000 and requires more meticulous due diligence when money goes in, according to fund documents. Among other things, clients have to give information about their source of wealth.

Offshore Locations

Smith is among the most prominent figures in Mauritius in financial services, and is on the board of directors of the Mauritius Economic Development Board, a government agency.

With its location in the Indian Ocean, the island is marketing itself as an “investment hub located midway between Africa and Asia.” In early 2020, it was put on the “grey list” of the Financial Action Task Force, which polices compliance with anti-money laundering measures, meaning it was subject to increased monitoring. It was removed in October 2021 for progress in addressing issues.

But lawyers and tax experts, speaking broadly about offshore locations, say there are still questions about regulations and enforcement, particularly in smaller jurisdictions.

The International Trade Administration, a US government agency, has noted such risks in the past. It cited a commercial dispute in Mauritius involving an unnamed US investor that “raised questions of governmental impartiality.”

“There's an appearance of compliance but no real compliance, that’s the biggest risk,” said Richard Murphy, a professor of accounting at Sheffield University, speaking generally about offshore jurisdictions. “In small regulatory environments the effectiveness of regulation is lower because there's no separation between the regulator and the company they are regulating.”

Fund Transfer

In 2016, de Freitas opened an account in the Mauritius fund. She put in $80,000, a gift from her father that he was allowed to pay directly into the account, according to de Freitas and emails seen by Bloomberg. She also transferred her Fundsmith Equity stake there.

But the relationship gradually broke down, according to de Freitas, and she ultimately ended things in 2020.

In April 2021, after the split, she applied to pull her entire stake, valued at about $1 million, from Smith’s fund. The application was approved and the investment was redeemed, Smith's lawyers said in an email. In such situations, the money typically moves into a client account, meaning Smith doesn’t have any financial gain from the investment. However, de Freitas wasn’t able to withdraw the proceeds.

Apex, the fund administrator, declined to comment when contacted by Bloomberg.

At the time, Smith and de Freitas were involved in multiple disputes, including his petition for the freezing order over the alleged misappropriation of funds.

The account that de Freitas took cash from was used to deposit Smith’s monthly salary of 1.67 million Mauritian rupees from his business there.

The Mauritius police told Bloomberg News that “no investigation has been carried out into the alleged misappropriation of fund as the couple held a joint bank account.”

Emails seen by Bloomberg suggest Smith was aware at the time — August 2020 — that de Freitas had withdrawn large sums from the account and planned to put the money into the Fundsmith Mauritius fund. Smith told the court that he only became aware “in or around November” 2020.

Smith's lawyers said that at the time he “did not appreciate the significance of Ms de Freitas stating that she may be transferring funds.” He thought she was just considering her options and that her “true intentions were never spelt out.” They said he never gave his consent.

Smith’s lawyers also say the timing doesn’t prevent him from “raising a legitimate legal complaint.”

Frozen Money

This complaint, alongside the now discontinued allegations of theft, prompted the enhanced due diligence, according to Smith’s lawyers and the affidavit. The former also cite anti-money laundering rules in Mauritius.

In a statement to Bloomberg on the withdrawals, de Freitas said that Smith “was well aware of my plans and did not object as it was our understanding that the money was mine.” She said it’s “appalling” that her money has been held up due to “accusations made by Terry regarding alleged ‘misappropriation’ of the money from the joint bank account.”

After submitting her Fundsmith withdrawal request, de Freitas exchanged multiple emails with Apex. She was asked to provide information showing proof of the source of wealth for her investments, and explain why she asked for the money to be deposited in a new bank account.

Smith’s lawyers said that de Freitas has failed to provide adequate documentation. They also said Fundsmith operates to “exacting standards” when it comes to money laundering prevention and that Apex acts independently.

De Freitas says she's struggled to find some documents. The original transaction document for the sale of a flat more than a decade ago that financed her initial investment in the UK fund could be among some of her possessions in a property she shared with Smith in the UK, she said. Smith’s lawyers say he ensured all of de Freitas’s documents were returned to her after the separation.

She says she sent Apex a letter from her lawyers confirming the transaction.

She also says she can’t provide proof of wealth for the $80,000 from her father, who has since died, because it was paid directly into Fundsmith Global Equity Fund Feeder when she opened the account. He was still alive when the request for proof was first made more than two years ago. Emails seen by Bloomberg show correspondence between de Freitas, Smith and at least one Fundsmith employee at the time about the payment from her father.

There have been no exchanges in more than a year, de Freitas says. Now living in Malta, she still doesn’t have access to her assets in Mauritius. She’s waiting for the court to decide if the enhanced due diligence was fair.

The court declined to comment on any new dates.

--With assistance from Kamlesh Bhuckory.

(Updates to underscore affidavit in eighth paragraph is the same as the one previously cited, adds more detail on timeframe in third to last paragraph.)