The yen is nearing levels that will likely prompt Japan to again jump in and defend the currency, according to T. Rowe Price’s Quentin Fitzsimmons.

The level of 150 per dollar “appears to be pretty sensitive,” especially with a fresh report signaling ongoing inflationary pressures, said the global fixed-income portfolio manager at the $1.35 trillion investment giant. The yen traded around the 143.50 level on Monday, the weakest since November.

Commenting on the currency’s weakness in Tokyo, the nation’s top FX official Masato Kanda said recent moves were excessive and the government wasn’t ruling out any options.

“Recent moves are seen as rapid and one-sided,” Kanda said. “We’d like to pay close attention with a strong sense of urgency and deal with excessive moves appropriately.”

The growing divergence between the Bank of Japan’s easy monetary policy and the hawkish bent of its major counterparts continues to weigh on the yen, which has weakened almost 9% against the dollar this year.

Officials intervened last year when the currency was quickly heading toward 146 after a BOJ meeting in September and followed up with further yen buying in October when it was fast approaching 152 per dollar.

“We’re entering the intervention levels that we saw in September and October,” Fitzsimmons said. “If they intervene, they will support it, but then the problem is the contradiction with their monetary policy stance — the currency is really telling you that monetary policy is too loose.”

So far, however, BOJ Governor Kazuo Ueda is standing pat, repeatedly saying he will patiently continue with monetary easing. That’s in stark contrast with other central banks and proving to further erode prospects for a turnaround for the currency.

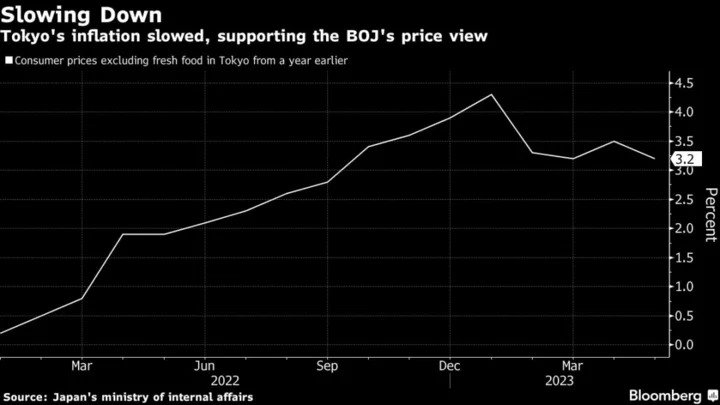

Japan’s consumer prices rose at a faster pace than expected in May, with a measure that excludes energy and fresh food accelerating at the fastest pace since 1981, data showed on Friday. A weaker yen helps fuel the inflation trend by raising the prices of imports.

“There is clearly a big conflict between the evidence that we have for the rate of inflation and inflationary pressures in Japan versus the BOJ’s monetary policy stance,” Fitzsimmons said. “It’s extraordinary on the face of it that they’re sticking to their guns.”

Fitzsimmons still sees the central bank stepping away from their ultra-loose policy this year. An unexpected intervention could precipitate more formal policy changes, he said.

“They love to surprise,” he said. “That’s been the history of the institutional framework.”

--With assistance from Yoshiaki Nohara and Emi Urabe.