Switzerland’s lenders are strong enough to cope with possible additional interest-rate increases by the Swiss National Bank, its vice president, Martin Schlegel, told Schweiz am Wochenende.

Most lenders have sufficient capital buffers to handle even an abrupt increase in borrowing costs, Schlegel said in an interview published in the weekly newspaper on Saturday. While further monetary tightening could lead to more credit defaults, these remain rare in Switzerland, he added.

“Price stability has top priority,” Schlegel said. “At the moment, we don’t see any signs that the interest rate hikes pose a threat to financial stability.”

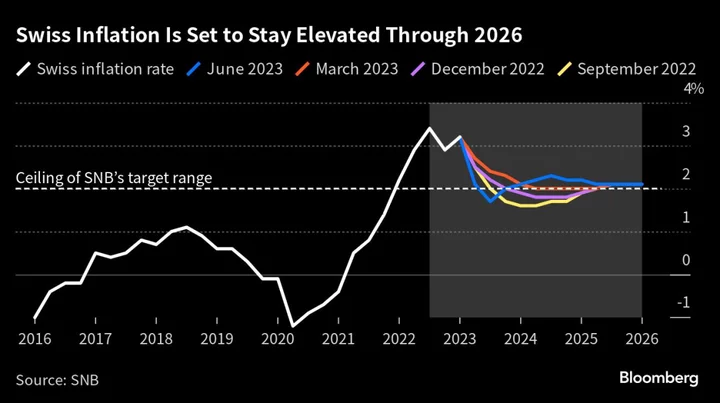

The SNB has raised rates by 250 basis points since last June to 1.75% and has sent strong signals that another hike will come at officials’ next scheduled meeting in September.

Although inflation in June dipped below the 2% ceiling the central bank is targeting, officials have warned this may not yet be permanent due to ongoing second-round effects. The SNB expects consumer-price growth to average 2.2% both this year and next.

Schlegel also told the newspaper:

- Credit Suisse could not have been saved as an independent bank with more liquidity help from the SNB

- “Credit Suisse did not get into trouble because of a lack of liquidity assistance,” Schlegel said. “Without massive liquidity assistance from the SNB, however, there would have been an international financial crisis”

- While the circulation of 10-, 20- and 50-franc bills is increasing, bigger notes are being returned. Since last June, the circulation of 1000-franc bills has dropped by around 10 billion francs

- The SNB doesn’t want a law forcing businesses to accept cash

- Over recent years, the vulnerability of Switzerland’s real estate market has increased, and there is a risk of price corrections