Swedish underlying inflation eased further from its fastest pace in three decades, as moderating food prices brought relief to the country’s central bank, which is planning to dial back the pace of tightening.

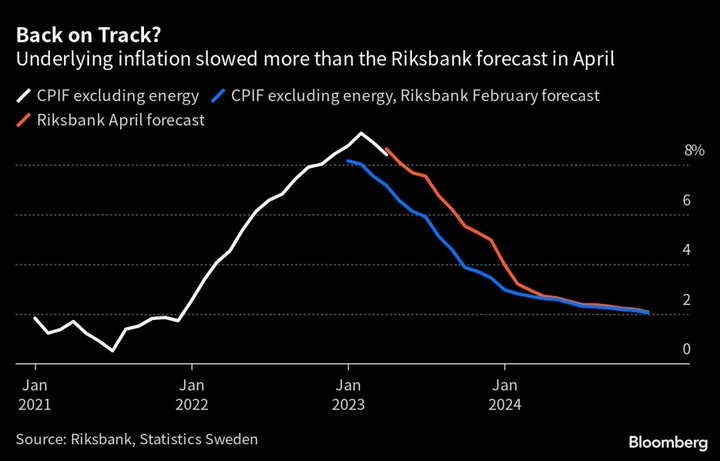

A price measure that strips out energy costs and the effect of interest-rate changes rose 8.4% from a year earlier in April, according to data published by Statistics Sweden on Monday. That was lower than the median estimate of 8.7% in a Bloomberg survey as well as the 8.6% expected by the central bank.

The Riksbank — which has also confronted a weakened krona that worsens imported inflation — raised its key rate by half a percentage point to 3.5% in April. While board members outlined smaller hikes ahead, minutes from the meeting showed that they are still prepared to act more forcefully if necessary to curb price increases. The latest reading indicates that inflation could cool more rapidly than the Riksbank expected, according to Nordea Bank Abp’s chief analyst Torbjorn Isaksson.

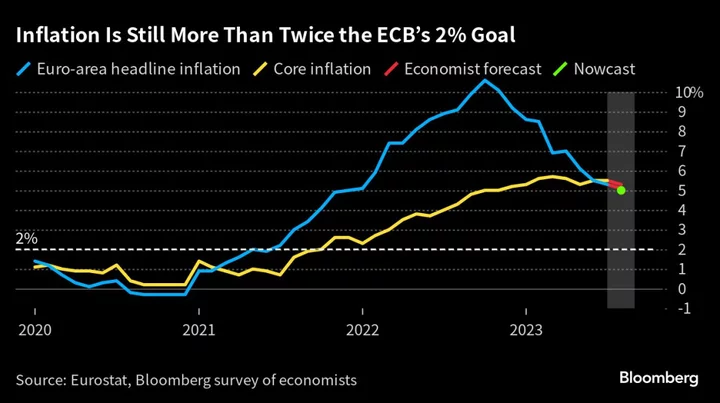

“The outcome strengthens the view that inflation is on a downward trend,” Isaksson said in a note. “We stick to our view that Riksbank will hike rates by 25 basis points in June to 3.75%, not least as the ECB is expected to hike rates further, but risks are tilted to the Riksbank staying on hold.”

What Bloomberg Economics says...

“Going forward, we expect inflation to follow a downward trajectory toward a year-end rate closer to 3%, markedly higher than the Riksbank’s forecast of 1.9%. This also motivates our call for a 25-bp hike in June, which compares with the Riksbank’s ambiguous signaling of a likely increase in either June or September.”

- Selva Bahar Baziki, economist. Click here to read more.

The central bank’s moves are already having a tangible effect on the Swedish economy, as housing prices have slumped, new-home construction is plummeting and retail sales are plunging at a record pace, with the country set to undergo the worst economic contraction in the European Union this year, according to OECD forecasts. That development has led some economists to warn that the rate hikes could jeopardize the Swedish economy and its labor market.

One of the critics, Laura Hartman, chief economist at the Swedish Trade Union Confederation, took to Twitter to say that the Riksbank should take a “chill pill” after the latest inflation reading.

“Now we have definitely had enough of rate increases and focus should be on a soft landing for the economy and preventing unemployment,” Hartman said.

At the same time, highly leveraged commercial real estate companies are finding themselves in trouble as borrowing costs rise. Last week, fissures in the sector became apparent as one of the country’s largest landlords, SBB, postponed dividends and canceled a rights issue after suffering a debt ratings cut.

While price increases are expected to remain far above the 2% targeted by the Riksbank for the rest of the year, the reading marks a second consecutive slowdown in underlying inflation, from a peak of 9.3% in February. Food prices fell by 1.3% in April from the previous month, marking the first decline since November 2021.

--With assistance from Joel Rinneby.

(Adds analyst comments from third paragraph.)