SBB, the embattled developer at the center of Sweden’s property crisis, is considering carving out its entire residential business with a portfolio of 36.5 billion kronor ($3.4 billion) for an initial public offering, according to a person familiar with the matter.

Samhallsbyggnadsbolaget i Norden AB — as the company is formally known — has asked SEB AB to explore options for a potential listing either in the fourth quarter of this year or the first half of 2024, the person said, asking not to be identified as the discussions are private. SBB intends to keep a material shareholding following the IPO, the person said.

As an alternative, SBB is also considering bringing in one or two institutional investors to control 50% of the residential portfolio while retaining the other half, the person added.

Representatives for SBB didn’t respond to requests for comment, while SEB declined to comment.

Stockholm-based SBB is racing to raise cash to bolster its books as it grapples with an $8 billion debt pile and a spate of rating downgrades. The company, which expects a cash shortfall of 8.1 billion kronor over the next 12 months, suffered a setback in July when talks to sell a 51% stake in a portfolio of school buildings to Brookfield Asset Management Ltd. abruptly ended.

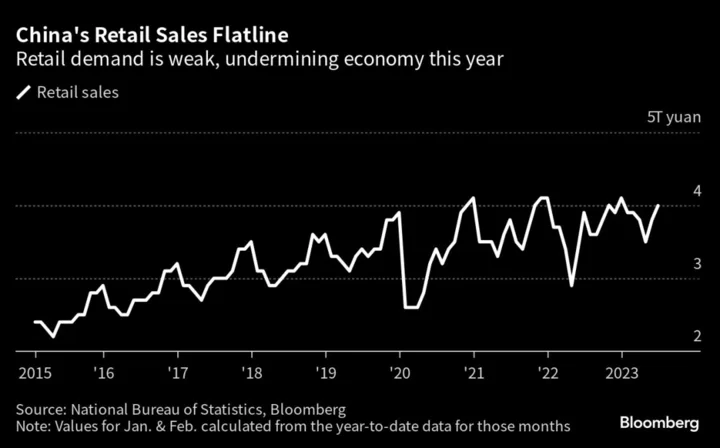

SBB’s woes are reflective of the broader turmoil that’s engulfed real estate markets globally, as higher interest rates depress valuations. They are also becoming a broader issue in Sweden, where SBB owns many public-sector buildings like nursing homes and schools.

Previously, SBB had said it was considering an IPO of Sveafastigheter Bostad Group AB, a residential property company it acquired in 2020 for 2.8 billion kronor. That unit represented less than half of the portfolio of residential assets now under consideration for a listing, according to a valuation published by the firm in February.

In the meantime, SBB’s troubles continue to mount. Last week, S&P Global Ratings cut the company’s rating by four more notches to CCC+, saying “securing sufficient funding needs is taking longer than expected, and we believe SBB’s access to capital markets remains remote.” A group of bondholders has threatened legal action if various demands weren’t met to protect their investments.