UK Prime Minister Rishi Sunak risks failing against the very promises he told voters to judge him by.

At the beginning of January, the premier set five pledges he said would be the test of his performance. They were to halve inflation, grow the economy, reduce the national debt, shrink National Health Service waiting lists and stop migrants crossing the English Channel.

“I fully expect you to hold my government and I to account on delivering those goals,” Sunak said.

But six months on, inflation is proving sticky, recession is becoming more likely, and debt has risen, leading Bank of America Corp. strategists to characterize the UK as the “stagflationary sick man of Europe.” Meanwhile, hospital waiting lists are at a record and boats full of migrants continue to land on England’s shores.

That leaves Sunak heading toward a probable general election in 2024 defined by failure on his own terms.

Here’s how the premier’s performance stacks up against his promises:

Inflation: Stuck

What he said:“We will halve inflation this year.”

Inflation ended 2022 at 10.5%, so it will need to come down to around 5.25%. In January, that looked like an easy goal, with the Bank of England and Office for Budget Responsibility both forecasting a fall to below 4% this year.

It was widely assumed inflation would fall mechanically as the energy-cost surge triggered by Russia’s invasion of Ukraine fell out of the year-on-year comparisons.

But the optimists didn’t bargain on the labor market being as tight as it is. With the main lever to control inflation lying with the Bank of England, achievement of the goal is largely out of the government’s control and is now in question.

Inflation held at 8.7% in May, figures Wednesday showed. Worryingly, core inflation — an indicator of how “sticky” prices are — accelerated to a 31-year high of 7.1%.

That triggered a 50 basis-point rise in interest rates from the BOE, but it’s clear that the fight against inflation — Sunak’s primary goal — is not going to plan.

Nevertheless, with energy prices falling, Bloomberg Economics reckons Sunak will meet his goal — but only just.

Growth: Anemic

What he said: “We will grow the economy.”

The UK economy is growing, just, though it has yet to recover the output lost during the pandemic — only Germany is in the same position among Group of Seven nations.

Any growth is nonetheless a success of sorts. When Sunak made his pledges, both the OBR and the BOE were predicting lengthy recessions amid a deepening cost-of-living crisis. The OBR saw the economy resuming growth in the final months of 2023, a forecast Sunak then turned into a commitment.

Until recently, the prime minister appeared set to deliver. After a second quarter hit by an extra holiday for the coronation, economists predicted steady, if unspectacular growth. That may change.

Some economists are predicting it will require a recession to finally tame inflation. The BOE raised rates again on Thursday to 5% and money markets are pricing in 6.25% by the end of the year, inflicting further mortgage pain on already squeezed households.

Bloomberg Economics assesses that a 6% rate would equate to a 2% plunge in GDP. That may compound the polling nightmare for the governing Conservatives, with a general election due by January 2025 at the latest.

Debt: Rising

What he said:“We will make sure our national debt is falling.”

It was almost lost among the bad inflation news on Wednesday, but UK government debt rose above 100% of GDP for the first time since 1961 last month.

The bleak milestone is not just embarrassing for Sunak, it has political consequences too. The premier will find it harder to deliver the big tax cuts many Tories say are needed if the party is to avoid electoral defeat.

Inflation is once again the culprit. The Treasury is spending billions in energy subsidies and other payments to help struggling households. Meanwhile, debt costs have risen sharply, largely reflecting the fact that a quarter of UK government bonds are tied to the Retail Prices Index.

Support payments are time-limited. What matters more for Sunak are interest rates and gilt yields, which have risen further since the OBR delivered its last assessment of the public finances in March.

At the time, the watchdog judged the government had just £6.5 billion ($8.3 billion) of headroom against its main fiscal rule — to get debt falling as a share of GDP within five years.

All else equal, the rise in borrowing costs since then leaves Sunak on course to miss his debt commitment, according to Dan Hanson of Bloomberg Economics. The rule is based on net debt excluding the Bank of England, which climbed to 89.6% of GDP in May.

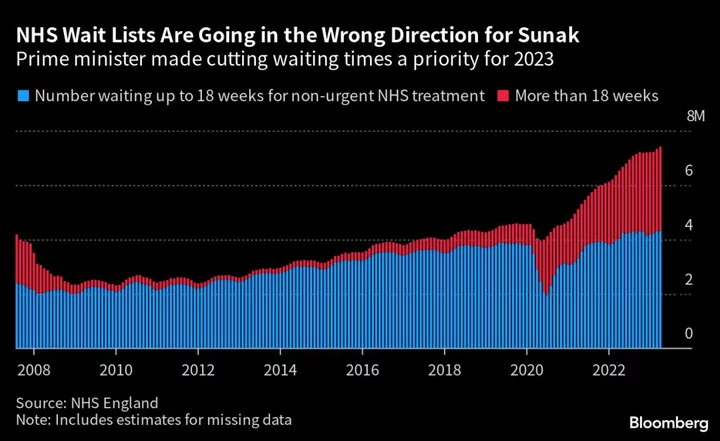

Waiting lists: Record-breaking

What he said: “NHS waiting lists will fall.”

NHS waiting lists rose to a record 7.4 million people in April, according to data released in June by the health service.

The rise came as the government contends with ongoing industrial action over pay from NHS workers that’s seen nurses, paramedics, and doctors walk out.

More than 542,000 appointments have already been rescheduled due to strikes since December according to NHS Providers, a group that represent trusts in the state-run system. That’s a number that’s set to grow: the government remains in dispute with nurses and junior doctors, while consultants and other senior doctors are also being balloted for strike action.

The government has stressed the need for spending restraint to keep up the fight against inflation, and though a pay offer was accepted by most unions representing NHS staff in May, two unions including the Royal College of Nursing rejected it and pledged more strike action.

Health leaders have blamed staff shortages and people seeking treatments after the Covid-19 pandemic for the rising waiting times.

Boats: Not stopped

What he said: “We will pass new laws to stop small boats.”

The pledge to “stop the boats” bearing migrants from crossing the English Channel was perhaps Sunak’s most ambitious.

Parliament did approve the government’s contentious Illegal Migration Bill in April. And the number of people arriving has come down slightly compared with last year’s figures.

However, with the weather improving in June, the numbers have started to rise again. Almost 11,000 have made the crossing so far this year, including more than 3,300 this month, with little sign of the government stopping the flow.

It is equally unclear how the government plans to tackle the backlog of asylum cases, which has rocketed to more than 130,000. Sunak has been unable to keep his promise to deport migrants on flights to Rwanda, after an order from the European Court of Human Rights prevented the first flight from taking off last year.

The government says it is spending around £5 million a day housing asylum seekers in hotels, has procured barges to accommodate migrants, and announced a £478 million deal with France to fund better enforcement across the Channel. So far, the return on that investment has been limited.

--With assistance from Philip Aldrick and Stuart Biggs.