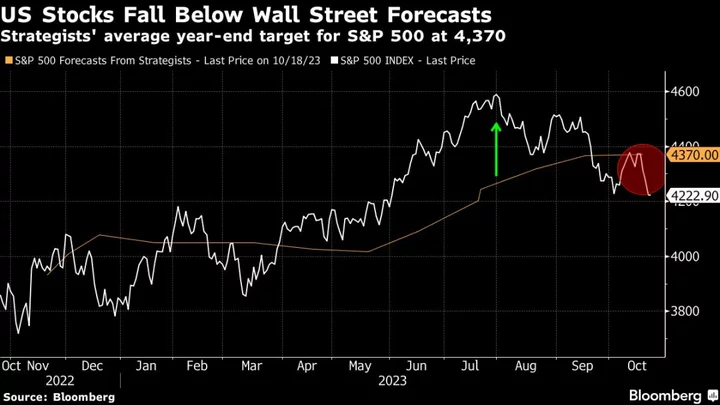

Don’t anticipate big gains from US equity markets anytime soon, says one Wall Street prognosticator who foresaw the rally in the first half of this year.

The S&P 500 Index peaked in July and is unlikely to trade beyond the mid-4,000s for the next six months as higher rates weigh on corporate earnings growth, according to Stifel Chief Equity Strategist Barry Bannister. The US stock benchmark rose slightly on Monday, hovering above the key technical 4,200 level, while the 10-year Treasury yield crossed 5% for the first time since 2007.

“Our view is that the S&P 500 peaked summer 2023 and tops around 4,400 through April 2024,” Bannister wrote Monday in a note to clients. He previously predicted stocks would be at that level by the end of December.

While Bannister believes that yields will top around 5% during the current cycle, he projects a normalized 10-year yield of up to 6% during the mid-2020s.

“It is not ‘Fed high for longer’ — the Fed has returned to ‘policy modulation at normalized rates,’” he said.

US stocks have flailed in recent months, eroding a strong advance in the first half of the year, against a backdrop of a turbulent bond market, driven by concerns that sustained higher interest rates will derail economic growth. Worries about the buying power of US consumers and fresh geopolitical risks from war in the Middle East have further weighed on investor sentiment in recent weeks, dragging the S&P 500 below its 200-day moving average on Friday for the first time since March.

Bannister was one of a handful of sell-side forecasters to accurately make a contrarian call on the US stock rally in the first part of 2023 and has since said gains would stall in the second half of the year — a projection that is so far playing out. The strategist also sees little to no upside for the US equities for the rest of the decade as tighter US financial conditions thwart price-to-earnings ratios across US firms.

“Our mantra has been that ‘We’re all traders now’ as the 2020s decade is likely flat/widely range-bound for the S&P 500,” said Bannister, adding that US stocks are in the “fourth secular bear market of the past century.”

This year’s topsy-turvy equity market has upended conventional wisdom for Wall Street’s soothsayers. In the first half of the year, strategists were blindsided by the resilience of the US economy, recovering corporate profits and an artificial intelligence frenzy that fueled technology stocks. Just as many were cornered into changing their pessimistic views this summer, US equities began to lose steam.

With just a little more than two months left in 2023, market participants are torn. Strategists at firms including Goldman Sachs Group Inc. and Deutsche Bank AG think earnings could drive the S&P 500 another leg higher at year-end, while bears like Morgan Stanley’s Michael Wilson see further declines in US equities.

RBC Capital Markets LLC’s Lori Calvasina said Monday that the “outlook has become cloudier and we don’t think the pause in the S&P 500 rally is done yet.”