BANGKOK (AP) — Shares were mixed in Asia on Monday after the S&P 500 logged its fourth winning week in a row, while investors await another decision by the Federal Reserve on interest rates.

Most observers expect no change in rates given recent data showing the U.S. economy slowing. This week also brings price data that might indicate whether the Fed is succeeding in snuffing inflation.

Friday also will bring a policy meeting of the Bank of Japan, which has refrained from making any major changes to its minus 0.1% benchmark interest rate despite rising prices, citing a need to wait and see if the inflation is sustained.

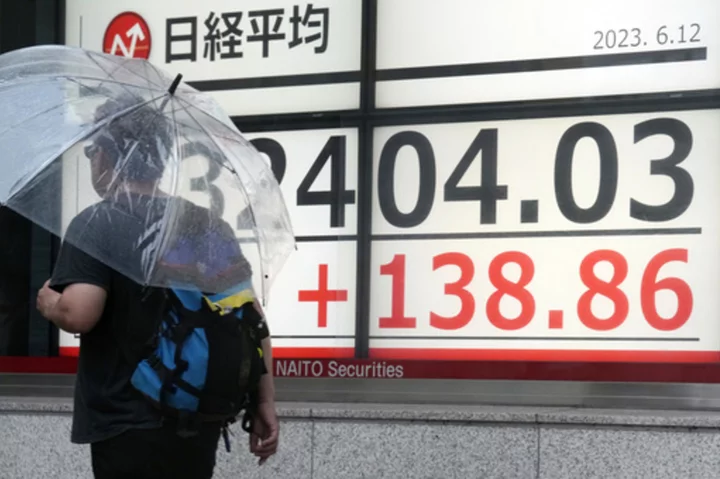

Tokyo's benchmark NIkkei 225 added 0.3% to 32,362.58, while the Hang Seng in Hong Kong gave up 0.6% to 19,279.66. In Seoul, the Kospi declined 0.5% to 2,627.52.

The Shanghai Composite index slipped 0.3% to 3,222.35. Shares rose in Taiwan and India but fell in Bangkok. Australian markets were closed for a holiday.

Stocks inched higher Friday to close out a listless week for Wall Street, though the S&P 500 rose 0.1%, to 4,298.86, capping its fourth straight winning week. The Dow Jones Industrial Average added 0.1% to 33,876.78, and the Nasdaq composite gained 0.2% to 13,259.14.

Tesla led the market, rallying 4.1% after announcing General Motors electric vehicles will be able to use much of its extensive charging network beginning early next year. GM rose 1.1%.

Energy stocks fell along with the price of crude oil. Exxon Mobil slipped 0.7% and was one of the heavier weights on the market.

On Monday, U.S. benchmark crude was down another 79 cents at $69.38 per barrel in electronic trading on the New York Mercantile Exchange. It lost $1.12 on Friday to $70.17 per barrel.

Brent crude oil gave up 84 cents to $73.95 per barrel.

The S&P 500 index's return to a new bull market reflects growing hopes the economy might avoid a severe recession despite the sharp rise in interest rates as the Fed strived to bring inflation under control.

“The S&P 500 is now at levels it has not seen since last September. The NASDAQ is up 26.68% year-to-date -– not bad for an economy that seems poised to slip into recession later this year,” ING Economics said in a commentary.

The highest rates since 2007 have helped inflation come down some, but it's still above everyone's comfort level.

Also Friday, Adobe rose another 3.4% to add to its 5% leap from the day before following its announcement of a new artificial-intelligence offering for businesses. It joined a frenzy around AI that has sent a select group of stocks soaring, such as a 165% surge for chipmaker Nvidia so far this year.

Proponents say AI will be the next revolution to remake the economy, while critics say it’s inflating the next bubble.

In the bond market, the yield on the 10-year Treasury rose to 3.75% from 3.74% late Friday. It helps set rates for mortgages and other important loans.

In currency trading, the dollar slipped to 139.37 Japanese yen from 139.39 yen. The euro weakened to $1.0743 from $1.0750.