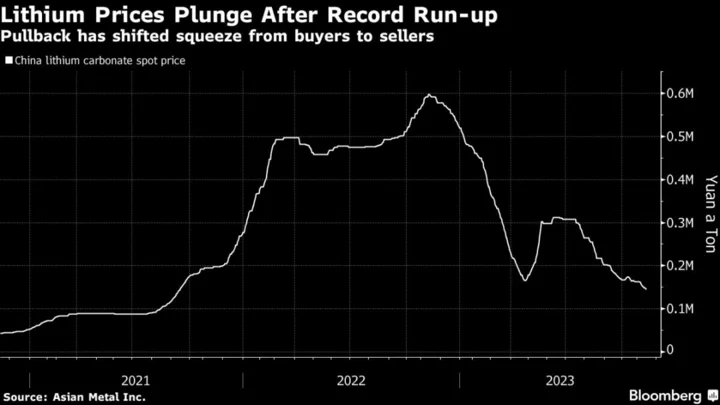

The world’s second-largest lithium producer is warning investors of further price declines as a glut of the metal continues to work its way through the battery supply chain.

Reporting a bigger-than-expected drop in third-quarter earnings, Chilean miner SQM blamed this year’s price pullback on an excess of inventory, particularly in Asia, as well as new supply coming on stream. Those pressures “could continue to have a negative impact on lithium prices in the short term,” said Chief Executive Officer Ricardo Ramos.

Shares fell as much as 8.7% in New York.

To be sure, SQM maintained its forecast for global demand to grow by around 20% this year and also stuck with its upbeat projection for electric-vehicle sales in the energy transition.

Still, the firm — which is closely watched because it’s more exposed to spot prices than peers — warned the downward price trend could continue for the rest of the year, with fourth quarter volumes set to be similar or lower than the previous period. SQM has “seen some softening of demand outside China,” Felipe Smith, senior commercial vice president, said on a call Thursday.

Lithium prices have tumbled in the past year after new supply came on stream in Australia and buyers ran down inventories as some EV makers rethink their growth plans. Albemarle Corp., the biggest lithium producer, said earlier this month that it was “a bit perplexed” as to why prices had fallen so far given EV demand remains healthy.

SQM said its lithium carbonate capacity had reached 200,000 tons a year and it expects to expand to 210,000 tons by the beginning of 2024, earlier than expected.

Despite the low prices, SQM will continue to run at full capacity, building inventory to be ready when purchasing rebounds, Carlos Diaz, head of lithium, told analysts.

Given its leadership in costs and sustainability, SQM will “always be there in the market,” Smith said.

On the call, SQM declined to comment on its takeover bid for Azure Minerals Ltd. after Australian billionaire Gina Rinehart built up a major stake in the firm.

Chief Executive Officer Ricardo Ramos said talks continue with Codelco over a new operating arrangement under Chile’s public-private participation model.

Some of those talks are focused on new production methodologies, with direct lithium extraction one of many alternatives, Ramos said. SQM bought a stake in Adionics last quarter and plans to work with the French firm on DLE technologies.

--With assistance from Philip Sanders.

(Updates with shares in third paragraph, comments from conference call from fourth paragraph)