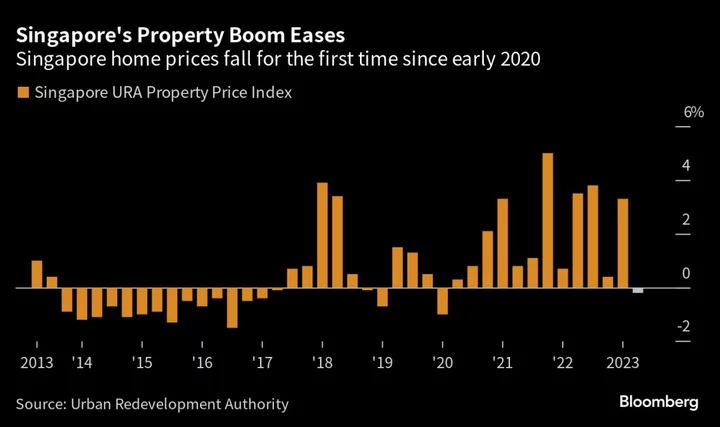

Singapore home prices fell for the first time in three years in the second quarter, adding to signs that the property boom is starting to moderate.

Private property values slid 0.2% from the previous three months, when they rose 3.3%, final Urban Redevelopment Authority figures showed Friday. That compares with a preliminary estimate of a 0.4% drop, and confirms the first decline since the start of 2020.

Price momentum is finally easing after a buoyant run that saw Singapore’s red-hot property market defy a global slowdown from Paris to Shanghai. To keep a lid on apartment values, the government doubled stamp duties for foreign buyers in April to 60% — the highest among major markets. It also raised levies for second-home buyers.

The tax hikes and elevated interest rates “may have reined in price growth as homebuyers purchasing for investment become price resistant and adopt a wait-and-see attitude,” said Leonard Tay, head of research at Knight Frank Singapore. He downgraded his 2023 outlook for Singapore’s private home price growth to 3% to 5%, versus the original 5% to 7% range projected at the end of last year.

Despite the decline in values, developers sold 2,127 private residential units in the second quarter, compared with 1,256 sold in the previous quarter, due to more new launches.

“Demand remains underpinned by homebuyers purchasing for their own occupation,” said Tay, adding that the latest measures have most acutely affected foreign purchasers.

While local demand remains undeterred, total foreign buying of private apartments in the second quarter slumped by 23% from the previous three months to the lowest since the first quarter of 2022, according to OrangeTee & Tie’s analysis of caveat data as of July 18.

“With more housing supply coming onstream, we estimate that overall property prices will continue stabilizing,” said Christine Sun, senior vice president of research and analytics at OrangeTee & Tie. Full-year growth could slow to around 4% to 6%, versus 8.6% in 2022 and 10.6% in 2021, she said.