A handful of European companies have stepped away from their plans to sell junk debt recently, underscoring the difficulty of trying to navigate turbulent markets.

Sweden’s Stena AB and France’s FNAC Darty changed their minds on issuing new bonds in the past month. Restaurant Brands Iberia scrapped its plan to reprice a euro-denominated loan, the first time that’s happened in seven months.

Meanwhile, two planned sales of portfolios of debt — so-called bids wanted in competition, or BWIC — were also cancelled, first a package of loans worth €290 million ($305 million) and the second a portfolio of leveraged loans and bonds worth €275 million.

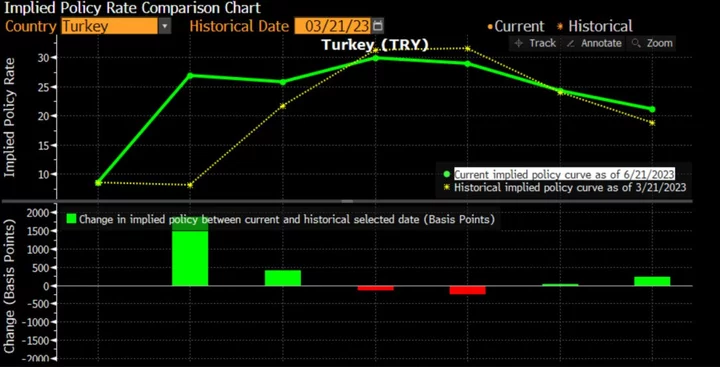

They’re all indications of how the market has become more challenging for lower-rated companies to borrow after the rapid surge in interest rates. On Friday European Central Bank Governing Council member Klaas Knot said that officials are likely to keep interest rates at their current high level for at least a year.

“The market will become increasingly selective,” said Nicolas Jullien, a high yield portfolio manager at Candriam SA.

Swedish ferry operator Stena had been working on a bond sale, but ultimately decided not to go ahead. “We will wait and see how the high-yield market will develop,” a spokesperson said.

The volatility has affected other high-yield sales. Britain’s Pure Gym saw its sterling debt fall in the secondary market. It’s currently trading at 97.6 cents after pricing at par.

“With some postponed deals in high yield and loans, one could not be faulted for thinking that the higher rates environment is really biting leveraged finance hard. To some extent that is true,” said Mahesh Bhimalingam, chief credit strategist for Bloomberg Intelligence.

However, he pointed to the turnaround in the iTraxx Crossover as a sign that sentiment could improve. The index, used as a measure of credit risk, is at around 437 basis points on Friday morning after pulling back from a five-month high earlier this week.

The slightly better tone has encouraged some companies to brave the market. Dutch software firm Exact Holding B.V., for example, is in the process of marketing a loan deal to raise at least €400 million.

--With assistance from Eleanor Duncan and Charles Daly.