As fears of a severe US recession recede, investors flush with cash are looking to put money to work in junk assets. Companies with upcoming maturities are rushing to take advantage.

Anemic issuance means demand far exceeds supply in high-yield markets. That’s paved the way for borrowers to create a little more wiggle room via refinancing and amend-and-extend transactions ahead of a wall of more than $1.6 trillion of junk corporate debt that’s due for repayment through 2029.

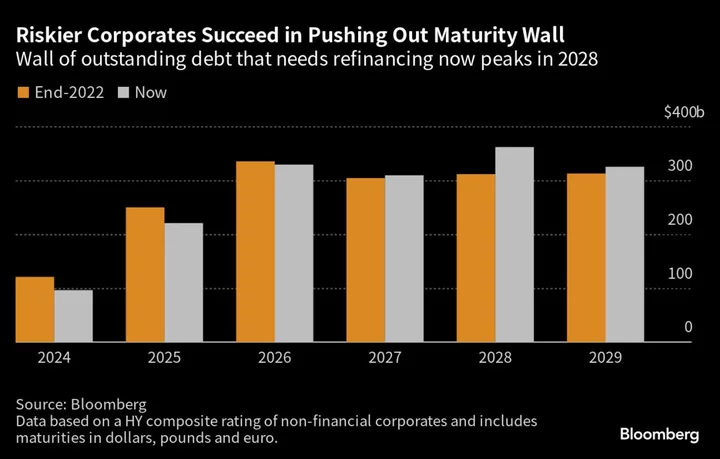

For now, the weakest companies are the ones chipping away at the maturity wall. The amount of high-yield credit coming due in 2025, which firms would typically need to start addressing later this year, is now less than $221 billion, according to data compiled by Bloomberg News. That’s a decline of almost 12% since the start of 2023.

The upswing in demand comes as US gross domestic product growth is expected to increase to an annualized 1.8% in the third quarter, nearly quadruple the 0.5% pace projected in July, according to the latest Bloomberg monthly poll of economists. The brighter outlook led Morgan Stanley to cut its base case for US junk and loan spreads by 100 basis points, to 450 basis points and 550 basis points respectively, last week.

“Credit spreads are now trading through our bull case in US investment grade and high yield, while approaching those levels in loans,” the strategists, including Vishwas Patkar, wrote in a note to clients. “While credit has lagged” the US rally in Europe, “overall valuations are also approaching our previous bull case targets.”

The safest companies have been more hesitant about taking advantage of the rally. Once investment-grade firms are added to the mix, the wall of debt for the coming two years is little changed since the start of the year. Debt maturing from 2026 onward has even grown since the end of last year, the Bloomberg News data show.

That suggests blue-chips are sitting tight on the low coupons they locked in during the cheap-money era, hoping that when the time comes to repay their old debt, borrowing costs will be lower than they are now. This waiting game can be a risky one.

“Many corporates are choosing to wait for peak terminal rates to be behind us, allowing for a less steep increase in average cost of debt upon refinancing,” said Fraser Lundie, head of fixed income at Federated Hermes. “However, fundamentals will be increasingly challenged the longer we stay at peak terminal rate levels.”

Concern around that higher-for-longer scenario has caused risk appetite to soften in recent days after minutes of the last Federal Reserve meeting further implied that the central bank was not done with raising interest rates. Some executives have warned of the implications for credit if interest rates remain high.

Armen Panossian, Oaktree Capital Management LP’s incoming co-chief executive officer, told analysts earlier this month that he sees a “capital crunch” for some highly-leveraged firms emerging over the next six to 18 months as the rise in base rates begins to have an impact.

For now, however, “a two-speed economy, sticky inflation and muddled global economic picture” looks to be “aiding high-yield assets generally but the most high-quality high-yield assets more specifically,” Bloomberg Intelligence’s chief US credit strategist Noel Hebert wrote in a note on Friday.

Week in Review

- The $1.5 trillion private credit market set a fresh record for the largest loan in its history. Lenders including Oak Hill Advisors LP, Blue Owl Capital Inc. and HPS Investment Partners LLC. are providing the $5.3 billion package for Finastra Group Holdings Ltd., a fintech firm owned by Vista Equity Partners.

- Country Garden Holdings Co. is seeking to extend a maturing bond for the first time ever and halted trading in local notes, leading to greater skepticism of the efficacy of China’s property policy help.

- Banks sold debt tied to Apollo Global Management Inc.’s leveraged buyout of Tenneco Inc. The firms have suffered big losses on their Tenneco LBO funding, but much of that pain has been offset by around $210 million of interest payments.

- Apollo is poised to sign more than $4 billion in so-called NAV loans as it steps up unorthodox lending to private equity firms looking to raise cash in a challenging high-cost environment.

- Trucking firm Estes Express Lines struck a $1.3 billion deal to acquire all of Yellow Corp.’s terminals out of bankruptcy.

- Zhongzhi Enterprise Group Co. missed payments on some investment products, fanning financial contagion fears in China’s $2.9 trillion trust industry. China’s banking regulator has set up a task force to examine risks at the group and Zhongzhi hired KPMG LLP to review its balance sheet.

On the Move

- Benjamin Gohman, a managing director in Credit Suisse Group AG’s leveraged finance group, is joining Canada’s Bank of Nova Scotia as head of non-investment grade finance and capital markets, and head of US loan syndication.

- Credit Agricole CIB recruited David Norton from Cantor Fitzgerald LP as a managing director in high-yield sales.

- Brokerage firm Performance Trust Capital Partners hired Erik Rand and Tom McLemore to lead loan trading efforts as managing directors.

- Credit Suisse’s Guillermo Dilone joined Wells Fargo & Co. as a director on the bank’s high-yield credit trading desk.

- Banco Santander SA hired private equity dealmaker Hayes Smith, who had worked at Credit Suisse for two decades before a stint at Truist Financial Corp.

--With assistance from Dan Wilchins.

Author: Tasos Vossos and Jill R. Shah