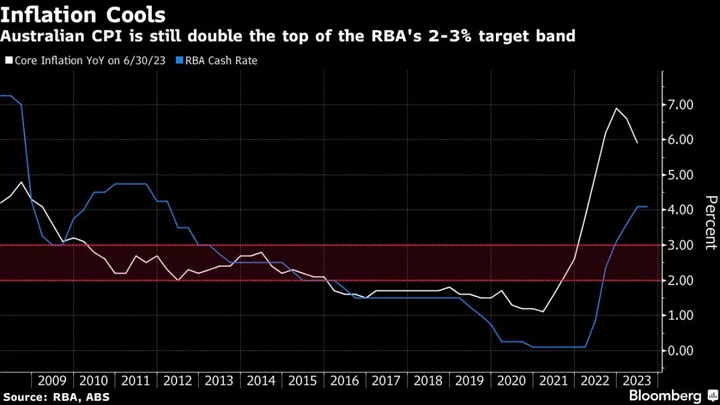

Australia’s central bank sees a “credible path” to return inflation to its 2-3% target with interest rates at their current level, minutes of its Aug. 1 meeting showed, suggesting a higher hurdle to further tightening.

The Reserve Bank debated raising the cash rate but decided to stand pat based on the view that its 4 percentage points of cumulative hikes are slowing the economy, the minutes showed Tuesday. The board also discussed the RBA staff’s quarterly forecasts, which were little changed from the prior three-month period, even though they were conditioned on a further rate hike.

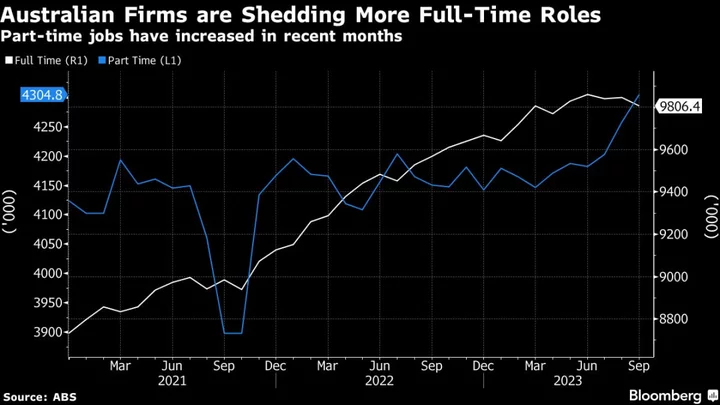

“Consumption had already slowed significantly, there were early signs that the labor market might be at a turning point and inflation was heading in the right direction,” the RBA said. “Members observed that there was a credible path to the inflation target with the cash rate staying at its present level.”

Further boosting the case for the RBA to stand pat at the current 4.1%, data Tuesday showed annual wage growth at 3.6% remained detached from the inflation rate of 6%. That report and the dovish minutes resulted in the Australian dollar extending its decline and yields on three-year government bonds paring earlier gains as traders scaled back bets on future hikes.

The minutes showed the case to hold borrowing costs for a second straight month was the stronger one, with the RBA citing a “reassuring” decline in consumer price growth. Among other reasons to pause, board members highlighted that policy has already been tightened “significantly” and “there were signs that this was working as intended.”

The RBA did leave the door ajar to further hikes to help bring inflation back to target “within a reasonable timeframe,” but the minutes suggest that will require data to surprise markedly on the upside.

“With inflation easing globally, including in Australia, there isn’t a strong argument in favor of hiking rates in September,” said Callam Pickering, an economist at global job site Indeed Inc. “The RBA does anticipate that further rate hikes may be necessary to contain the current inflation outbreak but they are clearly happy to wait-and-see before making their next move.”

Economists still expect one more rate hike by the RBA later this year, while financial markets reckon the tightening cycle is all but over.

The central bank also said that recent data signaled the economy remains on a narrow path in which inflation returns to target while employment and the economy continue to grow.

The case to raise rates was centered on the risk that inflation might prove stickier than anticipated and may not meet the current forecast of falling back within target by late 2025. Australia’s benchmark policy rate is also lower than many other countries despite inflation being at least as high.

Australia’s 4 percentage points of hikes since May 2022 trail both the US and New Zealand’s 5.25 points.

The RBA also suggested that an unexpected rebound in house prices may point to the need for further tightening, saying it “could be a signal that financial conditions were not as tight” as thought.

--With assistance from Matthew Burgess.

(Adds wages data, market reaction, chart)