Australia’s central bank considered alternative policy scenarios where its cash rate peaked at 4.8%, a level that returned inflation to its 2-3% target by the end of 2024 and avoided a downturn, internal documents show.

The Reserve Bank assessed three paths in the documents dated March 2023 and released under a Freedom of Information Act request by Bloomberg News on Thursday. The options discussed were based on technical assumptions used in the RBA’s quarterly economic forecasts published in February.

These were:

- “Steady Climb” where the cash rate rises by 25-basis-points at each meeting to 4.8% in August, a level described as about 1 percentage point above a “reasonable nominal neutral rate estimate”

- “Front-Loaded Path” where the rate jumps in 50-basis-point increments at each meeting to 4.8% in May

- “Flat” where the cash rate is left at 3.35% — the level it stood at in February — until mid-2024

“All cash rate paths bring inflation within the target band by the end of the Statement on Monetary Policy forecast horizon,” the unidentified authors said. “The ‘steady climb’ and ‘front-loaded’ paths are the quickest to return inflation to the target band in late-2024.”

The modeling suggests the RBA has scope to tighten further from the current 3.85% rate while still following its “narrow path”to a soft landing for the economy. The Australian dollar extended gains after the documents suggested more room for rate hikes, while yields on three-year bond futures — the most sensitive to RBA policy decisions — jumped to hit an intraday high.

“I find it pretty unbelievable that even with the cash rate at 4.8% it won’t have a material difference to their base case. I’d definitely be forecasting a recession in that scenario,” said Diana Mousina, deputy chief economist at AMP Capital Markets Ltd. “It just means that there’s still definitely the risk of more rate increases.”

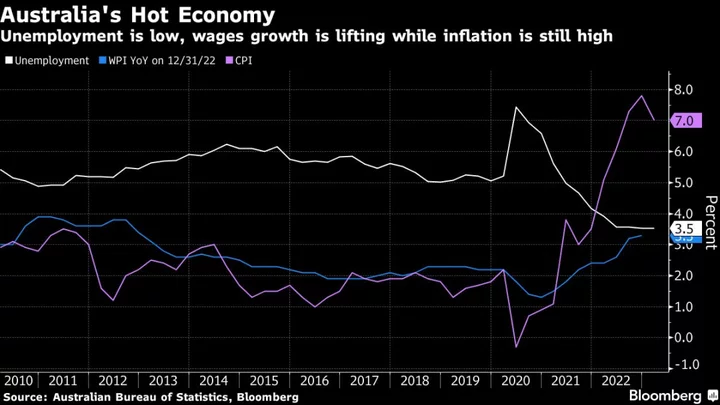

A peak cash rate of 4.8% would push the jobless rate to the RBA’s February estimate of full employment at 4.5%, from 3.5% now, while narrowly avoiding a “Sahm recession,” the documents showed. A Sahm recession occurs when the jobless rate rises by over three-quarters of a percentage point within a year.

The central bank used the Sahm rule rather than a fall in GDP to define a recession as it helps identify even a mild slump and “is consistent with broader interpretations of recessions in Australia,” according to email exchanges between RBA officials on Feb. 28. The names of the senders and recipients were redacted.

Under the “front-loaded” and “steady climb” scenarios the 4.8% rate peak is held for the remainder of 2023. From 2024, the cash rate then begins to ease quickly to reach 1.5% at the end of 2026, the analysis showed.

Since the report, the RBA has hiked rates in March, paused in April, and delivered a surprise increase in May. The documents shed light on Governor Philip Lowe’s previous public comments that the bank has looked at scenarios where inflation has been brought back to target quicker than currently anticipated.

Economists said the RBA’s decision to undertake the modeling isn’t surprising but expressed frustration that the central bank has so far refrained from publicly discussing the study.

“It is a little disappointing though that Governor Lowe did not communicate alternative paths in more detail, which may have given markets and the public a greater sense of the uncertainty,” said Tapas Strickland, head of market economics at National Australia Bank Ltd. and former RBA official.

“A cash rate of 4.8%, which would be more inline with other central banks, is not implausible,” he added.

The RBA’s latest quarterly forecasts released on Friday showed unemployment at 4.5% in late 2024 and inflation hitting the top of the target in mid-2025. The estimates were based on the cash rate peaking at 3.75% and easing back to 3% in two years’ time.

The RBA also undertook a similar analysis in February, where it included the more aggressive rate path adopted by the Reserve Bank of New Zealand. That showed a peak rate of a “little over 5%” resulted in a Sahm recession.

The central bank’s board next meets on June 6 and the governor delivers a speech the following day in Sydney. Money markets imply that policymakers will leave borrowing costs unchanged next month.

(Updates with comments from economists, further details.)