The new higher-for-longer stage of global monetary policy may last only until the early months of 2024 as central banks begin moving toward cutting borrowing costs.

That’s the outlook foreseen by Bloomberg Economics, whose aggregate gauge of world interest rates is seen beginning a swift descent in the first quarter. In advanced economies, that shift will take only slightly longer to transpire before they too synchronize downwards.

By the end of next year, only two of the 23 central banks in our quarterly global guide aren’t anticipated to have moved to rate reductions: borrowing costs in inflation-prone Turkey are seen staying steady, while the Bank of Japan is expected to finally exit negative monetary policy.

A remarkably stable “higher-for-longer” plateau in advanced economies that Federal Reserve chief Jerome Powell signaled in August will last no more than three quarters, according to the forecasts.

Both the US and the euro zone are expected to cut rates before the middle of the year, with the UK and Sweden waiting a bit longer.

The BE outlook points to a turning tide in the tightening cycle. It also highlights how the ultra-low-rate world that preceded it won’t be back any time soon, as the volatile era European Central Bank President Christine Lagarde terms as an “age of shifts and breaks” keeps officials wary of loosening too far.

More 125 basis points will be lopped off the aggregate global rate by the end of next year, with a smaller decrease of about half that size anticipated across the world’s richer countries that still amounts to noticeable easing too.

Even so, that’s a markedly slower pace of descent compared with how borrowing costs were jacked up in the first place.

What Bloomberg Economics Says:

“The peak for global central bank rates is in sight. The Fed may have one more hike to deliver — we think they won’t but it’s a close call. For the BOJ, 2024 will be the year when Governor Kazuo Ueda edges away from extreme stimulus settings. And Turkey’s central bank is still playing catch-up. The big picture, though, is that inflation is trending down, and 2024 will see cuts from most central banks.”

—Tom Orlik, global chief economist

Here is Bloomberg’s quarterly guide to a sample of the world’s top central banks that covers 90% of the global economy.

GROUP OF SEVEN

US Federal Reserve

- Current federal funds rate (upper bound): 5.5%

- Bloomberg Economics forecast for end of 2023: 5.5%

- Bloomberg Economics forecast for end of 2024: 4.75%

- Market pricing: Traders are split on the likelihood of another rate hike this cycle, before cuts to around 4.6% by end-2024

Most Fed officials have said they expect to raise their benchmark lending rate once more this year, capping the most aggressive tightening campaign in nearly four decades. But further progress cooling inflation, along with tightening financial conditions, could give them pause over the coming months.

Policymakers forecast rates reaching 5.6% by the end of 2023, according to their median projection released in September, with 12 of 19 officials penciling in one more 25 basis-point hike. It’s not clear whether the final hike could come at the Fed’s Oct. 31-Nov. 1 meeting, or its gathering in December. While investors place greater odds on the former, they anticipate policymakers will ultimately abandon the final increase. Seven officials projected no further hikes this year, amid signs that underlying price pressures have eased.

Fed Chair Powell and several of his colleagues have stressed that the US central bank can “proceed carefully,” suggesting they’re in no rush to push rates higher, and will look to the data to guide future decisions. Beyond 2023, they’ve made clear rates will stay need to stay higher for longer than they previously expected to bring inflation back to their 2% target.

What Bloomberg Economics Says:

“Fed officials have unified around the message that rates may be ‘at or near sufficiently restrictive.’ Though the median FOMC member sees another rate hike this year, our baseline is that the FOMC will rather hold rates at 5.5% in the rest of 2023. That’s because the economy faces a confluence of negative economic shocks – the UAW strikes, potential government shutdown, tightening financial conditions, surge in oil prices. If a recession unfolds around end-year as we forecasted, then the Fed cutting rates by 75 basis points in 2024. Still, if core inflation is higher than expected in the rest of the year, we see substantial risk that the Fed could follow through with another rate hike.”

—Anna Wong

European Central Bank

- Current deposit rate: 4%

- Bloomberg Economics forecast for end of 2023: 4%

- Bloomberg Economics forecast for end of 2024: 3.25%

- Market pricing: No further hikes are priced with cuts starting from the middle of next year, with the key rate priced to finish 2024 around 3.35%

After 10 straight rate increases, the ECB is ready to take a break from hiking. Keeping borrowing costs at current levels for a “sufficiently long” time will make a “substantial contribution” to a speedy return of inflation to 2%, policymakers said after their latest decision.

While some of the Governing Council’s more hawkish officials initially stressed further steps might be necessary — President Lagarde herself has refused to say that rates have reached their peak — a quickly deteriorating economy and slowing price pressures have calmed those voices. A debate on how to deal with the ECB’s €4.8 trillion ($5.1 trillion) of bond holdings, on the other hand, is set to pick up. Reinvestments of debt maturing from a portfolio built during the pandemic are currently scheduled to continue until the end of next year — a date that may be brought forward.

What Bloomberg Economics Says:

“The ECB has probably finished raising rates. Numerous measures of underlying inflation are falling, surveys are pointing to a significant deterioration in activity and credit extension is weaker than it was in the depth of the euro crisis. The Governing Council will still need a long time to have sufficient confidence to lower rates. We expect the first cut in June, as core inflation decelerates further.”

—David Powell

Bank of Japan

- Current policy-rate balance: -0.1%

- Bloomberg Economics forecast for end of 2023: -0.1%

- Bloomberg Economics forecast for end of 2024: 0%

- Market pricing: The key rate rising slowly, with a 10-basis point hike priced in early 2024. Market pricing suggest around 25 basis points of cumulative tightening over the next year.

The coming months mark a critical time for the BOJ as it could well pave the way for a policy adjustment after more than a decade of intense stimulus. Half of polled economists see the demise of negative rates coming in the first six months of next year after Governor Ueda has seen more data on prices and wages. That leaves the possibility of further yield curve control tweaks or an updating of guidance in the meantime.

With inflation likely to remain above the bank’s 2% target during the quarter, economists expect the BOJ will need to raise its price forecasts again in October. The bank will also likely get an early glimpse at the direction of next year’s wage talks when the biggest union group unveils its negotiating stance in the coming weeks. The yen is another critical factor. Ueda could come under pressure to take action early if the currency continues to weaken.

What Bloomberg Economics Says:

“The BOJ faces a dilemma. Its dovish policy stance is pushing the yen down and driving up import prices — contributing to cost-push inflation. But the central bank also sees a need to keep stimulating wobbly demand to secure its inflation objective. The BOJ is now leaning harder against a rise in JGB yields to defend its framework — and letting the government looking take care of the yen, with intervention if needed. The result could be markets that are more jittery and bumpy.”

—Taro Kimura

Bank of England

- Current bank rate: 5.25%

- Bloomberg Economics forecast for end of 2023: 5.25%

- Bloomberg Economics forecast for end of 2024: 4.75%

- Market pricing: Markets are leaning toward one further hike this cycle, before officials cut the key rate to 5% by end-2024

After 14 consecutive rate hikes, the BOE has pressed pause on its quickest monetary tightening in three decades. Britain’s economy is responding slowly to higher borrowing costs, but the outlook has darkened significantly since the start of the second half, with stagnant gross domestic product figures threatening to turn into a recession.

Policy makers led by Governor Andrew Bailey are likely to cut inflation and growth forecasts after their next meeting concludes on Nov. 2. That would help explain why in September they unexpectedly held their fire on further rate hikes despite prices growing at three times their 2% target. The gloom may be a challenge for Prime Minister Rishi Sunak’s government, which is likely to seek reelection next year.

What Bloomberg Economics Says:

“The BOE’s focus is shifting. Even though it has signaled more rate hikes are possible, it is becoming increasingly concerned about the faltering economy. The dovish data flow is likely to continue in coming months meaning the terminal rate for this cycle has probably been reached. Rate cuts won’t start until the second half of 2024 as the central bank balances strong underlying price pressure against an economy in the midst of a mild recession.”

—Dan Hanson

Bank of Canada

- Current overnight lending rate: 5%

- Bloomberg Economics forecast for end of 2023: 5%

- Bloomberg Economics forecast for end of 2024: 4%

- Market pricing: One more hike is priced as probable later this year or in the early months of 2024, with the key rate then falling back to 5% by end-2024

Canada’s economy unexpectedly contracted in the second quarter as its heavily indebted households feel the pinch of one of the most aggressive hiking cycles in the history of the central bank. Further proof of fading excess demand led Governor Tiff Macklem and his governing council to hold borrowing costs steady at 5% when they met in September, but they threatened the possibility of further tightening to damp expectations for any near term rate cuts.

So far, the threat has worked — traders in overnight swaps see rates higher for longer in Canada, too, and put the odds of a hike at the bank’s next meeting on Oct. 25 at over a third. And while the economy has weakened and the labor market has loosened, progress on inflation has reversed course, with oil prices pushing headline inflation to twice the 2% target. Policymakers will also update their forecasts this month, and will need to address why progress on cooling underlying price pressures has stalled.

What Bloomberg Economics Says:

“The Bank of Canada will likely remain on hold for now, keeping the target for the overnight rate at 5%. Though economic activity will likely be supported by energy prices, production, and exports, a swiftly cooling labor market crates downside risks for the economy. The BoC, however, has already shown a willingness to pause and restart rate hikes if the decline in employment proves to be a temporary hiccup and the pace of disinflation slows.”

—Stuart Paul

BRICS CENTRAL BANKS

People’s Bank of China

- Current 1-year medium-term lending rate: 2.5%

- Bloomberg Economics forecast for end of 2023: 2.3%

- Bloomberg Economics forecast for end of 2024: 2.2%

China’s economy is showing some signs of stability after the country rolled out stimulus to support growth. Recent data has shown a pickup in manufacturing activity, though the recovery is far from swift and readings for the services sector have been soft. Economists overwhelmingly see the property crisis as the major challenge to growth, which is now expected to match the government’s goal of around 5% this year.

Under new Governor Pan Gongsheng — who took office in late July — the People’s Bank of China cut its main policy rate by the most since 2020, marking the second reduction this year. The central bank also lowered the reserve requirement ratio for most banks in September, which should reduce financing costs for lenders. Economists see the PBOC cutting the rate on the one-year medium term lending facility again before the end of the year.

What Bloomberg Economics Says:

“The PBOC has accelerated its easing in 3Q23, with a 15-bp cut in its one-year policy rate in August and a 25-bp reduction in banks’ reserve requirement ratio in September — a stronger push compared with a 10-bp rate cut and a 25-bp RRR cut in 1H. It has more work to do to support the economy. We see it lowering the policy rate by another 20 bps by year-end along with another 25-bp cut in the RRR.”

—David Qu

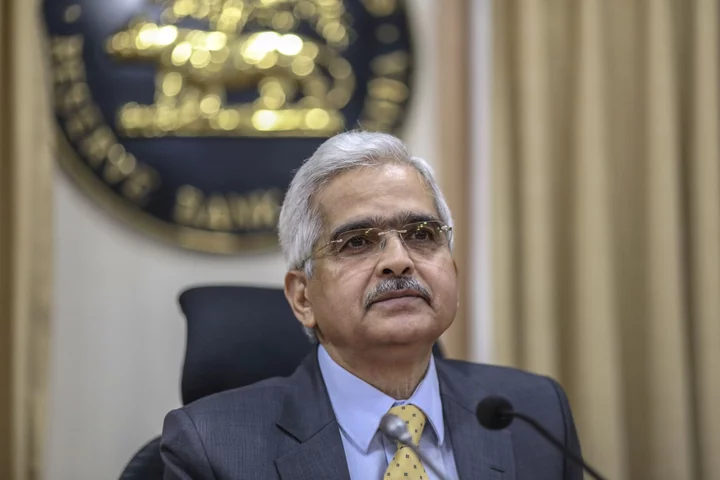

Reserve Bank of India

- Current RBI repurchase rate: 6.5%

- Bloomberg Economics forecast for end of 2023: 6.5%

- Bloomberg Economics forecast for end of 2024: 5.5%

Inflation risks remained front and center of the RBI, forcing it to strike a hawkish tone for the fourth straight meeting last week as it kept key rates and stance unchanged to support growth. Governor Shaktikanta Das highlighted inflation as a “major risk” to stability and growth, a warning that coincides with the weakest monsoon rains in five years and a rise in crude prices.

Economists say higher inflation concerns and a backdrop of resilient growth domestically implies the repo rate is likely to stay on hold for longer and rate cuts will be pushed back deeper into next year.

Excess liquidity in the market is also a worry for Das, who surprised investors by announcing the central bank is considering selling bonds in order to soak up extra cash. That suggests a shift away from using rates to liquidity-management tools to control inflation.

What Bloomberg Economics Says:

“The RBI guided bond yields higher at its October review by saying it might sell bonds to mop up surplus liquidity. This stealth rate hike is likely to temper growth and raises the risk that the central bank could extend its rate pause longer than we currently expect until 1Q24. The RBI expects inflation to drop to 5.2% by 1Q24, but its renewed emphasis on bringing it lower to 4% is likely driving it to keep liquidity tight.”

—Abhishek Gupta

Central Bank of Brazil

- Current Selic target rate: 12.75%

- Bloomberg Economics forecast for end of 2023: 11.75%

- Bloomberg Economics forecast for end of 2024: 9%

Brazil’s central bank has reaffirmed its plan to keep easing monetary policy with at least two additional rate cuts of 50 basis points this year. Policymakers led by Roberto Campos Neto have already delivered two reductions of that magnitude since August, after keeping borrowing costs at a six-year high of 13.75% for 12 months.

Such high rates, often criticized by President Luiz Inacio Lula da Silva as an obstacle to growth, have helped to moderate inflation even as economic activity remained relatively strong, with a resilient services sector and a tight labor market. The central bank says it has been able to engineer an economic soft landing, with the economy decelerating but avoiding a recession next year. Yet economists forecast consumer prices to keep rising above target until 2026.

What Bloomberg Economics Says:

“Global and domestic uncertainties won’t stop the BCB from cutting rates, though they will likely discourage a faster easing. Underlying inflation may run at target-compatible levels by mid-2024, which would allow the BCB to bring the Selic rate to a level policymakers view as neutral late in 2024. Our forecast of a 9% terminal rate for this cycle reflects an expectation of a cautious BCB that considers the real neutral rate may be higher than its 4.5% assumption.”

—Adriana Dupita

Bank of Russia

- Current key rate: 13%

- Bloomberg Economics forecast for end of 2023: 13.5%

- Bloomberg Economics forecast for end of 2024: 9.5%

One of the steepest currency depreciations in emerging markets this year is leaving Russia’s central bank poised to add to three straight rate hikes that included an emergency increase in August.

Tighter monetary policy remains warranted as the ruble again comes under pressure and the inflation outlook deteriorates as the wartime economy copes with sanctions imposed over the invasion of Ukraine.

In the absence of stiffer capital controls to stabilize the currency, policymakers led by Elvira Nabiullina will probably need to bring borrowing costs higher still, though the increasing risk of recession may prompt a less hawkish approach into next year.

What Bloomberg Economics Says:

“The Bank of Russia is running out ammunition in its inflation fight. After hiking the policy rate to 13% in September from 7.5% a year ago, the central bank is pushing the economy into recession, while data reveal no signs of inflation slowing. We forecast it to overshoot the central bank’s 4% inflation target in 2023 and 2024 as consumer prices increase by 6% each year. We estimate the central bank’s policy rate to a peak at 13.50% in October 2023 and start to decline in 1Q24, which is in line with money market expectations. On our estimates, the policy rate will reach 10.5% by mid-24 and 9.5% by December 2024.”

—Alexander Isakov

South African Reserve Bank

- Current repo average rate: 8.25%

- Bloomberg Economics forecast for end of 2023: 8.25%

- Bloomberg Economics forecast for end of 2024: 7.75%

While inflation is near to the midpoint of the central bank’s 3% to 6% target range where it prefers to anchor inflation expectations, policymakers are likely to sustain a pause on the key rate as inflationary pressures and risks to public finances persist. The Reserve Bank will closely watch the government’s budget update on Nov. 1 and should the assessed risks materialize, rate hikes may start again.

Governor Lesetja Kganyago has repeatedly hammered home that the central bank’s inflation fight is not yet over and warned at the MPC’s last meeting that deteriorating public finances will lead to higher rates. The repurchase rate was left unchanged for a second time this year at the meeting as the panel signaled it remains cautious and policy restrictive.

What Bloomberg Economics Says:

“We think monetary policy is currently restrictive enough to keep inflation within the 3-6% target, which should mean the hiking cycle has reached an end. The tone of the last MPC statement, however, was decidedly hawkish suggesting easing is a long way off. Kganyago noted uncertainty over a further slowdown in inflation. Our view is that the SARB will stay on hold at coming meetings. Our central case is that sticky inflation will rule out a rate cut until mid-2024.”

—Yvonne Mhango

MINT CENTRAL BANKS

Banco de Mexico

- Current overnight rate: 11.25%

- Bloomberg Economics forecast for end of 2023: 11.25%

- Bloomberg Economics forecast for end of 2024: 9.75%

Mexico’s central bank is expected to keep borrowing costs at a record-high of 11.25% through the remainder of the year, and possibly well into 2024, as it battles a “complex” inflation outlook with sticky core prices. Not only has the institution resisted joining regional peers that are already relaxing policy, one of its board members has cautioned that a rate cut, when it eventually comes, may still be an isolated move rather than the beginning of an easing campaign.

A stronger-than-forecast economic performance has given Banxico, as it is known, even more reason to remain cautious. Latin America’s second-largest economy has benefited from strong domestic demand, as local salaries grow, as well as imports from the US, its biggest trading partner.

What Bloomberg Economics Says:

“Strong domestic demand consistent with a positive and widening output gap argue against cutting rates. Inflation is decelerating but remains above the target, inflation expectations are slowing but are also above the goal and central bank projections. The downtrend along with tight monetary conditions show no need for hikes. The level limits room for cuts. We see policymakers holding rates until 2Q24 when slower inflation and more moderate growth should make room for cuts.”

—Felipe Hernandez

Bank Indonesia

- Current 7-day reverse repo rate: 5.75%

- Bloomberg Economics forecast for end of 2023: 5.75%

- Bloomberg Economics forecast for end of 2024: 4.75%

Bank Indonesia finds itself at an uneasy pause, unable to cut rates amid a strong dollar, and unwilling to tighten further amid cooling price gains. Instead, it will likely adjust other levers such as bond interventions to boost the rupiah, and reserve requirement discounts to spur lending.

Most economists expect the central bank to stand pat with inflation in Southeast Asia’s largest economy seen well within target until next year. And with just a quarter-point separating Indonesian and US rates from unprecedented parity, it is unlikely easing signals will be given before a Fed pivot. However, as market selloffs wipe out the rupiah’s gains this year, that’s prompted doubts as to how far BI can go in keeping the currency stable without a rate hike on the table.

What Bloomberg Economics Says:

“Bank Indonesia’s next move is likely a rate cut, but this is unlikely until next year. Narrowing the rate differential with the dollar too soon would erode key support for the rupiah, especially with the Fed signaling it has more work to do. Much weaker global demand in 4Q could also spark capital outflows. BI’s recent tightening cycle was aimed at stabilizing the currency, which is its primary objective.”

—Tamara Henderson

Central Bank of Turkey

- Current 1-week repo rate: 30%

- Bloomberg Economics forecast for end of 2023: 35%

- Bloomberg Economics forecast for end of 2024: 35%

Turkey’s shift toward more conventional policymaking to rein in inflation of more than 60% will likely continue through the end of the year, with the central bank signaling more rate hikes in the coming months. Still, real rates are expected to remain deeply negative.

With local elections slated for March, the country’s benchmark rate will remain politically sensitive. President Recep Tayyip Erdogan, a fan of monetary stimulus to boost economic growth, has dialed down on his critical stance of higher rates since he got reelected in May. But investors are wary he could – at any moment – pressure the central bank to bring down rates or stall further hikes. Finance Minister Mehmet Simsek and Central Bank Governor Hafize Gaye Erkan have been trying to convince markets that the president is fully behind their policies and secure foreign investment, which is direly needed.

What Bloomberg Economics Says:

“Turkey’s policy pivot since May’s presidential and parliamentary elections has seen the CBRT lift its key policy rate to 30% from 8.5% after four consecutive hikes. We expect the bank to lift its main lever to 35% by year-end and stay there through 1Q24 in the lead up to March’s local elections. Post vote, we see the key rate reaching 40% in 2Q.”

—Selva Bahar Baziki

Central Bank of Nigeria

- Current central bank rate: 18.75%

- Bloomberg Economics forecast for end of 2023: 23.5%

- Bloomberg Economics forecast for end of 2024: 23%

With a new governor — eager to restore the central bank’s credibility and show its inflation fighting mettle — in charge, another rate hike is likely on the cards.

Governor Olayemi Cardoso said in Senate hearings last month that the central bank will address Nigeria’s lofty inflation, which is among the highest in Africa, by adopting an evidence-based monetary policy. The central has lifted its benchmark rate by 725 basis points since May 2022.

What Bloomberg Economics Says:

“We think rate hikes are likely to steepen under incoming central bank chief Cardoso to halt runaway inflation. The removal of the petrol subsidy and the sharp devaluation of the naira imply an accelerating inflation rate in the short term. We also expect the new leadership at the central bank to address the foreign currency backlog, reducing the premium on the parallel market exchange rate. These factors could help lower inflation but it will remain in the double digits in the medium term.”

—Yvonne Mhango

OTHER G-20 CENTRAL BANKS

Bank of Korea

- Current base rate: 3.5%

- Bloomberg Economics forecast for end of 2023: 3.5%

- Bloomberg Economics forecast for end of 2024: 2.75%

The Bank of Korea is likely to keep its benchmark rate frozen at a “restrictive” level of 3.5%. Inflation has re-accelerated into the 3% range justifying the central bank’s need to stay guarded. While all policy board members have voiced their willingness to take the rate higher if needed, they are more likely to hold, given concerns over household debt weighing on the economy. Updated price and growth forecasts in November will give a fresh steer on the BOK’s outlook for the economy.

Adding to the outside chance of more tightening is the Korean won. With the Fed set to keep rates elevated for an extended period, the currency may remain under pressure, adding to BOK concern about importing inflation through the country’s dependence on food and energy imports.

What Bloomberg Economics Says:

“The BOK’s next move will probably be rate cut, likely in the second quarter of 2024. Until then, we see the central bank standing pat, but keeping a hawkish stance – to try to keep a lid on resurgent inflation risks and prevent households from getting even more overstretched with debt. Weak growth and worries about financial instability stemming from a shaky property market will keep further hikes off the table.”

—Hyosung Kwon

Reserve Bank of Australia

- Current cash rate target: 4.1%

- Bloomberg Economics forecast for end of 2023: 4.1%

- Bloomberg Economics forecast for end of 2024: 3.1%

New RBA chief Michele Bullock stuck to her predecessor’s cautious approach at her first meeting as governor in October by standing pat while retaining a tightening bias.

But that stance may be tested in the weeks ahead as quarterly inflation and updated staff forecasts are due to be released. Any risk of further delay in the RBA’s timeline for returning inflation to the 2-3% target — already long at 2025 — will prompt an increase in rates.

The RBA has been less aggressive in the current campaign than its US and New Zealand counterparts, having raised rates by 4 percentage points versus their 5.25. That reflects rapid policy pass through to borrowers with floating-rate mortgages as well as Australia having among the developed world’s highest household debt.

What Bloomberg Economics Says:

“Bullock is likely to bring continuity to the stance of monetary policy — rates are on hold so long as inflation resumes its downward trajectory as the oil shock passes. Growth is set to cool further, as rapid passthrough of rate hikes thus far hit consumer spending hard through 2H23. Swift policy passthrough means the RBA has less room to hold rates at their peak before policy needs to pivot to supporting growth.”

—James McIntyre

Central Bank of Argentina

- Current rate floor: 118%

- Bloomberg Economics forecast for end of 2023: 125%

- Bloomberg Economics forecast for end of 2024: 70%

Argentina’s central bank has tightened monetary policy significantly in recent months to make up for annual inflation that’s running above 124% a year. The benchmark Leliq rate rose from 75% in mid-March to 118% in August as the monetary authority struggles to tame price increases.

Complicating policymakers’ job is a public spending boom and generous tax cuts carried out by Economy Minister Sergio Massa, who’s also running for president in the October election. In a bid to revert his coalition’s defeat in the August primary vote, Massa has increased social welfare payments and public sector salaries — a spending spree that’s largely financed by the central bank’s money printing machines, and that’s likely to fuel even more inflation going forward.

What Bloomberg Economics Says:

“After the presidential elections, we expect the central bank to realign the currency somewhat in order to support building up reserves. The BCRA will likely raise the policy rate to 125% in nominal terms to mitigate the inflationary impact of a weaker currency and lure investors to finance part of the primary deficit at the start of the next administration. A sharp fiscal adjustment and a gradual descent in monthly inflation may then pave the way for rate cuts in 2024.”

—Adriana Dupita

G-10 CURRENCIES AND EAST EUROPE ECONOMIES

Swiss National Bank

- Current policy rate: 1.75%

- Economist forecast for end of 2023: 1.75%

- Economist forecast for end of 2024: 1.5%

Switzerland avoided most of the inflation surge experienced by others, allowing the central bank to hike rates less aggressively and pause its tightening cycle earlier than advanced-economy peers.

The question now shifts to whether officials are in fact done or could still opt for another move at their next meeting in December. Driven by electricity prices and rents, a moderate rebound of consumer-price growth is expected over the coming months, while unions also negotiate wage increases.

Should inflation surprise to the upside, President Thomas Jordan has indicated that he wouldn’t hesitate to take a further step.

Sveriges Riksbank

- Current repo rate: 4%

- Bloomberg Economics forecast for end of 2023: 4%

- Bloomberg Economics forecast for end of 2024: 3.5%

Sweden’s central bank kept the door open for another quarter-point rate hike this year after raising the borrowing costs last month to 4%. Governor Erik Thedeen said inflation pressures are still too high, while his comments after the decision and in the central bank minutes suggested a stronger resolve to extend tightening than communicated in the rate outlook.

Still, the balancing act for Swedish policymakers is becoming trickier as they have joined other forecasters predicting two consecutive years of recession, while the nation’s property and construction sectors are mired in one of the worst housing routs globally. In a rare bright spot helping the Riksbank to quell imported inflation, the krona has strengthened after the central bank said it will sell a quarter of its currency reserves.

What Bloomberg Economics Says:

“The Riksbank hiked its policy rate by 25-bps in September to what we think is the peak rate of its tightening cycle. We expect the central bank to hold through the first half of 2024 before delivering cuts in 2H24. Further slide in the currency risks higher policy rates in the near term, which would likely arrive at the cost of extending this year’s recession into next.”

—Selva Bahar Baziki

Norges Bank

- Current deposit rate: 4.25%

- Economist forecast for end of 2023: 4.5%

- Economist forecast for end of 2024: 3.75%

Norway’s central bank is set to raise its key rate by a quarter point to a peak of 4.5% before the year-end, most likely in December, according to the latest outlook from the policymakers. Underlying inflation has slowed more than forecast, while a strengthening in the krone during the past couple of months from its previously low level has helped to ease policymakers’ worries over imported inflation.

The fossil-fuel-rich nation has remained relatively resilient to higher prices, helped by unemployment near long-term lows and by windfall export gains allowing extra government spending. While the central bank has raised its wage growth estimates for next year, it’s now forecasting the mainland economy to steer clear of a recession next year.

Reserve Bank of New Zealand

- Current cash rate: 5.5%

- Bloomberg Economics forecast for end of 2023: 5.5%

- Bloomberg Economics forecast for end of 2024: 4%

The RBNZ has held its cash rate at 5.5% for the past three policy meetings and appears confident it has done enough to return inflation to target next year, even as some economists predict it will need to hike once more to get the job done. The economy has proved to be stronger than anyone expected, notching growth of 0.9% in the second quarter, and there are concerns inflation may not slow as quickly as the RBNZ would like. So far, the bank has responded by saying rates may need to stay high for longer rather than increase again.

That said, Governor Adrian Orr and his policy committee will be armed with crucial pieces of information when they meet for the final rate decision of the year in November — inflation and employment data for the third quarter, and the outcome of the Oct. 14 general election that looks likely to deliver a change of government.

What Bloomberg Economics Says:

“The RBNZ is done raising rates. The full effects of 525 basis points of tightening since October 2021 is beginning to emerge, as mortgages reset and repayments rise. Bloomberg Economics sees the RBNZ’s hawkish inflation stance easing as the economy contracts in 2H23 and unemployment rises at a faster pace than the central bank projects. Rate cuts are likely to arrive sooner than anticipated, in 1Q24, as the focus switches from fighting inflation to reviving demand.”

—James McIntyre

National Bank of Poland

- Current cash rate: 5.75%

- Bloomberg Economics forecast for end of 2023: 5.75%

- Bloomberg Economics forecast for end of 2024: 5%

Poland’s central bank cut rates twice since September as annual inflation slowed into single digits and economy contracted. The start of the easing cycle led to a currency selloff after the scale of the first reduction — three quarters of a percentage point — blindsided investors and raised concern policymakers were trying to help the ruling part ahead of a parliamentary election on Oct 15.

Governor Adam Glapinski promptly slowed the pace of cuts in October and pledged the central bank will continue to move slowly as not to upset the currency. At the same time, he said, the rates were still very high and inflation should slow to around 5% in the middle of next year.

What Bloomberg Economics Says:

“Poland’s decision to reduce the reference rate from its 6.75% peak to 5.75% in October was well timed. The cuts align well with weak activity and downside surprises in inflation. We estimate average seasonally-adjusted price growth for the six months ending September was 2.3% — in line with the central bank’s 2.5% inflation target. However, further easing at this pace could undermine the zloty, making it harder for policymakers to keep inflation under control. We estimate the central bank will slow the pace of rate cuts, bringing the reference rate to 5.0% by the end of 2024.”

—Alexander Isakov

Czech National Bank

- Current cash rate: 7%

- Median economist forecast for end of 2023: 6.625%

- Median economist forecast for end of 2024: 4.25%

The Czech central bank began discussing a plan for monetary easing, but it stressed that rates will go down at a slower pace than most investors are expecting. With the tight job market still posing price risks, policymakers want to be sure that inflation will stabilize near the 2% goal next year.

Governor Ales Michl steered clear of giving a clear outlook, leaving the door open for the first cut before the end of the year. “We will be ready, we have a clear strategy, but the key is that at each bank board meeting we will assess new data,” Michl said in September. “All options are open.”

--With assistance from Scott Johnson (Economist), Paul Abelsky, Beril Akman, Maya Averbuch, Bastian Benrath, Ruchi Bhatia, Walter Brandimarte, Matthew Brockett, Maria Eloisa Capurro, Kate Davidson, Toru Fujioka, Michael Heath, Erik Hertzberg, Harumi Ichikura, Paul Jackson, Claire Jiao, Peter Laca, Reed Landberg, Andrew Langley, Scott Lanman, Jana Randow, Greg Ritchie, Grace Sihombing, Piotr Skolimowski, Ntando Thukwana, Ott Ummelas and Monique Vanek.