With the Federal Reserve approaching a possible pause in interest rate-hiking, two close-call decisions elsewhere in the world offer a foretaste of the quandary US officials have in store.

The Reserve Bank of Australia and the Bank of Canada weren’t expected to raise borrowing costs at meetings in the coming week, until recent data suddenly put financial markets on edge for further action.

Those decisions will arrive just days before the Fed’s June 14 announcement. Recently, some Fed officials have signaled they’re leaning toward a pause while others have indicated a preference to keep going in the fight against inflation.

First up will be the RBA on Tuesday. Unexpectedly hot consumer-price data, a large rise in Australia’s minimum wage, and mounting concern that inflation expectations will de-anchor have made the decision a line-ball call.

Goldman Sachs Group Inc. expects a hike, having changed its view following the inflation numbers, while Royal Bank of Canada revised its forecast after the pay decision. They predict a quarter-point increase in the cash rate, to 4.1%. Money markets see a bit over a 50% chance of a hike, while a majority of economists anticipate a pause.

Governor Philip Lowe has dialed up his rhetoric, worried that a tight labor market and increases in property prices will make households feel wealthier and fuel further inflation. Against that, the RBA has delivered its most aggressive tightening cycle in a generation — hiking 11 times in 12 months — and economic activity is cooling.

Canada’s central bank is also in a bind ahead of Wednesday’s meeting. Continuous upside surprises — including gross domestic product and employment — are challenging the long-held belief that the nation’s economy is more rate-sensitive than peers.

While some deeply indebted households are starting to feel the pinch of higher borrowing costs, many consumers are resilient. Price pressures are also proving stickier than expected.

Traders in overnight swap markets see around a one-third chance that Governor Tiff Macklem will hike rates, with economists split on the likely outcome.

Whichever way they decide, Canadian policymakers will at least position themselves for additional increases to borrowing costs in the summer, so they can jump back into tightening when they have a more complete set of forecasts in July.

What Bloomberg Economics Says:

“Fed Chair Jerome Powell’s risk-management approach is to move gradually. That’s why we still expect the Fed to skip a rate hike at the June 13-14 FOMC meeting – though the risk has risen that Powell won’t be able to forge a consensus.”

—Anna Wong, Stuart Paul and Eliza Winger, economists. For full analysis, click here

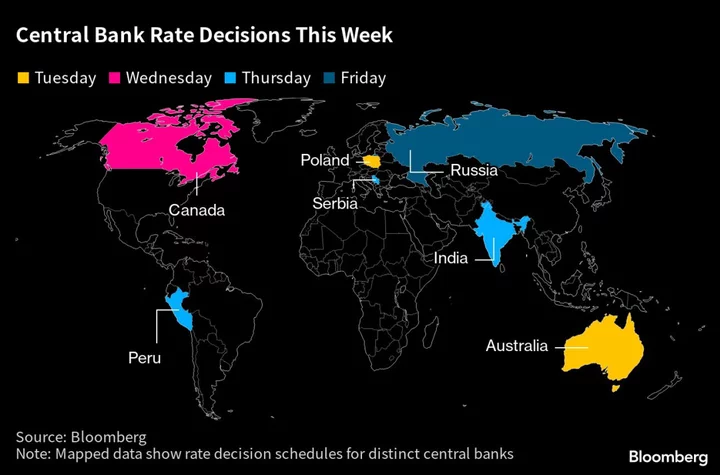

Elsewhere, multiple rate decisions from India to Russia, Chinese trade and inflation numbers, other consumer-price reports from Turkey to Brazil, and testimony by the European Central Bank president will be among the highlights. The World Bank will release new economic forecasts on Tuesday and the OECD follows with its own estimates a day later.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

US Economy

The US economic data calendar is light this coming week and policymakers are sidelined ahead of the Fed’s June 13-14 policy meeting.

On Monday, the Institute for Supply Management will issue its May services activity gauge. The measure is forecast to show a faster pace of expansion, unlike the ISM manufacturing index which indicated a seventh month of contraction.

A government report on Wednesday will probably show the US trade deficit in April widened by the most in six months. Already-issued merchandise trade data showed a bigger shortfall during the month as US exports declined and imports increased.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Asia

China will report its latest trade figures in the middle of the week, data that will be closely watched after the latest PMI readings showed further weakness in the world’s second largest economy’s recovery. Inflation data on Friday are likely to show subdued price pressures.

Aside from the central bank announcement in Australia, the other major decision in the region will be from the Reserve Bank of India on Thursday. Economists predict rates there to stay on hold.

Indonesia, Thailand and the Philippines will all report inflation figures toward the start of the week.

Japan will report revised growth figures for the first quarter as well as its latest wages figures as Prime Minister Fumio Kishida likely continues to mull an early election.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

The euro zone’s first-quarter performance will be revisited this week with fuller data that could show stagnation or even a recession after Germany suffered such a downturn.

How Europe’s biggest economy fared at the start of the second quarter will be a focus as well, in three reports starting on Monday with exports, followed by factory orders and industrial production. Italian and Spanish factory data will also be released.

Less backward-looking and more relevant for the ECB will be its own survey of consumers to be published on Tuesday, which will show whether expectations of faster inflation are becoming entrenched, even as data suggest price growth may be slowing.

Policymakers will make final comments before a pre-meeting blackout period kicks in on Thursday in advance of the June 15 rate decision. ECB President Christine Lagarde’s appearance in the European Parliament on Monday may draw attention.

Elsewhere in Europe, inflation data on Monday may provide comfort to the Swiss National Bank, with an underlying gauge of price growth predicted to slow to its 2% ceiling.

Norway’s equivalent report on Friday may be less encouraging: Inflation there is still likely to exceed 6%. The same day, in neighboring Sweden, the monthly GDP indicator for April will be released, the latest health check on an economy predicted by the European Commission to suffer the region’s worst contraction this year.

Elsewhere, three central bank decisions are scheduled:

- On Wednesday, Polish officials will probably keep rates unchanged after slowing inflation boosted speculation a cut may be just around the corner.

- Serbia’s central bank on Thursday will consider whether to pause tightening for a second time or to resume rate hikes.

- On Friday, the Bank of Russia may hold its key rate at 7.5%, extending the longest pause since late-2015 through mid-2016. Officials are increasingly on alert for inflationary risks, though.

Looking south, Turkey on Monday may post its first negative month-on-month inflation reading in more than four years after TurkStat’s decision to record household gas prices as zero for May.

President Recep Tayyip Erdogan pledged during his reelection campaign to give free gas to households for the month. Annual inflation is expected to slow to just under 40%.

Data on Tuesday will likely show South Africa averted a recession in the first quarter, despite more intense power outages. The central bank forecasts the economy grew 0.4% in the three months through March after a 1.3% contraction in the prior period.

And on Thursday, data will probably show South Africa had a current-account deficit in the first quarter.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

Brazil has seen almost 800 basis points of disinflation since last April, with May data out this week expected to show another move down, close to 4%.

Analysts surveyed by the central bank see the June print falling further toward the target followed by a jump back up the following month as last July’s negative print falls out of the 12-month series.

In Colombia, inflation has hit a “turning point” after a near unbroken two-year surge, according to central bank chief Leonardo Villar. The consensus call for May is slightly below 12.7%.

Rounding out the week’s inflation results from the region’s big five economies, data from Mexico and Chile should clearly show all now firmly in the grip of disinflation.

As to monetary policy, look for Peru’s central bank to keep its benchmark rate unchanged, though most analysts expect the board to maintain some room for maneuver by not calling the peak at 7.75%.

Closely watched surveys of economists in Brazil and Mexico may see consensus year-end inflation forecasts trimmed slightly.

Argentina is headed in the opposite direction. The country’s deepening financial crisis suggests that the steady deterioration of output and inflation forecasts in the central bank’s survey of economists posted Friday will continue.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Vince Golle, Sylvia Westall, Robert Jameson and Andrea Dudik.

Author: Michael Heath, Erik Hertzberg and Craig Stirling