Federal Reserve Chair Jerome Powell said policymakers expect interest rates will need to move higher to reduce US growth and contain price pressures, even though they held rates steady at their meeting last week.

“Earlier in the process, speed was very important,” Powell said Wednesday in testimony before the House Financial Services Committee, referring to the pace at which officials lifted rates over the past year. “It is not very important now.”

It may make sense to continue moving rates higher in the coming months, but at a more moderate pace, Powell said in response to lawmakers’ questions about the Fed’s plans. The timing of additional hikes will be based on incoming data, he said in his opening statement.

US stocks fell following Powell’s rates warning, thwarting bets that the US central bank was nearing the end of its tightening cycle. Swaps traders held in check pricing a greater than 80% probability that the Fed will lift its policy rate by a quarter point next month.

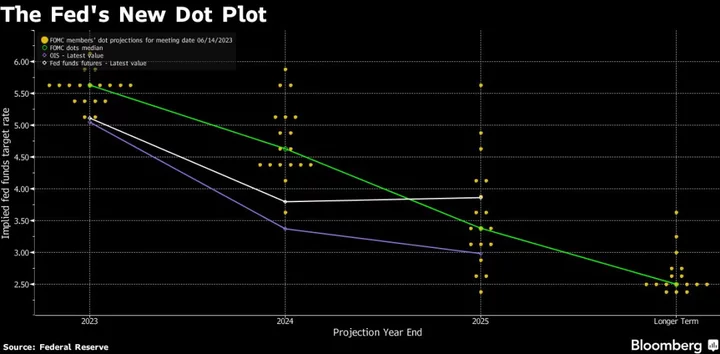

The Federal Open Market Committee paused its series of interest-rate hikes last week for the first time in 15 months, leaving rates in a range of 5% to 5.25%. But Fed officials estimated rates would rise to 5.6% by the end of the year, according to their median projection, implying two additional quarter-point hikes following surprisingly persistent inflation and labor-market strength.

Bank Oversight

Lawmakers also pressed Powell on the Fed’s plans to strengthen supervision and regulation for regional and big banks in the wake of several bank failures earlier this year.

Powell said that the Fed board hadn’t yet voted on changes to bank rules, but staff had been briefed on some tweaks that are under consideration. He added that the biggest US lenders were “very well capitalized” and that the central bank must be careful not to harm the business model of smaller lenders.

Read More: US Banks Face Capital Jump With More Lenders Roped In to Comply

The Fed chief is appearing on Capitol Hill this week for his semi-annual monetary policy testimony, the first time he has answered questions from Congress in public since early March. He will also testify before the Senate Banking committee on Thursday.

In a separate hearing, Fed governors Philip Jefferson and Lisa Cook said that any updates to bank regulations should be tailored according to an institution’s size. They also both raised concern about consolidation among lenders and emphasized the importance of smaller institutions to low- and moderate-income communities.

“As we think about capital requirements, I will always be thinking about that trade-off between making banks more resilient and sound and credit availability,” Jefferson said at a Senate Banking nomination hearing.

Read More: Fed Nominees Favor Tailoring Bank Rules, Vow to Cool Inflation

Moderating Pace

In his prepared remarks, Powell said Fed officials “understand the hardship that high inflation is causing, and we remain strongly committed to bringing inflation back down to our 2% goal.”

“Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year,” he added. “Reducing inflation is likely to require a period of below-trend growth and some softening of labor market conditions.”

Read More: Powell Faces Tricky Task of Explaining Rate Pause in Congress

His prepared comments largely echoed his remarks at his post-meeting press conference last week, where he said the committee felt it was appropriate to moderate the pace of rate increases following the most aggressive hiking in four decades as well as recent bank failures that might tighten credit conditions. At the same time, he said that the vast majority of the committee projected higher rates will be needed to tame inflation.

“We’re moderating that pace much as you might do if you were to be driving 75 miles an hour on a highway, then 50 miles an hour on a local highway,” Powell told lawmakers. “And then as you get closer to your destination, as you try to find that destination, you slow down further.”

Fed officials have been disappointed in how slowly inflation has fallen in recent months and are targeting a period of below-trend growth to reduce price pressures. The FOMC last week upgraded its view of economic growth and the labor market for 2023, but now is anticipating a rise in unemployment to 4.5% next year.

Labor Market

The Fed chair has faced criticism from some Democrats for his aggressive interest-rate hikes, with Senator Elizabeth Warren, for example, warning that his policies risk putting millions of people out of work.

Powell described the labor market as “very tight” in his prepared remarks, though the unemployment rate rose in May to 3.7%. “There are some signs that supply and demand in the labor market are coming into better balance,” he said.

Powell cited the Fed’s characterization in its semi-annual report to Congress released Friday of tighter US credit conditions following bank failures in March.

“The economy is facing headwinds from tighter credit conditions for households and businesses, which are likely to weigh on economic activity, hiring, and inflation,” he said. “The extent of these effects remains uncertain.”

--With assistance from Ben Bain, Liz Capo McCormick and Catarina Saraiva.

(Updates with additional market context in fourth paragraph.)