Poland will likely leave interest rates unchanged as inflation eases, fueling speculation that the central bank may shift in favor of cuts as early as the run-up to a tight election in October.

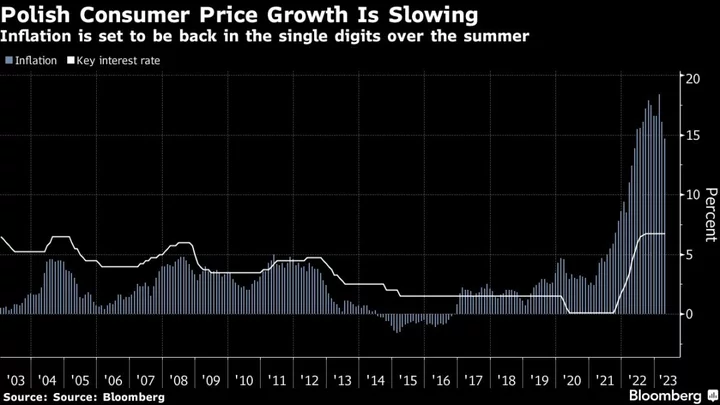

Policymakers will keep the benchmark rate at 6.75% for the eighth consecutive month on Wednesday, according to all economists surveyed by Bloomberg. A brisk slowdown in inflation last month prompted fresh bets by investors that a half-percentage-point cut could come in the next six months.

Members of the rate-setting Monetary Policy Council, including Ireneusz Dabrowski and Henryk Wnorowski, have begun to amplify market expectations. Both have signaled a return to single digits after inflation ebbed to 14.7% in April, while Dabrowski has said policymakers may “seriously consider” lowering rates after Poland’s summer holiday.

Central bank Governor Adam Glapinski will answer questions from the media at 3 p.m. in Warsaw Thursday. He has spoken publicly about the possibility of cuts in the fourth quarter.

Poland’s ruling nationalists may struggle to hold on to power in October vote, polls show. The governing alliance, which last year appointed Glapinski for another seven-year term, has come under pressure from the opposition for a deepening cost-of-living crisis on the back of surging prices.

The Polish economy probably contracted in the first quarter after consumer spending was weighed down by the highest borrowing costs in two decades. Glapinski said last week that Poland may be able to escape recession, as he predicted inflation will continue to ease in line with the central bank’s forecasts.

“The Council seems to have an appetite for cuts,” said Aleksandra Swiatkowska, an economist at BOS Bank in Warsaw, adding that markets might be running ahead of themselves given that underlying inflation will remain sticky. “It would be interesting to see whether Glapinski is going to confirm market expectations or try to quell them instead.”

Still, others MPC members insist the National Bank of Poland hasn’t done enough. Ludwik Kotecki, who is among a minority that has voiced criticism of Glapinski and his allies, has said record-low unemployment and loose fiscal policy will sustain higher consumer prices. He told a panel last month that inflation will only reach the central bank’s 2.5% target in 2026.

Most economists expect cuts in the first quarter of next year. The recent drop in the headline inflation is due primarily to the fading energy shock from the war in Ukraine, while the underlying price pressures remain strong, according to Rafal Benecki, chief economist for Poland at ING Groep NV.

“Despite two quarters of consumption contraction, there is only moderate progress on the inflation front,” he said in a note. “With the National Bank of Poland target still far away, we expect the MPC to keep policy rates unchanged by the end of this year.”