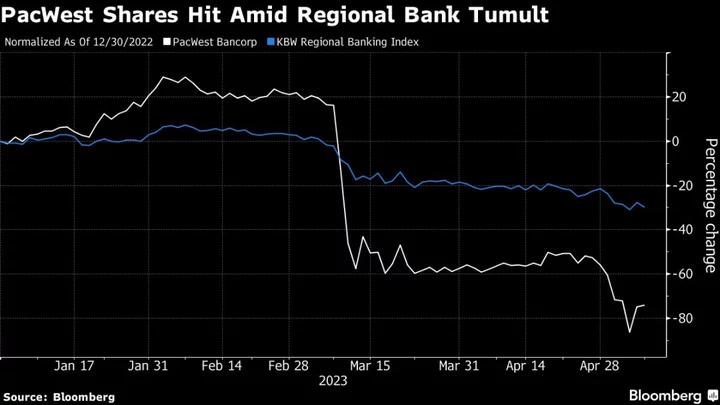

PacWest Bancorp shares fell on Tuesday, leading some peers lower in early trading as the hard-hit regional bank stock resumed its decline.

The stock dropped 11% as of 9:03 a.m. in US premarket trading, putting it on course to snap a two-day advance that included a record rally on Friday. Among other regional bank stocks following PacWest lower, Western Alliance Bancorp slides 3.6% and Comerica Inc. dips 1.4%.

Regional bank stocks have broadly been under pressure since the collapse of peers including Silicon Valley Bank and Signature Bank. Investors have been unnerved by a rash of deposit outflows from banks and increasing concerns about general stability. Concerns around longer-term pressures such as surging funding costs and potential regulatory tightening have also weighed on the banking sector.

First Republic Bank’s failure early last week further stoked the volatility in bank shares with the KBW Regional Banking Index falling nearly 11% since then.

PacWest shares are down 74% on the year through Monday’s close, making it the worst-performing member of the regional banking gauge. Only New York Community Bancorp has gained this year with a 16% rise, a move that has burned short sellers.

Many analysts, however, have remained positive about the sector despite the recent turmoil, with some saying the tumbling stock prices have become disconnected from the companies’ fundamentals.

“We recognize the potential challenges for the banks as the year progresses, but we also believe they are generally managing these headwinds quite well,” RBC Capital Markets analyst Jon Arfstrom wrote in a Tuesday note.

“We believe that valuations are attractive given the sharp pull-back in stock prices in recent weeks, particularly when contrasted against the reasonable fundamental outlooks.”

(Updates to add latest trading.)