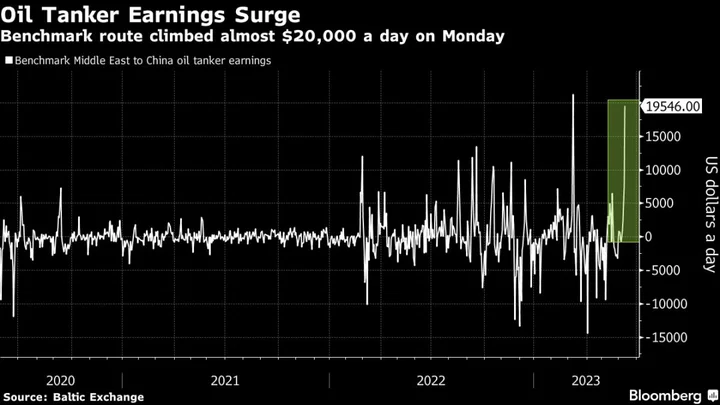

Earnings for giant crude supertankers posted their second-largest daily gain in three years as the number of cargoes jumped from the Middle East, the top exporting region.

The hike in rates and cargoes is a surprise because several producer nations including Saudi Arabia, the United Arab Emirates and Kuwait previously pledged to cut output. That doesn’t preclude them from selling barrels that they have in storage.

Rates for ships hauling two-million barrels of crude from the region to China climbed by almost $20,000 a day on Monday, according to figures from the Baltic Exchange. That’s only the second time they have posted such a large move since 2020.

As well as surprising traders, the extra cargoes have compounded several other bullish forces. A monsoon in India has brought disruption to the country’s top oil port, potentially meaning vessels won’t get back to the Persian Gulf as expected. Meanwhile, strong demand to export from the US and Brazil in recent months has also restricted the number of supertankers available in the Middle East.

Earlier this week, South Korea’s SK Innovation Co. provisionally hired Very Large Crude Carrier Melody Hope to carry crude from the Persian Gulf in late June at worldscale 71. Taiwan’s Formosa Petrochemical Corp. fixed supertanker Nave Quasar to load its cargoes from the Middle East at WS 46 last week.

Worldscale is an industry standard that reflects a percentage of an underlying flat rate for a specific route that’s fixed for the year.

“According to brokers, the increase is due to a flurry of cargo in the Middle East for late June loadings, combined with limited available ships,” Clarksons Securities AS analysts including Frode Morkedal wrote in a report. “While it remains to be seen how long-lived the bull run will be, considering the expected reduced volumes in July, the rate spike illustrates how tight the VLCC market is and helps to clear the tonnage list in the region.”

Saudi Arabia has pledged an additional unilateral production cut of 1 million barrels a day from July.

The number of cargoes booked this month from the Middle East has risen above 150, the highest tally this year, according to Halvor Ellefsen, a tanker broker at Fearnleys in London.

The cargoes in question are spot charters and don’t cover freight that is organized under longer-term transportation deals.

(Updates with shipping fixtures in fifth paragraph.)