Oil steadied after a two-day decline as industry estimates pointed to lower US inventories, potentially adding to signs of a tighter market.

West Texas Intermediate was little changed near $81 a barrel after losing 2.6% in the week’s first two sessions. The American Petroleum Institute said nationwide crude stockpiles shrank by 6.2 million barrels last week, according to people familiar with the figures. Inventories at the key Cushing, Oklahoma, storage hub were also seen declining to the lowest level since April.

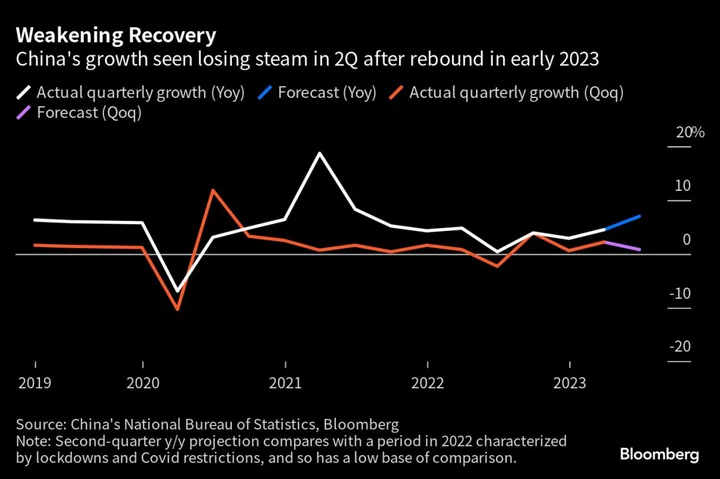

Oil has backtracked this week following a surge driven by supply cuts from OPEC+ linchpins Saudi Arabia and Russia, and estimates that worldwide crude consumption is running at a record pace. The decline has come amid disappointing economic data from top importer China, with banks cutting growth estimates as the nation’s gargantuan real estate sector flounders.

“With the disappointing turn in China’s economic data dominating headlines lately, sentiments around oil prices are being kept in check” despite the API figures, said Yeap Jun Rong, market strategist at IG Asia Pte.

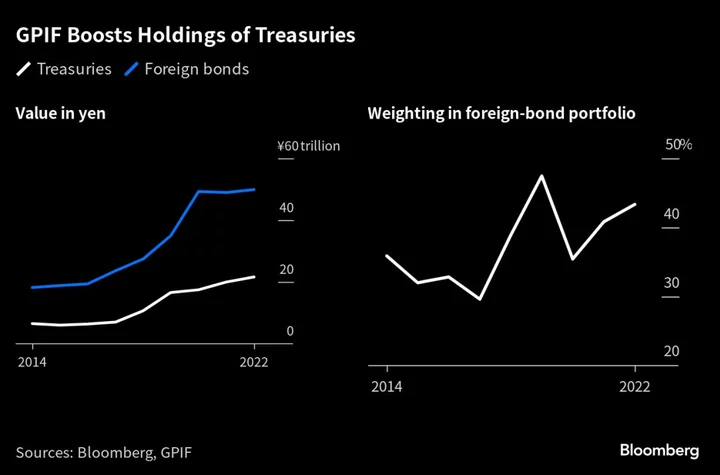

The US dollar’s recent advance has also been a headwind for commodities, with a Bloomberg gauge of the greenback set for a fifth straight session of gains. That’s making raw materials more expensive for most overseas buyers.

Timespreads have narrowed in tandem with crude benchmarks in recent sessions. The gap between WTI’s two nearest contracts was 50 cents a barrel in backwardation compared with last week’s intraday peak of 76 cents a barrel. The backwardated structure, however, still implies near-term tightness.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.