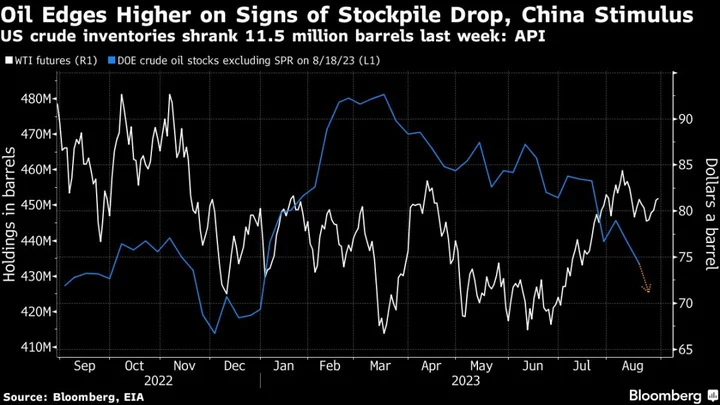

Oil advanced for a fifth day on signs of another substantial draw in US inventories and a buoyant mood across wider markets.

West Texas Intermediate rose toward $82 a barrel, on course for the longest winning streak since March. US stockpiles tumbled by 11.5 million barrels, according to the industry-funded American Petroleum Institute. If confirmed by official data later Wednesday, that would be the sixth drop in seven weeks.

Broader markets were also stronger as China may unveil fresh stimulus, and investors speculated that the US Federal Reserve could be done raising interest rates. That’s helping to outweigh signs of higher crude supply from Russia, after seaborne flows from the OPEC+ producer hit an eight-week high.

Oil’s latest string of daily gains means prices in New York are now trading slightly above where they began the year, with key timespreads pointing to tightening conditions. Crude has been supported by lower output from Saudi Arabia, with Riyadh implementing a substantial voluntary supply reduction in a bid to rebalance the global market following a weak first half.

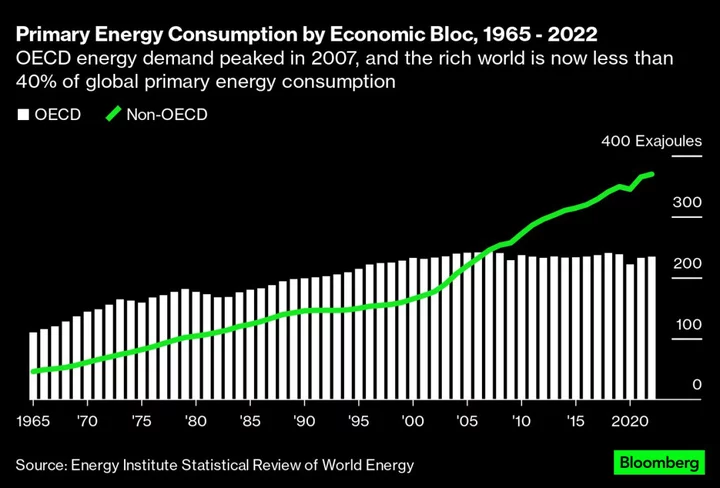

Investors will scrutinize key data due from the two largest economies, including growth figures from the US on Wednesday and manufacturing gauges from China on Thursday. The snapshots will shed light on the health of the global economy, as well as the outlook for energy consumption.

“There are still some reservations heading into China’s PMI data,” said Yeap Jun Rong, market strategist at IG Asia Pte. The figures are expected to reiterate the weak demand outlook, which could pressure prices, he said.

Still, widely tracked market metrics point to a positive picture. The spread between Brent’s two nearest December contracts is approaching $5 a barrel in backwardation — a bullish pattern — compared with less than $2 a barrel a little more than two months ago.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.