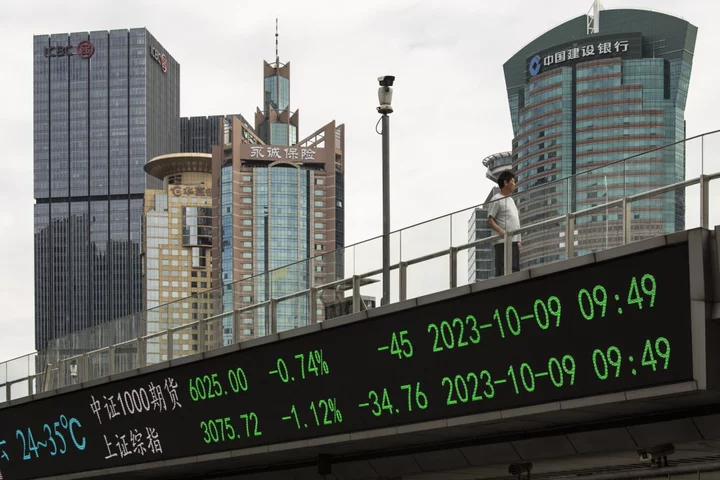

Japanese equities are set to climb over the next six months, helped by optimism for corporate profitability and speculation the US will pause interest rate hikes, according to strategists.

The Nikkei 225 Stock Average will rise to 34,000 at the end of the fiscal second half through March, according to the median forecast of strategists surveyed by Bloomberg News. That represents a 6.7% upside from the last close on Friday, and surpasses this year’s intraday high of 33,772 reached in June.

Estimates for the end of March 2024:

Japanese stocks have risen to multi-decade highs this year as the return of inflation, improving shareholder returns and an endorsement by Warren Buffett all boosted their appeal. The Nikkei has risen about 22% this year through Friday’s close, putting it among the best-performing major markets. Still, the return isn’t as stellar in dollar terms due to the weakening yen.

BlackRock Investment Institute strategists upgraded their stance on Japanese stocks on strong earnings, robust corporate buybacks and shareholder-friendly policy reforms. Goldman Sachs Group Inc. raised their forecasts on assumptions the yen will be stable, and earnings-per-share growth will increase.

“Japan will be the best performing developed markets over the next 12 months,” said David Chao, a strategist at Invesco. Japan is attractive when taking into account things like risk-adjusted returns, he said.

Japanese stocks will rise as expectations gain traction that Federal Reserve will pause rate hikes, according to Nobuhiko Kuramochi, a market strategist at Mizuho Securities Co.

Concerns over the Bank of Japan’s monetary policy, meanwhile, will be a headwind, according to Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. Half of BOJ watchers in a Bloomberg survey last month were split on whether the central would end its negative interest rate policy in the first half of 2024.