The Central Bank of Nigeria’s first interest rate decision since Godwin Emefiele’s removal as governor will be a litmus test of its inflation-fighting mettle and independence after President Bola Tinubu said borrowing costs should be lowered.

“The investment community will be looking closely to assess any changes in the credibility of the institution” and for more clarifications on the CBN’s plans for improving liquidity in the foreign-exchange market, said Ayodeji Dawodu, a director at BancTrust & Co.

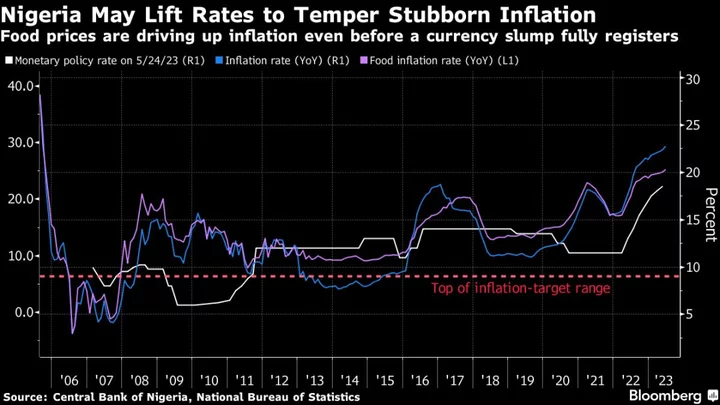

Most economists polled by Bloomberg expect the monetary policy committee to extend its longest unbroken series of interest-rate increases to rein in inflation that’s at an almost 18-year high, and are forecasting hikes of between 50 basis points and 200 basis points.

The MPC has raised borrowing costs by 700 basis points since May 2022 to 18.5% to contain an inflation rate that’s been at more than double the top end of its 6% to 9% target range for over a year.

Acting Governor Folashodun Shonubi, who replaced Emefiele, “is in the difficult position of choosing between implementing sensible monetary policy and appeasing the new president to make his position permanent,” Pieter Scribante, political economist at Oxford Economics Africa, said in a research note on July 19.

Tinubu, who has delivered on a number of pledges made in his inauguration speech in late-May — including removing fuel subsidies and liberalizing the foreign-exchange market — has said that high interest rates are stifling economic growth and should be lowered to encourage spending.

“A cut would suggest that the CBN’s inflation-targeting mandate has weakened under Folashodun and Tinubu, and put further downward pressure on the naira,” said Mark Bohlund, senior credit research analyst at REDD Intelligence. “Nigeria has its own problems but aligning the central bank to the government’s policy agenda will only make things worse,” as seen in Africa’s largest economy during former President Muhammadu Buhari rule, and in Turkey, he said.

Unorthodox Policies

Emefiele, who was arrested last month and later charged with the illegal possession of a firearm, was appointed head of the central bank in June 2014, a year before Buhari came to power. He was given a second five-year term in May 2019 and was one of the most influential figures in the Buhari administration. During his unorthodox tenure, the CBN made major interventions in the economy, including propping up the naira, lending unprecedented sums to the government and extending credit to multiple sectors.

In Turkey, President Recep Tayyip Erdogan pressured the central bank to follow loose monetary policies to boost economic growth even as inflation surged and the currency depreciated.

“The CBN has always prioritized inflation, which is part of its key mandate, over economic growth” though it seeks to maintain a healthy balance, said Yemi Kale, KPMG Nigeria chief economist and a former statistician-general. “I do not think the current macroeconomic environment presents the CBN with the opportunity to adopt the Turkey model now.”

Inflation is likely to remain elevated for some time. Money supply rose 31.6% in June from a year earlier, compared with 14% in May, and pump prices have more than tripled since the scrapping of the fuel subsidy. The currency has meanwhile dropped about 40% against the dollar in the last month following the easing of foreign-exchange controls.

--With assistance from Simbarashe Gumbo, Paul Abelsky and Robert Brand.