A reopening of Nigeria’s longest-dated bond was oversubscribed by more than three times at an auction on Monday as investors swooped on the issue’s record yield.

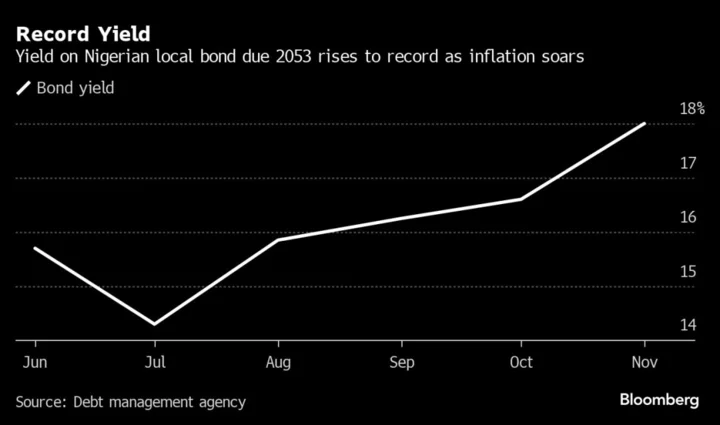

The 2053-dated debt attracted total subscriptions of 330 billion naira ($364 million), compared with the 90 billion naira of paper put on offer by the nation’s Debt Management Office. Other shorter tenor notes, including the 2029, 2033 and 2038 maturities, were all undersubscribed at the same auction, indicating a preference for the longer-dated debt, which was also offered at a record yield of 18%.

The demand for the 30-year paper showed investors betting it will deliver a handsome return over inflation in the long run, Wale Okunrinboye, chief investment officer at Access Pensions Ltd., said by email.

“Pension funds exist to meet long-term liabilities, so if you have a long-term asset yielding 18% which is 500-600 basis points over long-term inflation, you load up,” Okunrinboye said.

Read More: Nigeria Inflation at Fresh 18-Year High, Puts Rate Hike on Table

Even so, Nigerian inflation quickened to a new 18-year high in October. Consumer prices rose 27.3% from the prior year, compared with 26.7% in September, according to data published on Wednesday on the National Bureau of Statistics’ website.

The record yield on the 2053 paper comes against a backdrop of calls from investors for the central bank to raise interest rates and get them closer to positive territory on a real, or inflation-adjusted, basis. Analysts also warn that Nigeria’s negative real yields deter foreign investors, even as the government seeks to attract capital by easing exchange controls alongside other reforms of the economy.

Samir Gadio, head of Africa strategy at Standard Chartered Plc, said an assumption that market conditions will normalize in the medium-term increased the demand for the longer term paper.

The Debt Management Office has raised 5.8 trillion naira, representing 82% of the targeted borrowing this year from the domestic capital markets, Patience Oniha, director-general of the agency said this week.

There’s about 1.28 trillion naira of planned borrowing this year that hasn’t yet be raised. This excludes the extra 2.17 trillion naira that may be needed to fund the supplementary budget, which was signed into law last week.

The preference for the 30-year debt “signals that investors are very concerned about inflation in the near term,” said Fola Fagbule, deputy director and head advisory at Africa Finance Corporation. “The longer-term inflation outlook is more likely to be favorable than the near term.”

(Updates with total borrowing for the year and a comment in last paragraph)

Author: Anthony Osae-Brown and Emele Onu