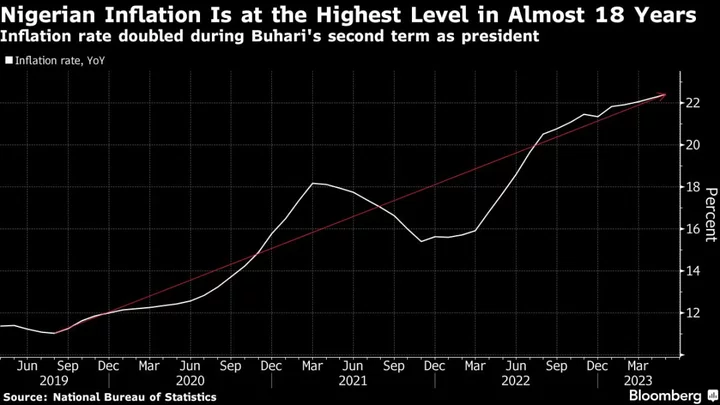

Nigeria’s inflation rate climbed for a fifth month on food prices, and is set for further rises when the impact of the recent scrapping of fuel subsidies and the sharp depreciation of the naira filter through.

Consumer prices rose an annual 22.4% in May, compared with 22.2% in the previous month, according to the data published on the National Bureau of Statistics’ website on Thursday. The median estimate of five economists in a Bloomberg survey was 22.1%. Prices rose 1.9% in the month.

The main drivers were oil and fat, root vegetables and bread. Food inflation accelerated to 24.8% in May from 24.6% a month earlier. Core-price growth eased to 20.06% from 20.1%.

Since being sworn in on May 29, President Bola Tinubu who replaced Muhammadu Buhari has rid the country of a costly fuel subsides introduced in the 1970s, removed controversial central bank Governor Godwin Emefiele and loosened foreign-exchange controls.

Within days of the moves pump prices almost tripled and the currency on Wednesday slid 29% to 664 per dollar at the close in Lagos, according to FMDQ, a local exchange operator.

Those changes could see inflation reach 30% in June and pressures grow until mid-2024, KPMG LLP said in a report.

Rand Merchant Bank’s Usoro Essien and Oyinkansola Samuel expect inflation to average 26.3% this year, compared with a previous forecast of 21.9% because of the cost pass-through from the reforms. That’s likely to persuade monetary policy authorities to raise the key interest rate, which could end the year at 22% from 18.5% currently, they said in a research note on Tuesday.

Nigeria’s MPC has lifted rates by 700 basis points since May 2022 to contain an inflation rate that’s been at more than double the top end of its target range of 6% to 9% for a year.

“I would expect a higher interest rate environment, and not just a high monetary policy rate, to support the free float of the foreign-exchange market and foreign portfolio inflows,” Ayodeji Dawodu, director at UK-based BancTrust & Co. Investment Bank, said ahead of the data release.

Investors will closely monitor what the central bank will do at its next rate-setting meeting in July after Tinubu said his administration will seek to reduce interest rates to increase investment “in ways that sustain the economy at a higher level.”

--With assistance from Simbarashe Gumbo and Rene Vollgraaff.