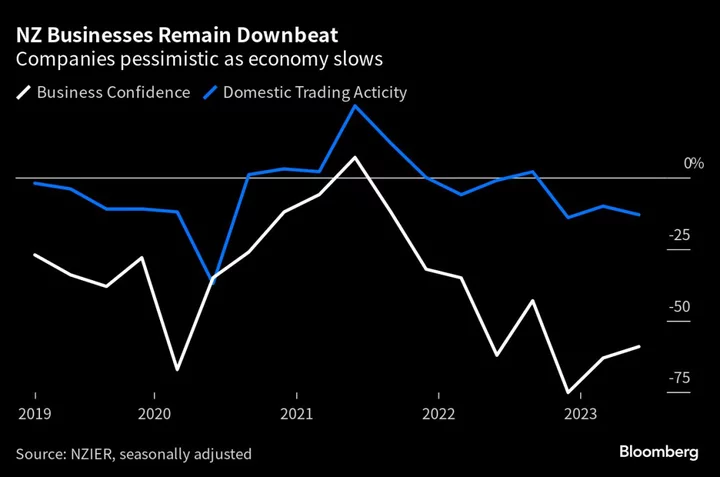

New Zealand companies are pessimistic about the outlook for the economy, and their own trading prospects, as slowing growth damps demand for their goods and services.

A net 59% of firms expect the economy will worsen, the New Zealand Institute of Economic Research said Tuesday in Wellington, citing its second quarter survey of business opinion. A net 13% said their own trading had slowed in the period, and 17% expect a deterioration in the three months through September.

Activity is slowing as high interest rates weigh on demand, and while economists expect the nation will emerge from recession in the current quarter, many expect it will quickly stumble into another one.

The Reserve Bank in May raised its Official Cash Rate to 5.5% — having hiked by 5.25 percentage points since October 2021 — and signaled the end of its tightening cycle. The RBNZ expects that weaker demand will start to reduce inflation pressures.

“There are signs that the impact of higher interest rates is gaining traction in the economy,” NZIER Principal Economist Christina Leung said. “We are seeing that softer demand picture coming through.”

Demand is increasingly becoming a constraint on businesses, Leung said. The survey showed 42% of firms cited slow sales as the biggest factor limiting their ability to expand. By contrast, just 25% cited labor as their biggest constraint.

Cooling activity is seeing capacity pressures ease and the difficulty of finding labor decline. A net 10% of firms reported trouble finding unskilled workers, down from 37% in the first quarter.

Cost pressures persist with 70% of respondents saying they had risen in the quarter. Still, fewer expect to raise prices in the third quarter, Leung said.

“This should give the RBNZ a degree of confidence things are moving in the right direction,” she said. “The RBNZ won’t need to increase further in this cycle.”