Major investors from Pacific Investment Management Co. to Fidelity Investments are pushing back against New York bills that stand to limit the amount private creditors can recover in sovereign debt restructurings.

The legislation — comprised of proposals in both the state senate and assembly — would force investors in defaulted sovereign bonds to accept comparable losses to governments and other public creditors during restructurings. If passed, the new rules would apply to debt governed by New York law, which makes up about half of all emerging-market bonds.

While similar proposals have failed to gain traction in the past, momentum is building behind the new legislation and stoking concern among some of the world’s biggest asset managers.

Approval would mark a major shift in the process for remedying emerging-market defaults, which have for years been negotiated between bondholders, advisers and the defaulted government. Under the proposed rules, any losses tied to a restructuring plan would be determined by a third party — such as an outside government or a multilateral lender such as the International Monetary Fund.

A group of investment firms, which oversees a combined $5 trillion of fixed-income assets, inked a letter Monday warning the proposals would result in higher borrowing costs for emerging-market governments and could potentially cripple the sovereign bond market. The bills, the group said, would apply retroactively.

“We cannot emphasize enough the dangers these bills pose to the very governments the bills seek to help,” the group wrote in the letter. “This will make emerging-market sovereign debt unmarketable in New York.”

The creditor group’s members include Pimco and Fidelity, as well as T. Rowe Price, Vanguard Group and Franklin Templeton. Spokespeople for Pimco, Fidelity and T. Rowe declined to comment. Representatives for Vanguard and Franklin Templeton didn’t immediately comment.

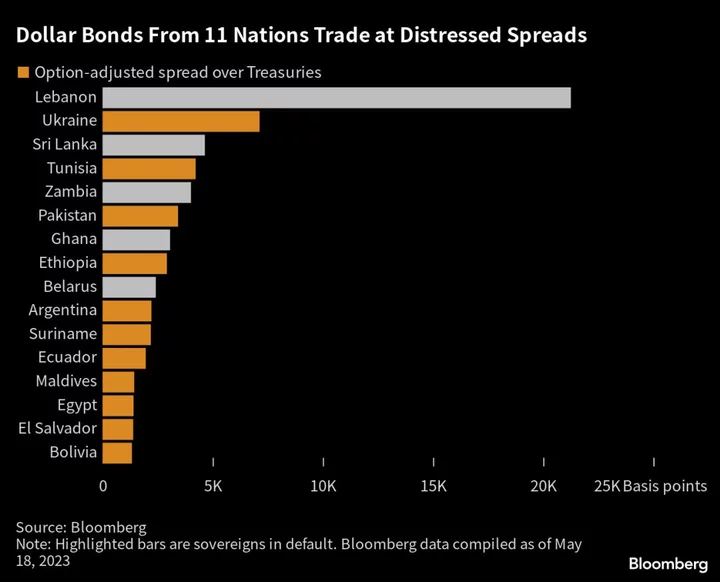

The bills come as emerging markets see a record level of sovereign defaults. Governments, especially those that borrowed heavily during the pandemic, have been hit by soaring borrowing costs and economic risks. In all, the developing world has about $100 trillion of total debt, according to Institute of International Finance.

Proponents of the legislation argue that countries are in desperate need of deep debt relief in order in order to avoid future crises.

Passing the measures “is essential for stopping predatory debt collection that takes advantage of developing countries,” said Eric LeCompte, executive director at Jubilee USA Network, a non-profit group that advocates for debt relief for smaller economies.

The bills, sponsored by Assembly Member Patricia Fahy and Senator Brad Hoylman-Sigal, argue that US taxpayers have been bailing out private creditors, who often demand higher recovery values in debt restructurings than the government.

“Not only will this legislation protect US taxpayers and enhance market stability, it will protect New York pensions, reduce stress on international supply chains and establish clear strategies for growth in nations burdened by massive amounts of debt,” said Fahy.

The push comes alongside global demands for action. In March, finance ministers from across Africa called on major creditor countries to implement more protections for borrowers and pass “anti-vulture fund legislation.”

The legislation has already passed the New York Assembly’s judiciary committee and has been referred to the ways and means committee. Timing will be tight, however, as the legislative session in Albany ends June 8.

--With assistance from Olivia Raimonde.

(Updates with comments from Fahy in 12th paragraph.)