Wages negotiated by union workers in Canada are creeping higher, complicating the central bank’s bid to restore price stability.

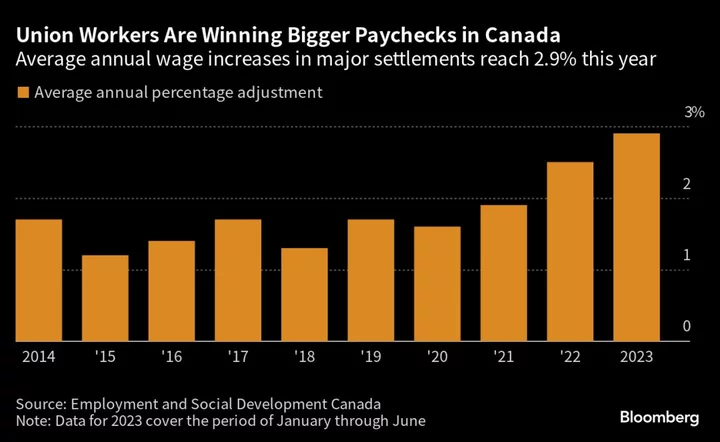

Unionized workers have staged 78 major strikes in the first six months of 2023 and pushed the average yearly wage settlement up to 2.9%, government data show. That’s the highest level in at least a decade, a partial recovery in purchasing power that risks refueling inflation expectations if momentum continues.

Canada’s largest private-sector syndicate Unifor, representing 37,000 auto workers, is now in negotiations with Ford Motor Co., General Motors Co. and Stellantis NV where improving wages and pensions are “two very key priorities,” the union’s leader said in an interview.

“Our members have high expectations leading into these talks, as they should and as all workers do at this moment,” Unifor President Lana Payne said, declining to share specific demands. “People continue to go through a period where things are more costly. Your mortgage or rent is higher, and it’s still very expensive to buy food.”

Canadian workers aren’t alone. The US is facing a burst of labor strife, with Hollywood actors and writers walking off the job together for the first time in a generation. The head of the United Auto Workers union asked members this week for strike authority, after demanding pay raises of more than 40% from the Big Three carmakers over four years. Europe and the UK have also seen walkouts, particularly in the transport sector, over the busy summer months.

The continued success of collective bargaining suggests labor isn’t done demanding higher compensation, despite inflation slowing sharply from last year’s peak. In Canada, that could derail a complete return to price stability and raise questions about whether residents’ beliefs about consumer price gains are still unmoored from the central bank’s 2% target.

In its July statement, the Bank of Canada specifically called out wages and expectations — alongside corporate pricing behavior and excess demand — as important factors they’re watching. Though dwindling, the threat of a wage-price spiral, a perpetual cycle wherein businesses drive prices up in order to compensate for higher employee costs, remains a risk.

Some of the wage pressure is pent up. Relative to their non-unionized counterparts, many organized workers missed out on pay hikes during their previous multi-year contracts, which didn’t account for the largest erosion of purchasing power in four decades, prompting a push for bigger gains.

That’s evident from recent wage demands. Federal tax workers were seeking a 20.5% increase over three years, plus an immediate 9% adjustment. They wound up receiving a 12.6% boost over four years, retroactive to 2021, plus a one-time lump sum of C$2,500 ($1,845). Dockworkers in British Columbia won a 19.2% wage hike over four years.

While Governor Tiff Macklem has made progress in reining in inflation, it rose to 3.3% in July, ticking back above the central bank’s control range just a month after slowing to 2.8%. Macklem and his officials recently pushed back the expected return to the 2% target by half a year, to mid-2025.

Economists agree that the inflation battle will get harder from here, as the central bank faces the so-called “last mile” problem, according to Bank of Montreal Chief Economist Doug Porter.

“We are actually seeing food and energy prices pushing back up for the raw materials, while wages appear to be settling into a zone above 4%. Given little or no productivity growth, wage growth at that pace is not consistent with getting underlying inflation back to around 2%,” Porter said by email. “To push inflation back below 3% will take one or more of these elements to break lower.”

About 30% of Canada’s overall workforce is unionized. But sectors including public administration, education, health care, utilities, transportation and construction all have higher-than-average union coverage rates, which means more negotiating power. Thousands of workers have walked out in recent months.

More strike votes and actions could be held in the second half of this year. Historically, the period of high inflation in the 1970s and 1980s led to a surge in work stoppages in Canada, most of which lagged the run-up in prices by several months and remained high several years after pressures abated.

“Workers have watched their wages and their purchasing power over the last couple of years diminish as a result of inflation, or now interest rates,” Payne said. “These things will factor into demands.”

Payne and other labor leaders have criticized the Bank of Canada for telling employers not to build higher inflation into their contracts, and have gone so far as to accuse Macklem and his officials of waging a class war. Along with the New Democratic Party, their ally in parliament that is propping up Prime Minister Justin Trudeau’s Liberal government, unions have recently been pushing the Bank of Canada to stop increasing interest rates.

Author: Randy Thanthong-Knight and Erik Hertzberg