Mizuho Financial Group Inc. is forging further into US investment banking through a deal to buy Greenhill & Co. as it seeks to accelerate growth.

The Japanese banking giant agreed to buy Greenhill for $15 a share in an all-cash transaction, which values the firm at $550 million including debt, the firms said Monday in a statement. The lender will retain Greenhill’s leaders, including Chief Executive Officer Scott Bok, who will be chairman of mergers, acquisitions and restructuring.

Mizuho joins its Japanese rivals to expand investment banking tie ups in the US — though goes a step further in making an acquisition. Sumitomo Mitsui Financial Group Inc. last month said it will expand a tieup with Jefferies Financial Group Inc. to boost US capital markets and M&A advisory businesses. Japan’s largest bank Mitsubishi UFJ Financial Group Inc. has a more than decade-old alliance with Morgan Stanley, a deal struck in the heat of the 2008 financial crisis.

The $15 a share price represents a 121% premium to where Greenhill’s stock traded at the close of Friday, before the deal was announced. Shares in the firm jumped 115% to $14.6 in early New York trading on Monday.

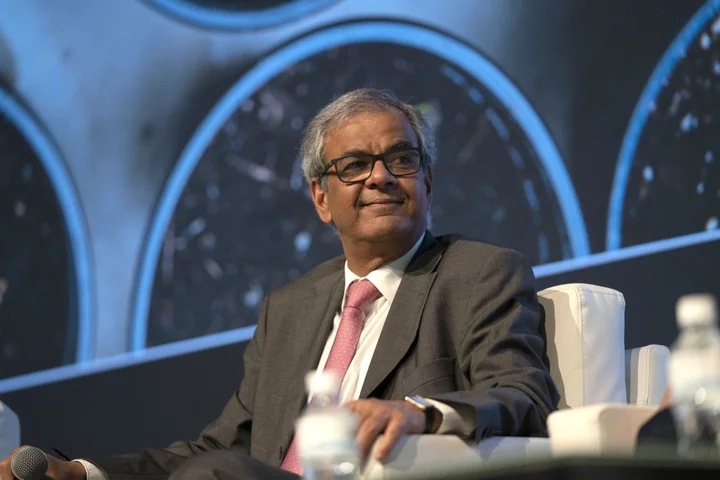

“The stock as recently as February was trading right around this price,” Jerry Rizzieri, the president and CEO of Mizuho Securities USA, said in an interview. “Regional banks are down 40%, this stock has taken a pretty big drop,” he said. “We think we’re paying a fair price for a premium brand.”

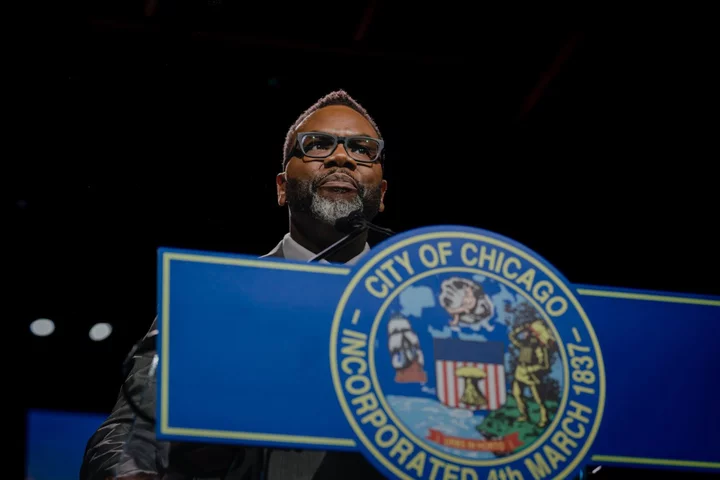

The deal gives Mizuho another 370 employees, and Greenhill will continue to operate in 15 locations around the world. Most locations overlap with Mizuho’s existing locations except Melbourne and Stockholm, according to Rizzieri. Mizuho plans to complete the transaction by the end of the year, and the Greenhill business will be within Mizuho’s larger dealmaking division run by Michal Katz, head of banking in the Americas.

Read More: Jefferies Shares Surge as Sumitomo Mitsui Agrees to Boost Stake

Mizuho is betting the takeover will complement its investment banking teams.

“We only recently began hiring M&A bankers in the last few years,” Rizzieri said. “Mizuho offers a full complement of products ranging from debt, equity, capital markets, derivatives, fixed income and equity sales and trading, securitization. The piece that’s been missing has been M&A,” he said.

Mizuho’s takeover ends a nearly two-decade run in public markets for Greenhill, an early boutique investment bank to go public in 2004 under its iconic founder, M&A veteran Bob Greenhill. Bok was tapped to co-lead the firm three years later, and became sole CEO in 2010. The stock traded at more than $81 per share at the end of that year.

In the past decade, Greenhill faced competition from a proliferation of boutiques, with Moelis & Co., Houlihan Lokey Inc. and PJT Inc. also among those going public.

“Our firm was a pioneer in the concept of the publicly traded independent investment bank, and that format served us well for many years,” Bok said in a statement. “Now, given the evolution of markets, we believe our clients and employees will benefit from our team becoming part of a larger, more diversified financial institution.”

(Updates with share price in fourth paragraph.)