Asian markets tumbled Thursday on fears the Israel-Hamas crisis would spill over into a wider conflict in the Middle East, with some warning that a full-blown war was increasingly likely.

With Benjamin Netanyahu building up a huge force ahead of an expected land incursion into Gaza, Iran has warned of a possible pre-emptive strike and called for an oil embargo against Tel Aviv.

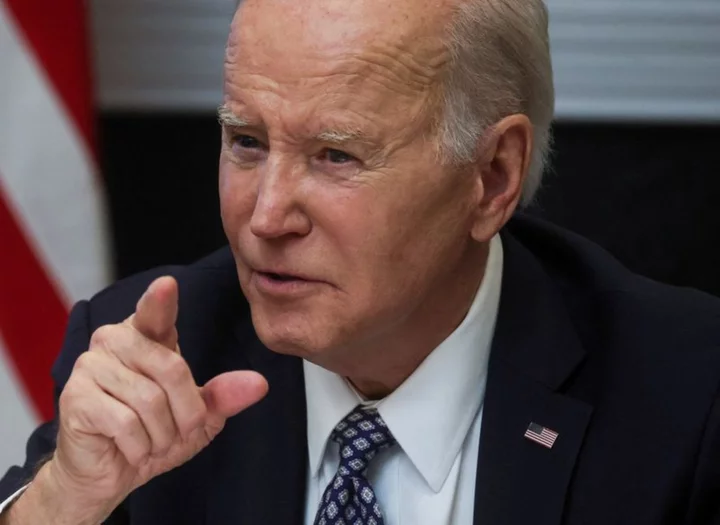

President Joe Biden was due to make a television address on the crisis later in the day, having delivered full US backing for Israel in person on Wednesday during a solidarity visit.

However, Jordanian King Abdullah II, Palestinian leader Mahmud Abbas and Egyptian President Abdel Fattah al-Sisi cancelled a meeting with Biden after a deadly strike on a hospital in Gaza.

The tragedy, which each side has blamed on the other -- with Biden backing Israel -- ratcheted up tensions and saw Lebanon's Iran-backed Hezbollah movement call for a "day of rage".

Meanwhile, Iran's Foreign Minister Hossein Amir-Abdollahian called for an "immediate and complete embargo on the Zionist regime by Islamic countries, an oil embargo against the regime".

He also urged Muslim countries to expel Israeli ambassadors in comments at a summit of the Organisation of Islamic Cooperation, called in Saudi Arabia to discuss the crisis.

"The risks of an escalation have risen on the back of the latest news reports regarding the hospital bombing," Jane Foley, of Rabobank, said.

"On any clear escalation, we can expect to see a ratcheting up of risk aversion" in markets, she added.

All three main indexes on Wall Street ended in the red, and Asia followed suit, with Hong Kong, Tokyo, Sydney, Seoul and Singapore more than one percent down.

There were also losses in Shanghai, Manila, Jakarta and Wellington.

"The window for a diplomatic off-ramp to avert a wider war in the Middle East appears to be closing," said RBC Capital Markets' Helima Croft.

"A regional crisis appears the most likely outcome, especially with Israel still seemingly committed to a ground offensive to crush Hamas."

The prospect of an all-out war pushed oil prices up Wednesday, though Washington's decision to suspend some sanctions on Venezuelan output tempered the gains and both contracts were slightly lower in Asian trade.

Risk aversion among traders was increased by concerns the Federal Reserve would hike interest rates again, or at least keep them elevated for an extended period.

That pushed US 10-year Treasury yields above 4.9 percent for the first time since 2007, fanning even more unease on trading floors, with focus turning to Fed boss Jerome Powell's speech later in the day at the Economic Club of New York.

That comes after New York Fed chief John Williams said borrowing costs would need to be kept restrictive "for some time" if the bank wanted to get inflation back to its two percent target.

And Governor Christopher Waller said: "I believe we can wait, watch and see how the economy evolves before making definitive moves on the path of the policy rate... As of today, it is too soon to tell."

Carol Kong, at Commonwealth Bank of Australia, said: "A reiteration of the 'higher for longer' message on interest rates may allow US yields to stay at or above their current levels and keep the dollar supported."

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.9 percent at 31,446.99 (break)

Hong Kong - Hang Seng Index: DOWN 1.4 percent at 17,478.06

Shanghai - Composite: DOWN 0.7 percent at 3,036.72

West Texas Intermediate: DOWN 0.5 percent at $86.84 per barrel

Brent North Sea crude: DOWN 0.7 percent at $90.88 per barrel

Euro/dollar: DOWN at $1.0537 from $1.0540 on Wednesday

Pound/dollar: DOWN at $1.2136 from $1.2141

Dollar/yen: UP at 149.83 yen from 149.93 yen

Euro/pound: DOWN at 86.82 pence from 86.79 pence

New York - Dow: DOWN 1.0 percent at 33,665.08 points (close)

London - FTSE 100: DOWN 1.1 percent at 7,588.00 (close)

dan/smw