By Jamie McGeever

A look at the day ahead in Asian markets from Jamie McGeever, financial markets columnist.

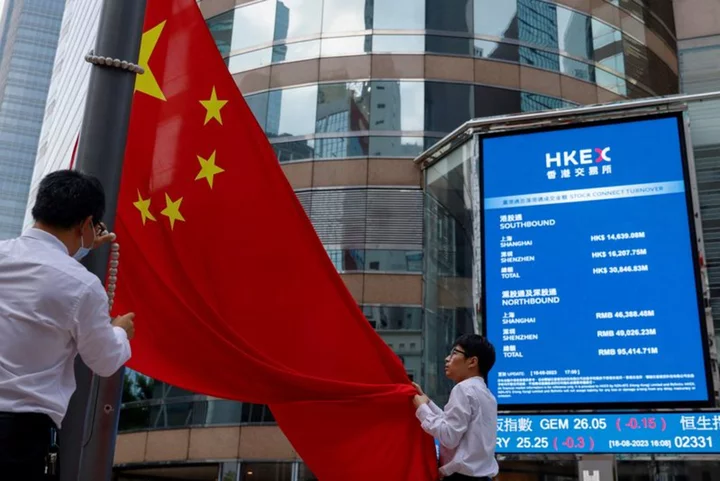

Asian markets are set to end the week strongly following risk-friendly moves in the U.S. and Europe on Thursday, although a deluge of top-tier economic data from China on Friday could sour the mood at a stroke.

The latest indicators from the region's largest economy to be released include house prices, fixed asset investment, retail sales, industrial production and unemployment, all for August.

The annual pace of retail sales and industrial production growth is expected to pick up, but fixed asset investment growth is predicted to slow to a new low of 3.3% going back to the 1990s, if pandemic-related distortions in early 2020 are excluded.

The People's Bank of China insists it will take "appropriate" steps to support the economy, although a growing number of economists are skeptical Beijing will meet its 5% GDP growth target this year and many are cutting their 2024 outlooks.

The PROC on Thursday announced its second 25-basis point cut to banks' reserve requirement ratio this year. Unsurprisingly, the move stopped the yuan's recent mini-revival in its tracks, and pressure on the currency on Friday will probably be to the downside again.

China's deteriorating trade relations with the West, meanwhile, is a darkening cloud that shows no sign of lifting.

Beijing has hit back at a European Commission probe into China's electric vehicle subsidies as protectionist, warning it would damage economic relations, and analysts have warned that if the probe results in punitive tariffs, Beijing will take retaliatory action.

However, all that could be parked for another day if investors decide to run with Thursday's bullish momentum.

It was a case of 'good news is good news' for Wall Street as investors welcomed hot U.S. retail sales and accelerating producer prices as a sign of economic resilience rather than fret about the hawkish rate implications.

Coupled with falling euro zone bond yields and implied rates after the European Central Bank's 'dovish hike' - perhaps the central bank's last in the cycle - risk assets got a shot in the arm, paving the way for a positive open in Asia on Friday.

The big three U.S. indexes rose between 0.8% and 1.0%, European stocks had their best day in six months and the MSCI Asia ex-Japan Index had its best day in 10 days on Thursday. The rise in oil to new 2023 highs and another dollar surge failed to dampen investors' mood.

Another positive portent for Asian markets on Friday: the VIX gauge of implied S&P 500 equity volatility - Wall Street's so-called 'fear index' - registered its lowest close on Thursday since before the pandemic.

Here are key developments that could provide more direction to markets on Friday:

- China 'data dump' (August)

- Indonesia trade (August)

- New Zealand manufacturing PMI (August)

(By Jamie McGeever; Editing by Josie Kao)