A look at the day ahead in European and global markets from Sonali Desai

With the U.S. debt ceiling bill clearing an important procedural hurdle en route to a vote in the House of Representatives on Wednesday, markets are back in data-watching mode for now.

Unfortunately, there's little respite on that front given disappointing economic activity and persistently elevated inflation data out of Asia.

China's official PMIs indicated a faster-than-expected contraction in manufacturing activity and slower growth in services in May. That followed consistently weak economic releases for April, suggesting the post-COVID reopening bounce has run out of steam.

Forecast-beating Australian consumer prices, released at exactly the same time, appeared to back up Reserve Bank of Australia Governor Philip Lowe's earlier warning that risks to inflation are on the upside, keeping rate hike bets alive.

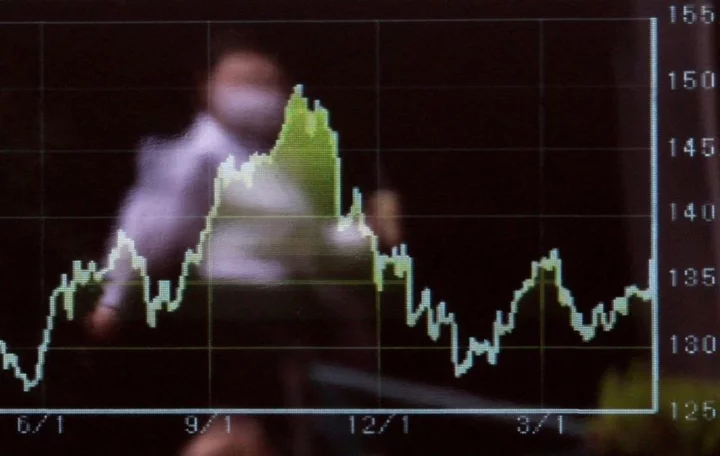

The Aussie dollar's volatile reaction sums up the mood - the risk-sensitive currency bounced initially on the CPI release before more than reversing its gains due to the bleak Chinese data.

Asian stock markets fell and even U.S. equity futures turned negative despite the debt ceiling reprieve, while China's yuan promptly skidded to fresh six-month lows, giving the U.S. dollar a broad boost.

News of a North Korean satellite launch and intensifying fighting in Ukraine only added to the grim backdrop.

Europe's calendar is likely to be dominated by national CPI releases from France, Germany and Italy for May ahead of Thursday's flash euro zone inflation number. Italy's first-quarter GDP and the European Central Bank's biannual Financial Stability Review are also due.

In the U.S., the Federal Reserve's Beige Book will be of interest and a number of Fed officials are also scheduled to speak. But much of the focus will, of course, be on the House debate over the debt ceiling bill.

Key developments that could influence markets on Wednesday:

German, French, Italian May CPI; Italy's Q1 GDP

ECB's Financial Stability Review, Bank of Italy Governor Ignazio Visco's speech, Bank of England MPC member Catherine Mann participates in a panel

U.S. JOLTs data, Fed Beige Book, House vote on debt ceiling

Earnings: Salesforce, Nordstrom

(Reporting by Sonali Desai; Editing by Muralikumar Anantharaman)