Sampo Oyj is spinning off its unit Mandatum, the biggest addition to Helsinki’s stock market in five years.

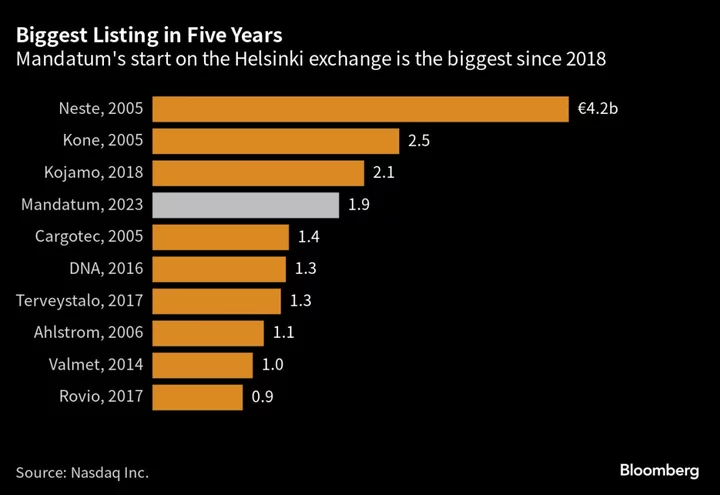

Shares of the asset manager and life insurer started trading at €3.70 each on Monday on the main list, giving Mandatum Oyj a market value of €1.86 billion ($2 billion). That’s less than an estimate of about €2.3 billion by analysts at Inderes Oyj, and makes it the largest debut since landlord Kojamo Oyj listed in 2018, according to data compiled by Nasdaq Inc.

Mandatum sold no new shares in connection with its entry to the bourse.

While initial public offering activity in Europe is slowly bouncing back after over 18 months of next-to-no activity, with questions remaining about the extent of investor appetite, some firms have turned to spinoffs, where no new money is raised. Instead, the new firm’s stock is essentially handed to existing shareholders of the parent company.

Mandatum, which manages €11.2 billion of client funds, has two business areas: asset management and life insurance.

The spin off allows Mandatum to accelerate growth, making use of “interesting growth opportunities” in the Finnish asset management space and opens up the possibility of mergers and acquisitions that remained out of reach under Sampo, Inderes analysts Sauli Vilen and Kasper Mellas wrote in a note to clients on Wednesday.

In addition to its home market, it’s planning to embark on an expansion with a focus on Denmark and Sweden.

Mandatum was separated from Sampo through partial demerger, with Sampo shareholders receiving one new share in Mandatum for each existing share they held.

Read More: Sampo to Separate Mandatum Unit to Focus on Insurance

For Sampo, the move implements its strategy of becoming a pure-play property and casualty insurer following its 2022 sale of a stake in Nordea Bank Abp to exit banking. The firm owns Nordic non-life insurer If, UK car and home insurance provider Hastings and almost half of the shares and votes in Danish insurer Topdanmark A/S.

Mandatum plans to focus on its capital-light business based on fees, with institutional and wealth management services the key driver for growth. Investors can expect €500 million in dividends during 2024–2026, with the potential for extra payouts, the company said in September when outlining its targets.

--With assistance from Swetha Gopinath.

(Updates with opening price, market value from second paragraph.)