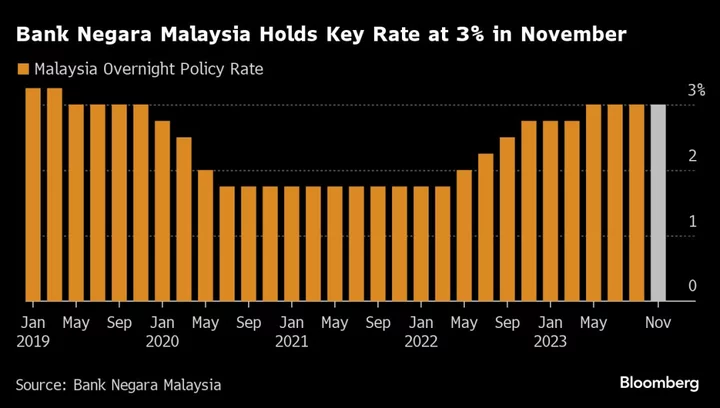

Malaysia kept its benchmark interest rate unchanged for a third straight meeting on Thursday, as cooling price pressures gave policymakers room to resist following hawkish peers in Southeast Asia.

Bank Negara Malaysia maintained the overnight policy rate at 3%, as predicted by all 21 economists in a Bloomberg survey. BNM said it will ensure the monetary policy stance remains conducive to sustainable economic growth amid price stability.

The decision bucks the tightening trend in the region, and highlights Malaysia’s dilemma as it juggles between the ringgit hovering near 1998 levels, and 30-month-low inflation. While the Philippines and Indonesia resumed hiking in the past few weeks to bolster their currencies, Malaysia’s stance keeps its interest rate at a record discount relative to the Federal Reserve’s.

Malaysia’s ringgit advanced to its highest since Oct. 18 in intra-day trading on Thursday, tracking most Asian currencies after Federal Reserve Chair Jerome Powell hinted that the US tightening cycle may be over.

Prime Minister Anwar Ibrahim said he was working on decoupling from the US dollar in the long term to defend the ringgit.

Malaysia’s central bank expects economic activity to have improved in the third quarter, and growth in 2024 to be supported by resilient domestic demand. At the same time, it expects inflation to remain modest.

“Risks to the inflation outlook remain highly subject to changes to domestic policy on subsidies and price controls, as well as global commodity prices and financial market developments,” the central bank said.

--With assistance from Joy May Yen Lee, Marcus Wong, Tomoko Sato, Derek Wallbank, Kok Leong Chan and Kevin Varley.